Investment Insights

Eurozone inflation expectations and real rates

In this Macro Flash Note, GianLuigi Mandruzzato looks at the evolution of inflation expectations and real interest rates in the eurozone after the ECB's recent pivot towards tighter monetary policy.

Private sector inflation expectations are an important factor in monetary policy decisions. Central banks that pursue an inflation target monitor their evolution to get timely feedback on how their actions are assessed by markets. Thus, it is interesting to see how eurozone inflation expectations changed following the recent ECB pivot towards tighter policy that culminated with the announcement that rates will be increased at the next Governing Council meeting on 21 July.

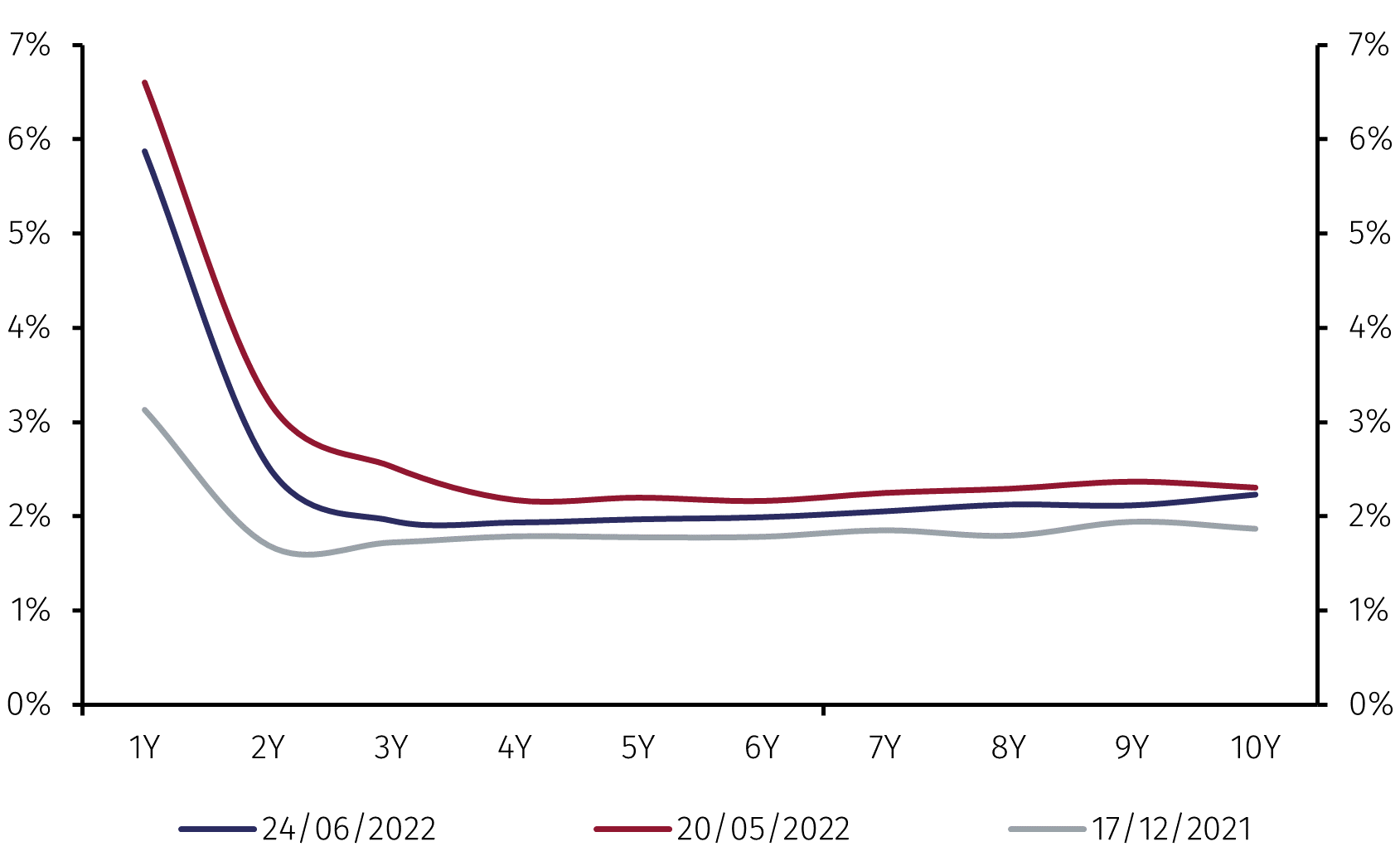

The most reliable reference for market expectations for eurozone inflation is that derived from the inflation swaps market.1 Chart 1 shows that since the early 2000s to the outbreak of the pandemic, inflation expectations declined. In 2014, medium to long term expectations fell below the ECB’s 2% target, a shift that convinced the ECB to restart and broaden its bond-buying program.

Source: Refinitiv and EFGAM calculations. Data as at June 24 2022.

After the pandemic, inflation expectations rose, exceeding 2% in early 2022 and peaking in late May at levels much above the ECB's inflation target. Mirroring 2014, the drift of inflation expectations away from the ECB’s inflation target prompted the Governing Council to tighten monetary policy. The decline of market-based inflation expectations seen in the last few weeks must be encouraging for the ECB. However, some commentators note that average expected inflation remains above the ECB’s target over the next five years.

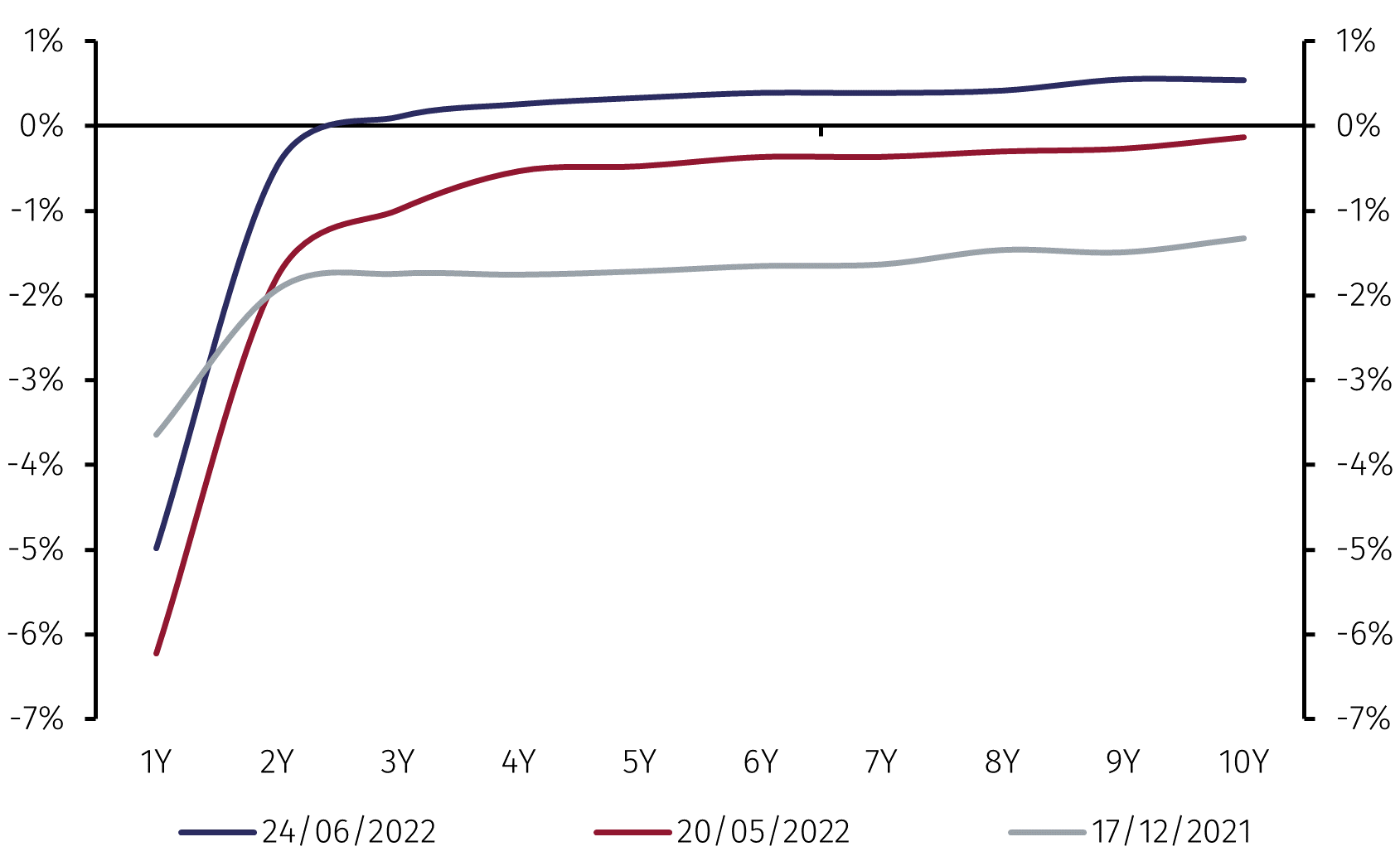

It is important to recognise that the current high inflation rate influences the average expected inflation in the near term. Extracting from the term structure of inflation swaps the expected rate of inflation for each of the next ten years is very informative.2

Source: Refinitiv and EFGAM calculations. Data as at June 24 2022.

Chart 2 shows that financial markets believe that the high inflation of recent months will be transitory, although it will take almost two years before inflation returns close to 2%. While still not entirely satisfactory, this scenario is much improved from the end of May when inflation was not expected to return close to 2% for at least three years.

Subtracting expected inflation from nominal swap rates sheds light on market expectations of real rates. Chart 3 shows that real interest rates have turned positive in recent weeks. It is also interesting that the expected level of real rates is consistent with ECB policy rates peaking at around 2%, at the upper end of the neutral range of between 1-2% indicated by ECB Chief Economist Philip Lane.

Source: Refinitiv and EFGAM calculations. Data as at June 24 2022.

To conclude, the ECB's recent pivot towards tighter monetary policy seems to have stopped the drift in market-based inflation expectations and brought them closer to the 2% target. Furthermore, markets believe that ECB monetary policy will not need to become overly restrictive to return inflation close to target. If these projections are a good guide of future developments, ECB policy rates will turn positive again before the end of the summer. Subsequently, if after September the ECB increased rates by 25 basis points at each meeting, the eurozone monetary policy normalisation would be completed during the summer of 2023.

1 Inflation swaps are more liquid than inflation-indexed government bonds issued by eurozone member countries and are not distorted by creditworthiness-related risk premia.

2 A bootstrap is applied to the term structure of the inflation swaps to extract the expected levels of inflation for each of the intermediate periods.

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London, W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.