Investment Insights

Inview November 2022

Editorial

Welcome to the November edition of Inview: Global House View. In this publication we consider significant developments in the world’s markets, and discuss our key convictions and themes for the coming months.

2022 has so far been very challenging for investors. Equity markets have experienced large declines, in many cases exceeding 20 percent, and bond markets have been no different. The result of this unlikely combination has been that the returns of a balanced portfolio have been unusually weak, at times supported only by the revaluation of the US dollar for investors based in other currencies, including the euro, yen, pound sterling and Swiss franc.

The adverse performance of financial markets reflects a long list of concerns. The most relevant among them are high inflation and the restrictive response of central banks that risks pushing the economy in recession, the war in Ukraine, tensions between Beijing and Washington over Taiwan, and continued lockdowns in China. In addition, markets were unsettled by the reckless fiscal policies announced in the UK and are disturbed by uncertainty ahead of the US Congress mid-term elections.

However, some of these tensions appear to be solving or, at least, to moderating. Indeed, if Xi Jinping's re-election for another five years as head of the Chinese Communist Party makes it unlikely that relations between China and the West will quickly improve, the mid-term elections will take place in early November, soon removing one factor of uncertainty. It is encouraging to note that while midterm election years have often been turbulent for equity markets, the period after that volatility has normally seen strong market returns. Moreover, despite the slowdown in the business cycle, for the third quarter of 2022 listed companies are reporting earnings above analysts' expectations.

Furthermore, the tone of central banks has recently become more cautious about the future monetary policy. Doubts have emerged about whether interest rates should continue to be raised aggressively in the face of rising risks to growth and financial stability. The recent stabilisation of bond yields could prelude a recovery in prices of fixed-income assets in the coming quarters, as was the case after previous periods of heavy losses.

Finally, another positive development for the markets was the British government's backtracking on the planned fiscal expansion which led to the replacement of Liz Truss with Rishi Sunak as Prime Minister. The former Finance Minister in the Johnson government has committed to a pragmatic fiscal policy and this has reduced volatility in British government bonds and the pound, with positive spillovers to global markets.

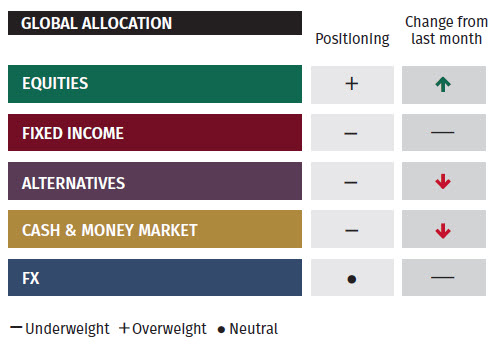

In a market characterised by widespread investor pessimism, well reflected in the downturn of the recent months, the emergence of favourable elements suggests that a turnaround, at least for some time, is likely. Therefore, it seems advisable in our view to increase exposure to equity markets above benchmark levels at the expense of cash in portfolios. The share of fixed-income securities can be kept neutral as it ensures a relatively attractive yield now. Finally, it seems appropriate to protect portfolios against a possible weakening of the US dollar from current high levels.

Global Asset Allocation: Summary

Equities

We are adding to our equity weight, taking the allocation above the neutral benchmark weight. We foresee a short-term tactical rally for equity markets, similar to the one observed in the summer months. The move is also supported by valuations, slower economic data, and positioning. We anticipate holding this position for a couple of months, dependent on incoming data.

Within equities, we expect a weaker dollar in this rally, and therefore we are increasing the exposure to European equities, although we remain marginally underweight. We are also increasing exposure to Latin American equities by 1 percentage points, increasing our overweight. These moves are funded by cutting exposure to Asia ex-Japan to marginally underweight, reducing existing cash levels and reducing exposure to alternatives, see Alternatives section below. Within Asian equities we are reducing the allocation to China, taking it to underweight, waiting for a bounce if positive news does emerge. Meanwhile we are increasing exposure to other countries such as Taiwan and Korea which are more sensitive to international equity market conditions.

From a sector point of view, we maintain our balanced approach between Growth and Value styles. In the US, sectors such as Industrials, Financials, Consumer Discretionary and Energy continue to outperform. The cyclicality of these suggest the US economy is not yet in a recessionary environment, although we remain cautious on the outlook given the recent inversion of the yield curve slope.

Fixed Income

We maintain a neutral to slightly underweight exposure to fixed income. Within the asset class, we are roughly overweight in the rates component of the portfolio and underweight in the credit portion. As part of the rates exposure, we are overweight in investment grade, particularly in the 5-year part of the curve, and neutral in the exposure to sovereign bonds for USD portfolios. However, we are underweight in sovereign debt for non-USD portfolios. We maintain an overall portfolio duration around 4 years, in line with the neutral benchmark. Within the credit components, we are neutral on high yield, insurance-linked bonds, convertibles, and EM hard currency.

Alternative Investments

We are reducing our exposure to Alternatives, moving into an underweight position, to partially fund the increase in Equities. This comes as part of a rebalancing to our allocation to the asset class, taking profits from CTA strategies, which have returned close to 30% year-to-date on a relative basis. We remain cautious on commodities given their cyclical nature, consistent with the weakness in the OECD leading indicator. Despite reduction in production from OPEC+ inventory levels are above average for the last two years, which is not supportive of prices. Gold price has declined based on higher bond yields and a stronger US dollar. Weak demand from China for metals such as copper will continue to weigh on prices. However, this could present an opportunity when China lifts Covid-related restrictions.

Global Asset Allocation

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Leconfield House, Curzon Street, London W1J 5JB, United Kingdom, telephone +44 (0)20 7491 9111.