Investment Insights

Is Fixed Income back in favour?

With many of the major developed market central banks expected to begin cutting interest rates this year, fixed income investments look set to be back in favour. In this article we explain why this is the case and the potentially attractive ways to access this asset class.

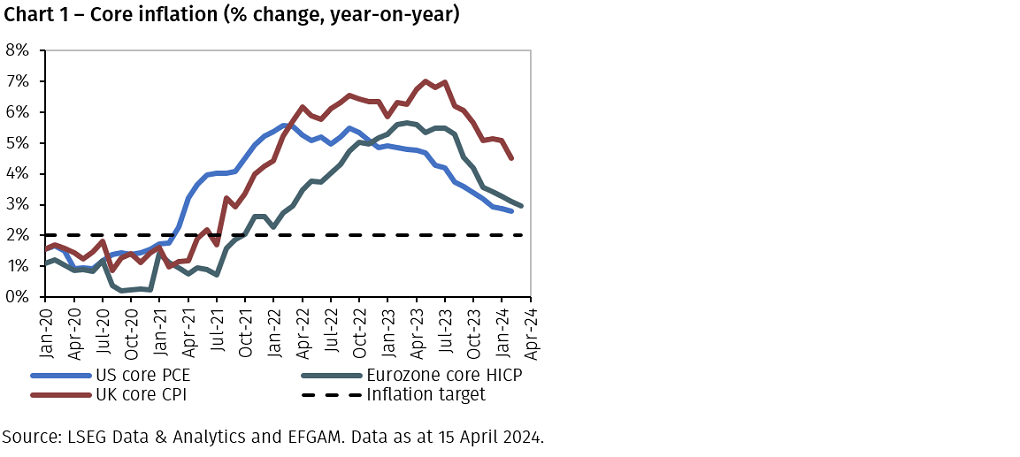

Between 2021 and 2022, inflation in the US, eurozone and UK rose sharply (see Chart 1). Consequently, the Federal Reserve (Fed), European Central Bank (ECB) and Bank of England (BoE) all raised their policy interest rates to levels not seen since before the Global Financial Crisis to better balance supply and demand and help stem further increases in inflation.

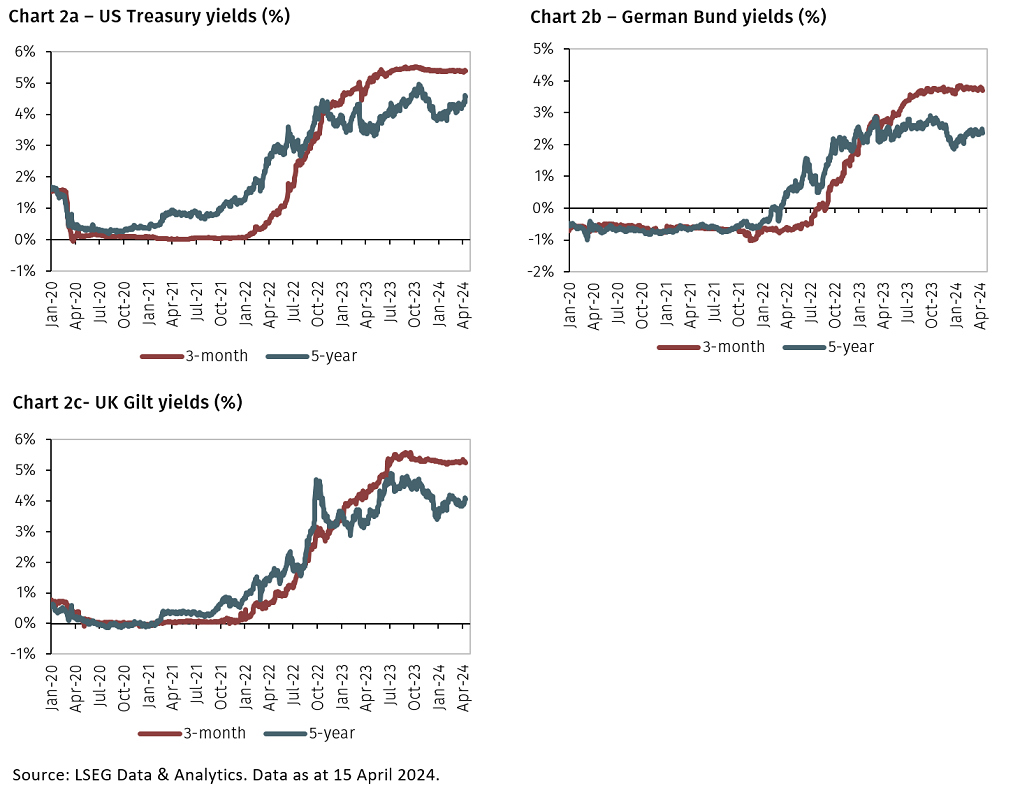

On the back of the interest rate increases, yields on government bonds also increased. However, these yield increases were not consistent across different maturities, with short-term yields rising more than their longer dated equivalents meaning yield curves inverted (see Charts 2). In turn, this made cash deposit rates relatively more attractive as an investment option for investors seeking a fixed return in a diversified portfolio.

2023 and beyond

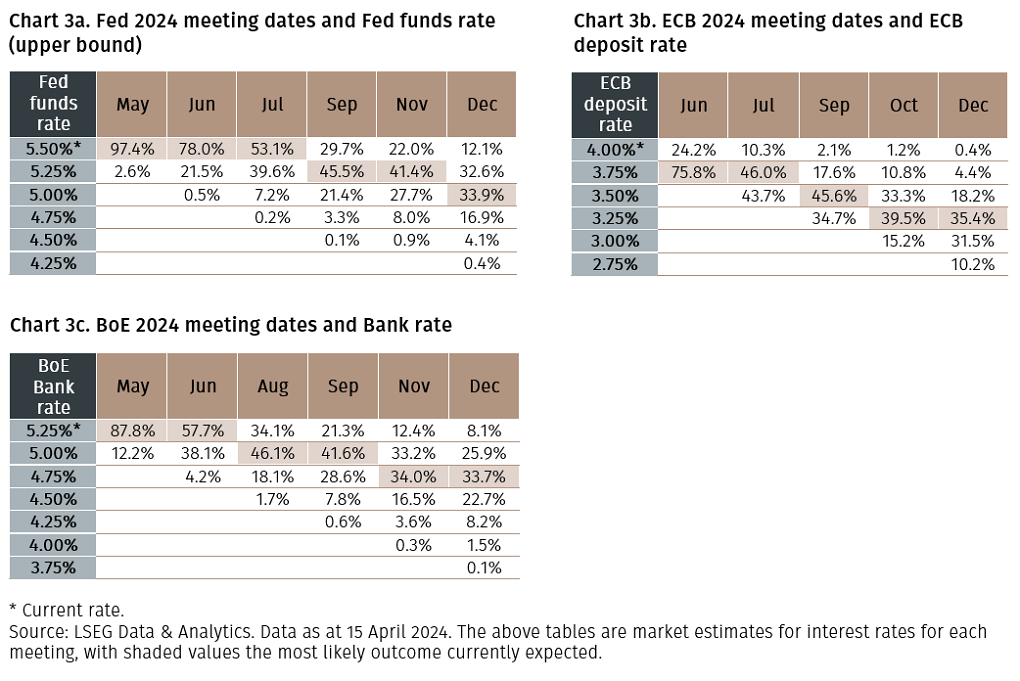

In 2023, inflation rates began to converge towards central banks’ targets. Subsequently, central banks stopped raising policy interest rates and began discussing how long they would need to be maintained at current levels. The Fed, ECB and BoE have all indicated that they will start to cut interest rates in 2024 (see Charts 3):

“If the economy evolves broadly as we expect, most FOMC participants see it as likely to be appropriate to begin lowering the policy rate at some point this year.” – Chairman Powell, Fed (3 April 2024)1

"We are making good progress towards our inflation target. And we are more confident as a result. But we are not sufficiently confident, and we clearly need more evidence, more data. We will know a little more in April, but we will know a lot more in June.” – President Lagarde, ECB (7 March 2024)2

“The fact we have a curve that has cuts in it for the year as a whole is not unreasonable to me.” – Governor Bailey, BoE (22 March 2024)3

‘Markets expect the ECB to begin cutting interest rates in June, with the BoE following in August and the Fed in September’

What does this mean for investors?

As interest rates are lowered, yields are also expected to decline. And with the yield curve currently inverted, we believe that short duration yields, such as cash deposit rates, will fall by more than longer duration yields. This means that while cash deposit rates may currently offer a higher yield than longer-dated alternatives, there is a potential opportunity for investors to lock in higher yields for longer.

……a potential opportunity for investors to lock in higher yields for longer…...

1https://www.federalreserve.gov/newsevents/speech/powell20240403a.htm

2https://www.ecb.europa.eu/press/pressconf/2024/html/ecb.is240307~314650bd5c.en.html

3https://www.ft.com/content/964d883f-4f47-4f2f-bd13-b44858efa075

New Capital Global Value Credit Fund

New Capital Wealthy Nations Bond Fund

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.