Macro Flash Note

MFN - Debt ceiling deal finally reached

Alim Remtulla, Foreign Exchange Strategist

Details are being finalized but the contours of debt ceiling resolution are coming into focus.

The compromise struck between US president Joe Biden and Republican House Speaker Kevin McCarthy on Sunday 28 May must still pass through both houses of Congress. A vote is expected Wednesday within the Republican-controlled House of Representatives. From there the bill would go on to the Democrat-controlled Senate ahead of the updated 5 June X-date, when the US Treasury’s funds are expected to be depleted.

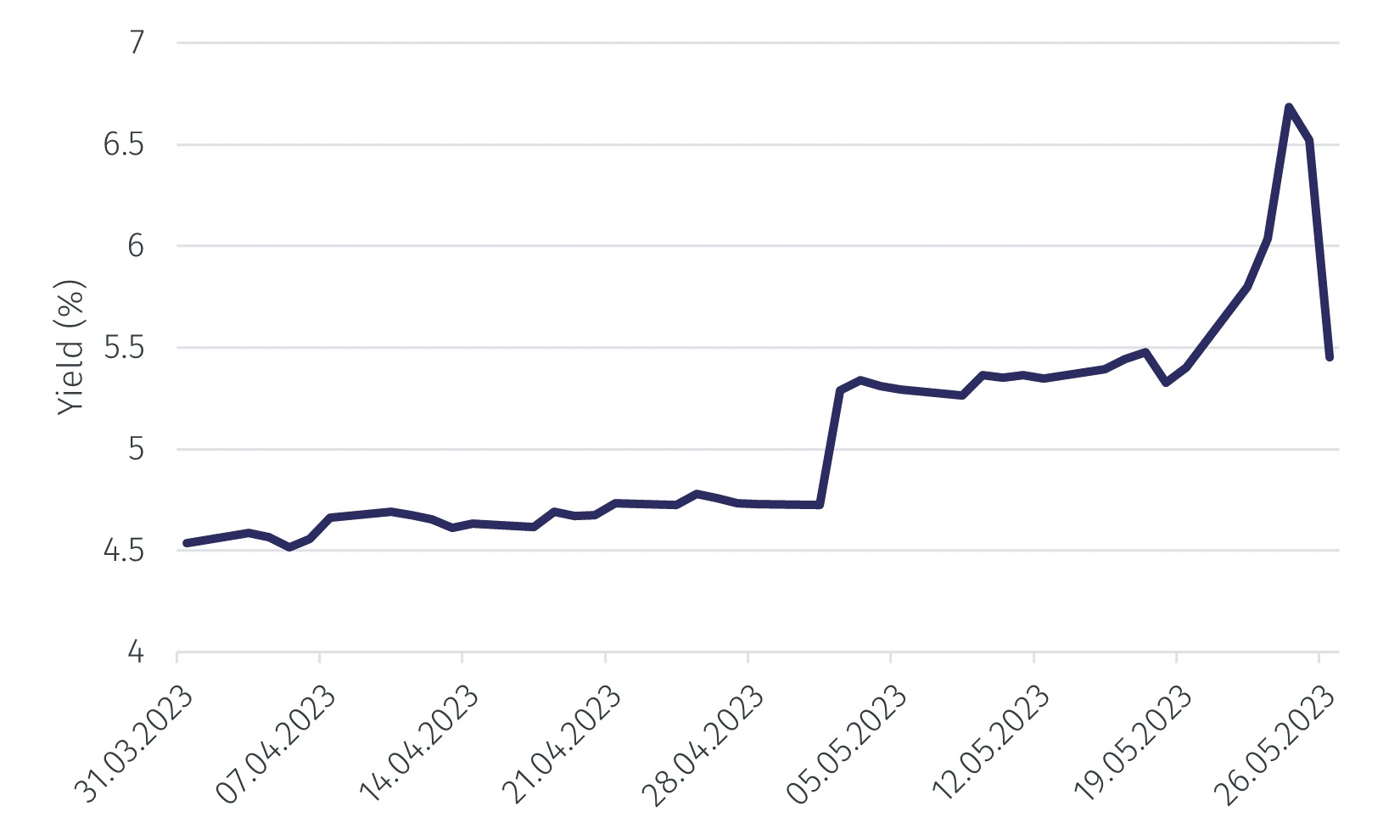

Markets have expressed relief on the news with the yield on the US Treasury bill maturing 6 June falling nearly 120 basis points, from 6.7% last week to 5.5%. Both the dollar index (DXY) and the S&P 500 initially rallied on the news.

Source: Bloomberg. Data as at 30 May 2023.

Early details suggest that the debt bill will not add significant headwinds to US growth. Nominal fiscal spending is expected to remain at least at its current level for the next two years and the bill is likely to include a continuing resolution ensuring funds are in place through the end of the fiscal year in September. The latter removes the risk of a government shutdown in October if the government can’t agree on a new budget.

The votes in the House and Senate will be close, however, as risks remain that extreme factions within each party could sink the bill. The bill needs 218 votes to pass the House and 60 to pass the Senate. If a vote fails or is even anticipated to fail, the bill would have to be renegotiated, renewing the risk of a US default.

As a contingency, Biden has the option of enacting the 14th amendment by declaring the debt limit unconstitutional. This would be an extreme measure that would likely be challenged in the courts but which buys time for Congress to negotiate.

Market implications of a US default

The Federal Reserve and Treasury have discussed contingency plans if the US debt limit is neither raised nor suspended.

One option is the prioritization of debt payments over social security, Medicare, and military salaries. This may work for a few days or perhaps weeks but is politically untenable in an extended deadlock.

Another possibility is simply delaying payments to bond holders. When the interest and principal are eventually paid under a debt ceiling resolution, creditors are likely to be compensated at the Fed funds rate or SOFR rate for the delay.

Under a US default without the prioritization of timely interest and principal payments to bond holders, the Fed has discussed swapping out the defaulted collateral and using the clean collateral on its still-sizeable balance sheet. This would work to ensure the proper functioning of the Treasury repo market.

It’s worth emphasizing that while these options have been discussed within the Fed and Treasury, they have never been implemented before. Counterintuitively, a technical default would likely result in lower treasury yields given the prevailing risk-off sentiment. However, there are no cross defaults in the treasury market. The only treasuries exposed to a potential default are those that mature near the X-date. Washington analysts have placed the X-date within the first week of June, when Treasury is expected to be down to its last $20-30 billion, with roughly $100 billion in outlays for social security and Medicare. If withheld taxes surprise to the upside and the Treasury’s account can remain in surplus until roughly 12 June, quarterly corporate tax revenues should push the X-date back into July or even August.

Economic implications of a US default

Fitch has already warned that a temporary default would lead to a ratings downgrade.

In 2011, when a default was avoided at the last minute, the S&P fell nearly 20% across the month before and after the debt limit deadline. High yield spreads climbed over 200 basis-points and gold rose almost 20%.

Similar market shocks can still be expected today, even if a default is ultimately avoided.

If a default does occur, Fed models suggest the shock could tip the economy into recession.

Over the long term, a technical default may dampen foreign demand for treasuries, at least at the margin, leading to yields being higher than they might otherwise have been.

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.