OVERVIEW

The financial markets’ preoccupation with central bank policy remains. But four aspects of the new reality of the global economy are worthy of closer attention.

The Powell Pivot and beyond

Financial markets always have a keen focus on the actual and expected path of policy rates – most notably the US fed funds rate. That focus is now on policy rate cuts. So, when Fed chair Powell indicated in mid-December 2023 that US rates had most likely peaked and were heading downwards – a move described as the Powell Pivot – it was a particularly significant event for markets. Expectations for future rates fell sharply (see Figure 1) and these were welcomed, with a drop in 10-year bond yields and a rise in equity markets. By the start of the second quarter of 2024, however, US rate expectations had moved back up. Indeed, they are now forecast to be higher in the longer-run than they were before Powell’s comment. Broadly, the markets have reacted calmly to this change – reflecting, we think, a new reality that has dawned regarding global economic outlook and policy. It has four key elements.

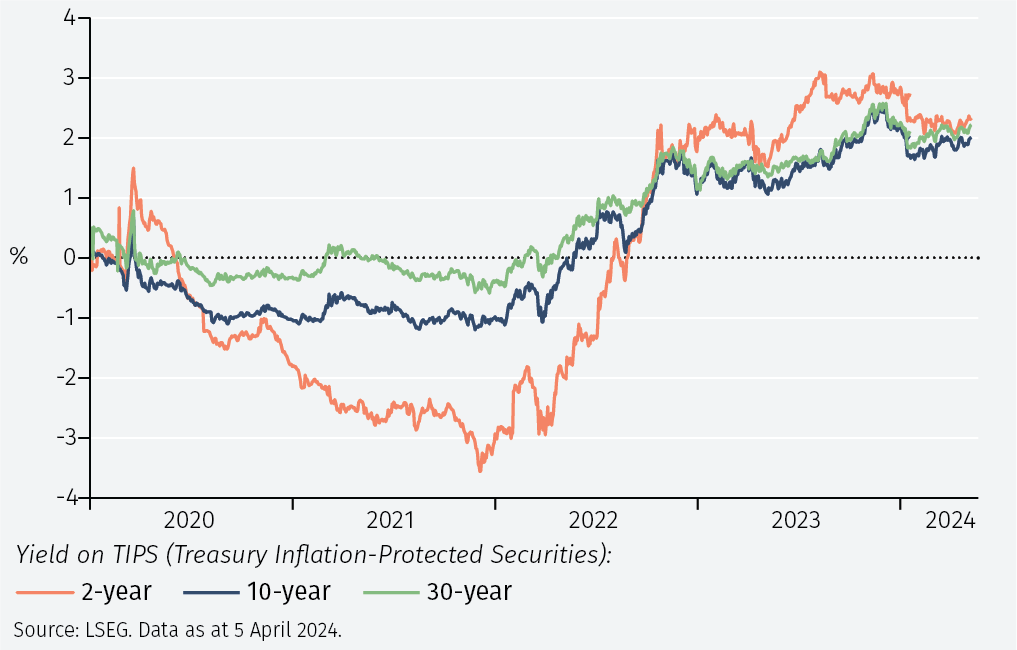

New reality #1: higher real rates

First, real interest rates – notably the yields on inflation-protected securities (see Figure 2) have stabilised at a new, higher level of around 2%. The low or negative levels of such rates both before and during the pandemic were unusual and clearly unrealistic: markets can surely not function properly if real rates are negative. A 2% real rate seems broadly appropriate in a world where there are large new demands on global savings. These come from the public sector (ageing-related and defence spending as well as infrastructure improvements) and the private sector (which will have to finance a large part of the green energy transition, estimated at around USD 4 trillion per year for the next 30 years). The demands for greater spending are huge and, reflecting these, real yields cannot realistically return to zero or negative levels. If inflation does return to 2% in the major advanced economies, that suggests nominal interest rates may not fall much below 4% (a 2% real rate plus a 2% inflation expectation).

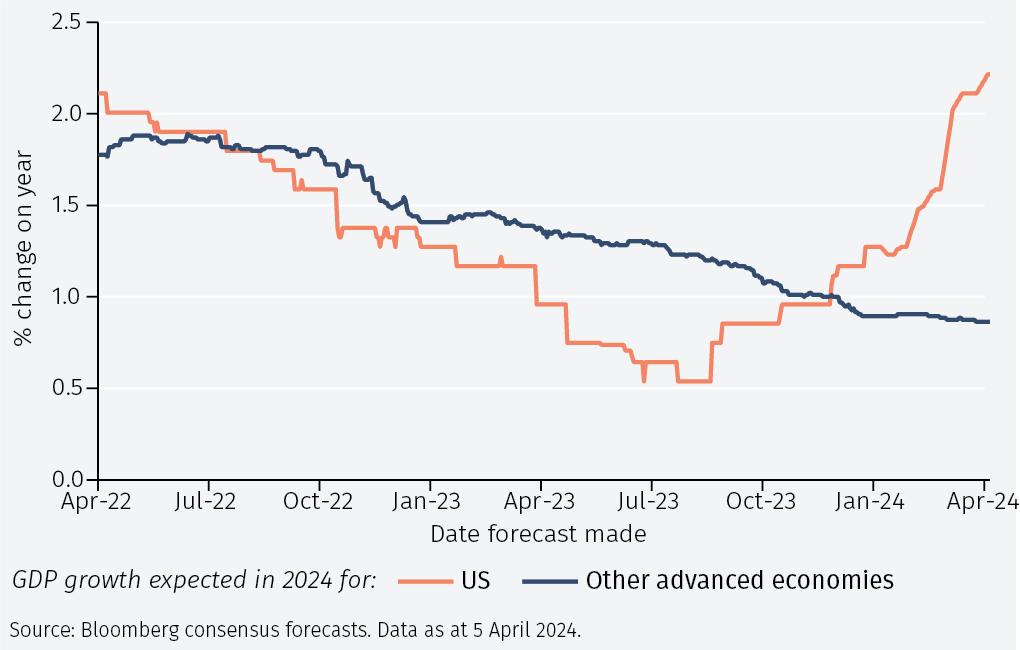

#2: Advanced economies: US strengthens, others weaken

The second new reality is that although the soft landing for the global economy – one of our key themes for the outlook for 2024 – is materialising, this relies a great deal on the strength of the US economy. Since mid-2023, consensus expectations for US growth have improved, while forecasts for other advanced economies have deteriorated (see Figure 3). Germany, the UK and Japan have all been in, or on the brink of, mild recession. As always, however, economic data are backward-looking. All too often, economies are classified as being in recession only when they are emerging from it. Europe and Japan may not be in such a poor state. However, there is a deeper sense in which the US outlook is better versus other developed economies.

First, US productivity growth is ahead of other advanced economies and is set to remain so. Notably, the US seems better placed to garner the benefits of artificial intelligence (AI) as the US maintains its lead in the development of new technology in this area. This is reflected in the continued strong performance of US large-cap technology stocks.

Second, US demographic trends are more favourable than in most other advanced economies. Notably, its population is still growing, and is expected to continue to do so, as immigration offsets a natural decline in population as fertility rates fall. The same degree of immigration is unlikely to be accepted by other economies. While the US may well remain the leader of the advanced economies, the previous Chinese leadership of the emerging economies is clearly faltering. In Asia, notably, India and Indonesia have better potential growth prospects (due to more favourable demographics and the prospect of productivity catch-up).

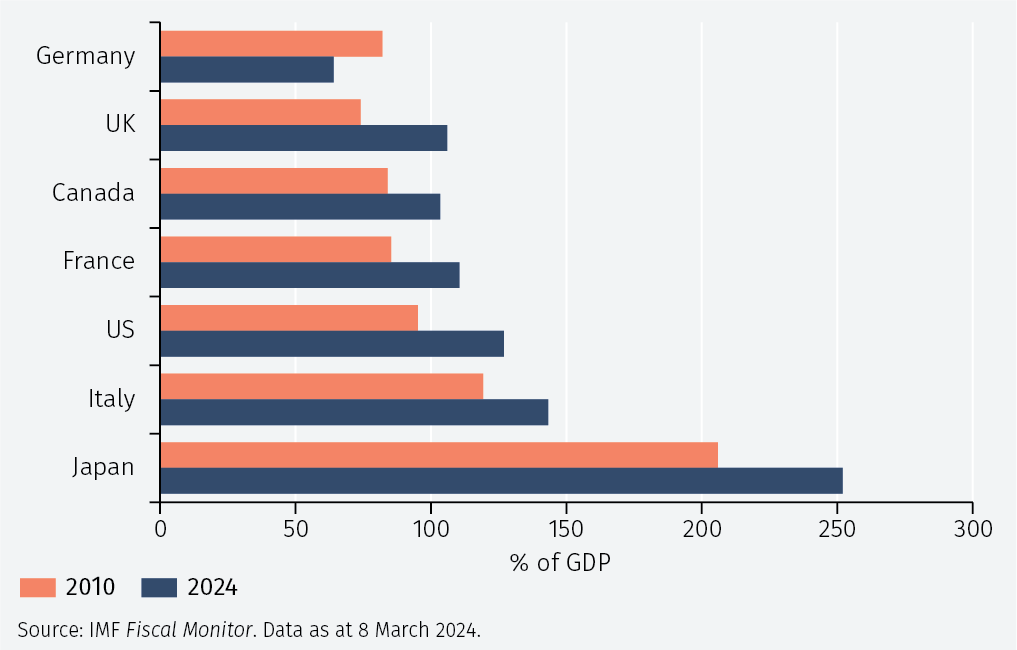

#3: Fiscal support remains

The third new reality is that supportive fiscal policy is set to remain in place. After the global financial crisis there was seen to be a need for austerity in order to rein in government debt levels, which were viewed as becoming dangerously high – putting future growth in jeopardy. That assessment was probably incorrect at the time, and the reality has been debt levels have continued rising across the advanced economies (see Figure 4).

Germany is the notable exception to that. German Finance Minister Christian Lindner is determined to set an example for the rest of the eurozone by keeping government debt levels as close to 60% of GDP as possible. Elsewhere, although there is much concern about the rise in government debt, in reality little serious action is taken to curb the trend. The UK’s fiscal ‘rule’, for example, aims to see debt as a share of GDP fall but only at a horizon five years in the future: a requirement that hardly seems stringent. In the US, large federal government budget deficits (around 6% of GDP) are likely to persist for years to come.

#4: Resilience of global trade and growth

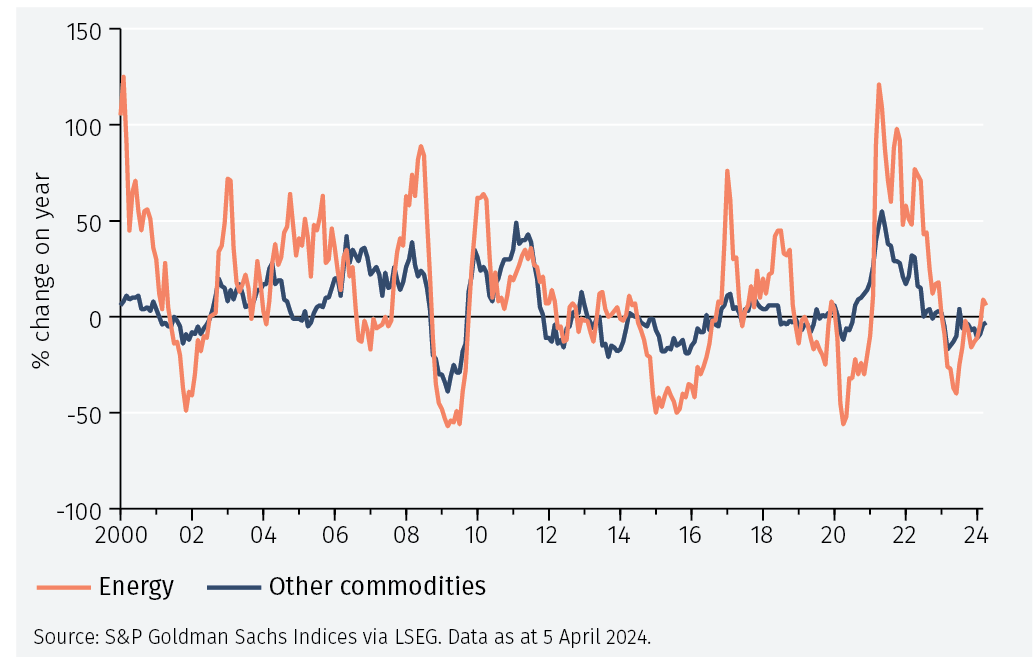

The final, and arguably the most powerful, new reality is the resilience of global trade and growth. Just one year ago, Kristalina Georgieva, International Monetary Fund (IMF) managing director, commented that disruptions to global trade could wipe 7% off global GDP – equivalent to the output of Germany and Japan’s economies combined.2 That has not yet materialised. World trade and production have shown no marked fall (see Figure 5). Diversion of trade routes, onshoring and near-shoring of production have proved effective even in the face of ongoing difficulties, especially in maritime trade.

Moreover, that resilience in trade is accompanied by a return of some important global disinflationary forces. Commodity prices (other than energy) remain subdued (see Figure 6). China, once again, is a prominent supplier of cheap goods to the rest of the world. Chinese exports of electric vehicles (EVs) and cheaply-priced consumer goods promoted through rapidly-evolving marketing and distribution channels are attracting considerable attention. It may well be that, once again, China exports deflation to the rest of the world.

To continue reading, please download the full article.

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.