Investment Insights

Inview September 2022

Editorial

Welcome to the September edition of Inview: Global House View. In this publication we consider significant developments in the world’s markets, and discuss our key convictions and themes for the coming months.

The message from the Kansas City Fed’s annual symposium in Jackson Hole couldn’t be clearer. Central banks across the world will continue to raise interest rates, with few exceptions. Indeed, it seems likely that the pace of tightening may even accelerate.

Thus, markets expect the Federal Reserve to raise interest rates by another 150 bps by the end of the year and the ECB by a similar amount, if not more. This is a very rapid tightening of monetary policy. While a review of US tightening cycles since 1980 (disregarding the slow tightening in 2015) suggests that normally the Federal Reserve raises interest rates by around 300 bps over 15 months, this year it might raise rates by 400 bps in nine months. Anything that changes that quickly must be watched very closely.

Of course, such a rapid tightening might be necessary. However, a recession is forecast in the UK and looks increasingly likely in the eurozone. And while the US economy may be doing fine so far, interest rates moving 75 or 150 basis points higher may quickly change that.

The shocks that central banks have had to deal with have been unprecedented and almost all have contributed to a sharp rise in inflation. Given the nature of the shocks, there was little central banks could have done to prevent that outcome. Nevertheless, central bankers appear stung by criticism that they have failed to maintain low and stable inflation.

They are quick to emphasize that long-run inflation expectations, which are measures of their credibility, have risen in many countries in recent months. However, in many cases they have gone up because expected inflation over the next one or two years has risen, suggesting that observers view the increase in interest rates as largely temporary.

But the risk now is that central banks see raising interest rates rapidly and by large amounts, despite the obvious risk of triggering a recession, as a way for them to prove their mettle and restore their credibility. That may be true, but two wrongs don’t make a right.

The expected aggressive tightening of monetary policy pushed market volatility higher again in August. For investors, the positive is that a lot of bad news seem to be already discounted in asset prices. Hence, in our view a diversified portfolio should maintain a slight overweight to equities over fixed income assets.

In terms of preferred markets, in our view the US and emerging Asia should be favoured at the expense of European markets, which are more exposed to fallout from the war in Ukraine and the resulting energy crisis and whose central banks are in the early stages of monetary policy normalisation. In contrast, the US Federal Reserve is more likely to slow the pace of rate increases in the last quarter of the year. Bond yields have risen again and become more attractive as a result, particularly for high quality corporates. Finally, the ongoing high degree of uncertainty warrants an adequate exposure to safe assets, including the Swiss franc and gold.

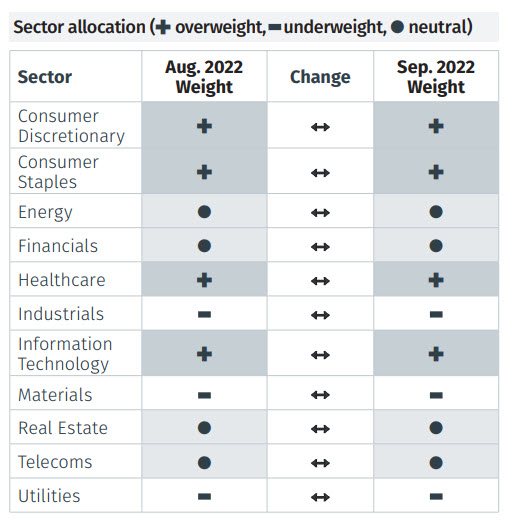

Global Asset Allocation: Summary

Equities

- Europe is entering a tough period, facing rising gas prices, a high risk of recession as well as uncertainty surrounding ECB policy. European banks have also started to underperform relative to the rest of the market and so we are tactically downgrading our European equity position to underweight.

- With the downgrade to European equities, we are upgrading our US positioning back up to overweight on a tactical basis. This is supported by the recent pullback in valuations, as well as the Federal Reserve coming closer to the peak in its interest rate cycle.

- Japan looks interesting from a sterling, dollar or euro perspective. Trends in earnings, valuations and technicals appear positive and we will watch this closely.

- A downgrade of Asia ex-Japan equities was considered. However, given moves by Chinese authorities to support the real estate sector as well as interest rate cuts, we hold our overweight for now. The trends in India continue to look positive in our view.

- UK equities continue to outperform other developed markets year-to-date, but valuations appear more expensive relative to other areas.

Fixed Income

- The end of a rate cycle is usually associated with a credit event. Nothing is currently clearly identifiable, but we remain vigilant and maintain the underweight in fixed income.

- In our view, investment grade credit looks attractive and so we hold our overweight positioning. Given that we're entering into a slow growth period for Europe, we are more cautious on credit within Europe, but certainly in high quality, investment grade credit we would be overweight there as well on a relative basis.

- If US high yield spreads moved below 400 basis points then that would encourage us to be more conservative, but overall we are still overweight.

Alternative Investments

- The outlook for oil is mixed, with demand dropping on slowing economic growth, while inventories are at a low level with the possibility of OPEC further cutting production if prices fall too far. Meanwhile the outlook for industrial metals remains positive in our view, with low copper inventories having the potential to trigger a rebound in prices should there be a pickup in economic activity.

- We remain both strategically and tactically overweight on infrastructure, which can offer protection for portfolios in a world of rising inflation.

Currencies

- Technicals for the US dollar continue to look very strong. The rise in the US dollar is also reflective of the worsening outlook for the eurozone and the UK. We expect the dollar to stabilise as the Fed reaches a peak in rates.

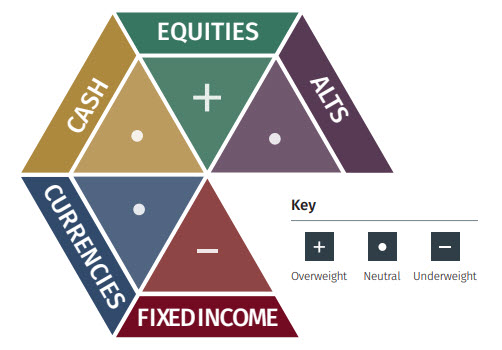

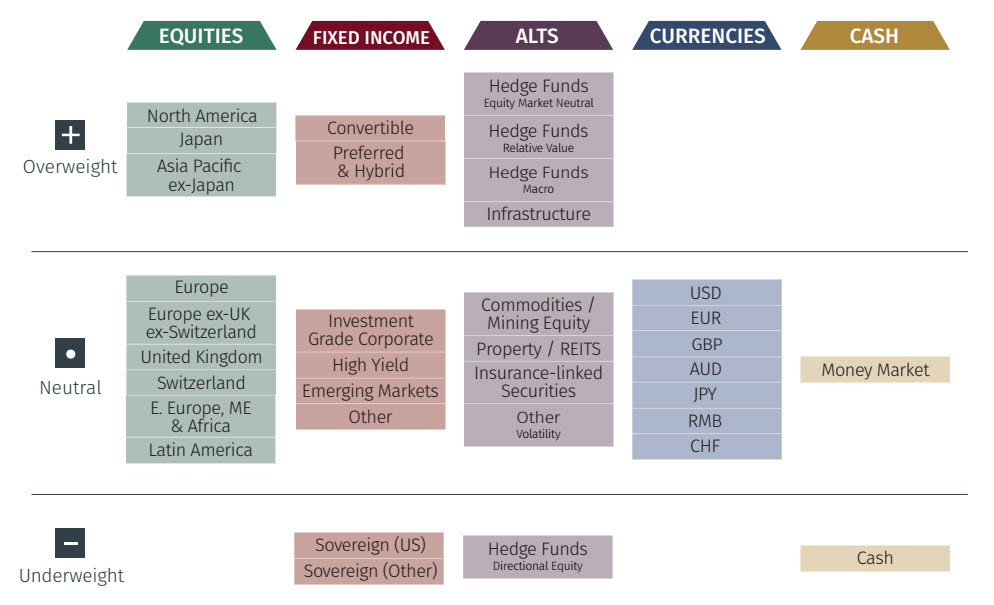

Global Asset Allocation: 12-Month Strategic Outlook

Based on a balanced mandate, the matrix below shows our long-term house view on investment strategy.

Overall Asset Allocation Views

Asset Class Breakdown

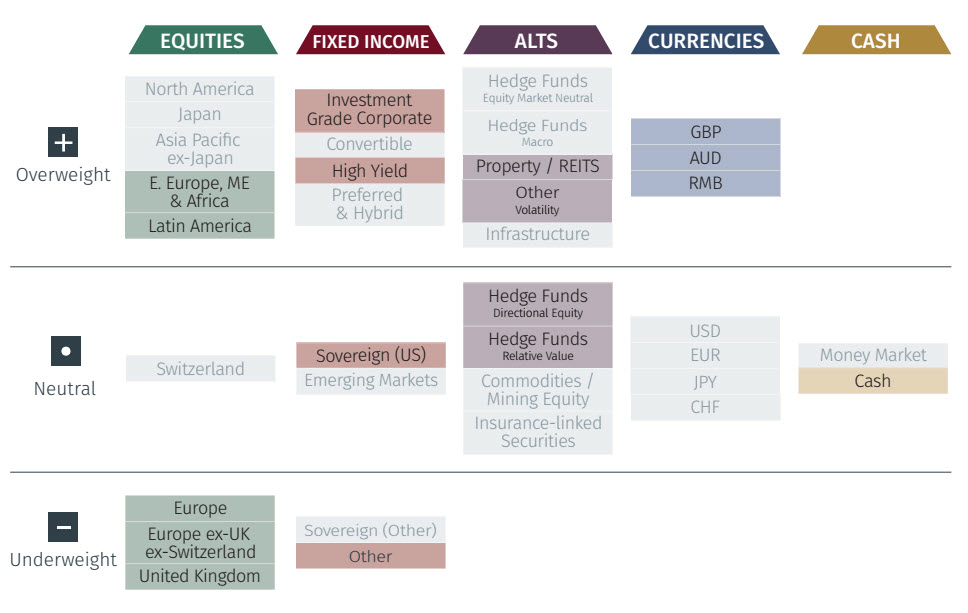

Global Asset Allocation: 3-Month Tactical Outlook

Based on a balanced mandate, the matrix below shows our short-term house view on investment strategy.

Note: The highlighted boxes indicate a difference from our 12-month strategic outlook.

Asset Class Breakdown

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Leconfield House, Curzon Street, London W1J 5JB, United Kingdom, telephone +44 (0)20 7491 9111.

ASSET ALLOCATION GRIDS

Please use the button below to download the full article to see asset allocation grids.