Macro Flash Note

Misinterpreting inflation and the risk of recession

Will central banks continue to push up interest rates rapidly to ensure that inflation returns to their 2% inflation objectives, at the risk of triggering recessions? The answer to that question may hinge on how they think about inflation. Conventional measures of annual inflation remain high in the US and the eurozone. Although still above 2%, alternative measures that are more sensitive to current inflation pressures are much lower, particularly in the US. In this Macro Flash Note, EFG Chief economist Stefan Gerlach concludes that while continued tight policy is warranted in both economies, it is time for both central banks to slow the speed of rate increases.

Inflation is typically measured as the percentage change in prices over 12 months. The reason for doing so is that monthly inflation rates are highly erratic, making it difficult to interpret them.

But using annual inflation introduces a long delay between monthly inflation and the year-on-year change in prices that may lead central banks to misinterpret inflation pressures. Consider the annual US inflation rate, which was 6.5% in December 2022. In the same month, prices fell by 0.1%. Indeed, the high annual inflation rate largely reflects the very high monthly inflation rates recorded in March and June 2022, that is, nine or six months earlier.

When inflation rates are broadly stable, the annual averaging provides a good indication of current inflation pressures. But when inflation rates are changing quickly, as they have in the last two years, then the averaging procedure produces a backward-looking and distorted picture of price pressures. Annual inflation will look too low when rising price pressures intensify and too high as they abate.

A recent paper proposes a new way of computing inflation that is more informative about price pressures but not as volatile as monthly inflation rates.1 While annual inflation can be thought of as a putting an equal weight on the last 12 monthly inflation rates, the new measure puts more weight on recent observations and less on observations in the distant past.2

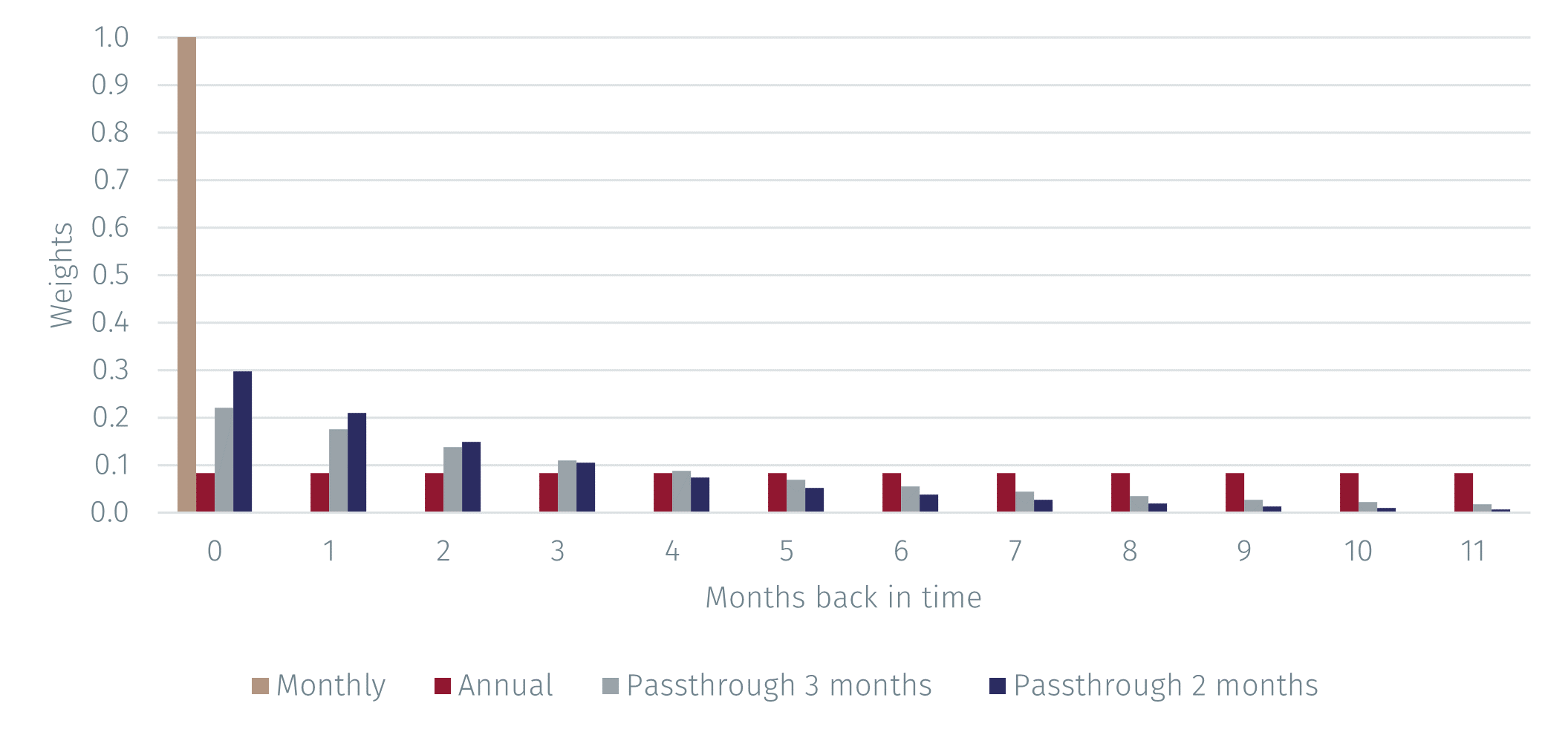

To illustrate the method, the figure below shows the weight for different measures of inflation. The brown pillar shows that monthly inflation puts a weight of unity on the current monthly inflation rate. Since monthly inflation rates are affected by measurement errors and other irregularities, it is very volatile.

The annual inflation rate puts an equal weight on the current and on the past eleven monthly inflation rates as shown by the red pillars.3 This procedure smooths the effects of any measurement errors and temporary disturbances, at the cost of introducing a six-month delay between the monthly and annual inflation rates.4

In comparison with the annual inflation rate, the new measures put greater weight on the current and recent monthly inflation rates, but less weight on monthly inflation rates further back in time. This makes it more sensitive to current inflation pressures, at the cost of being a little more volatile.

The weights can be constructed in many different ways. The figure below shows two such sets of weights. The first, shown in grey, is selected so that half of the adjustment of annual inflation to monthly inflation is achieved in three months, and the second in navy assumes that half of the adjustment is achieved in two months.5

Source: EFG calculations. Data as of 25 January 2023.

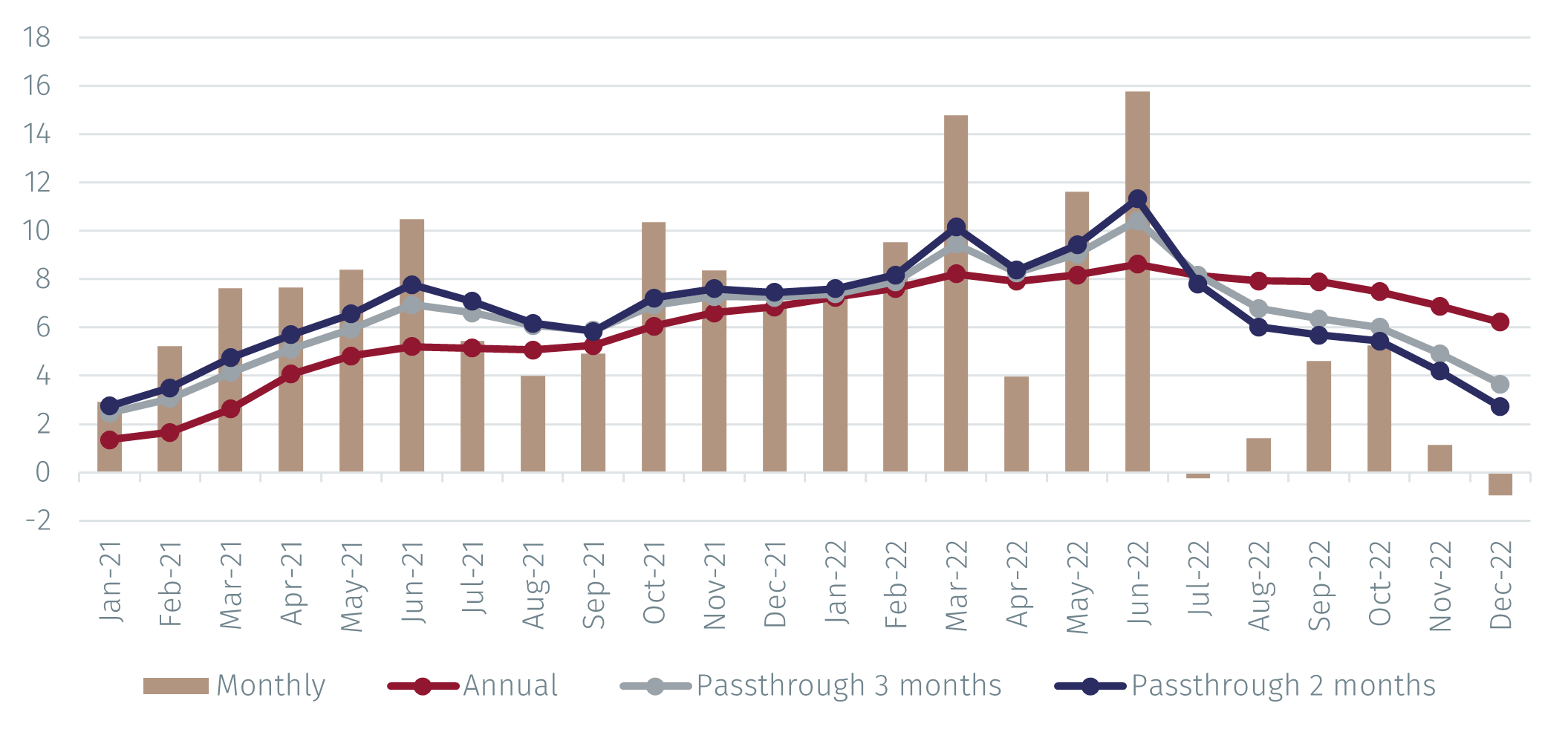

Turning from theory to practice, the graphs below show monthly and annual inflation, together with the new measures selected for a passthrough of three and two months, for the US and the eurozone in 2021 and 2022.

Consider first the results for the US. The graph indicates that annual inflation rose gradually between early 2021 and the summer of 2022 and has since declined gradually but remained above 6% in December. That suggests that continued tight policy is called for.

The adjusted measures of inflation - that are more sensitive to current price pressures - show that pressures were stronger than indicated by the annual inflation rate in the first nine months of 2021, but have since declined rapidly. In December 2022, these measures pointed to inflation in the 3-4% range.

These more flexible measures suggest that tighter monetary policy was called for already in early 2021, but also that good progress in lowering inflation has been made since the summer of 2022 and that the need for large interest rate increases is now commensurately lower. It is not surprising that the members of the Federal Open Market Committee are signalling that the period of large interest rate increases may be in the past.

Finally, the graph shows (annualised) monthly inflation rates, which fluctuate sharply from month to month.

Source: EFG calculations on data from BLS. Data as of 25 January 2023.

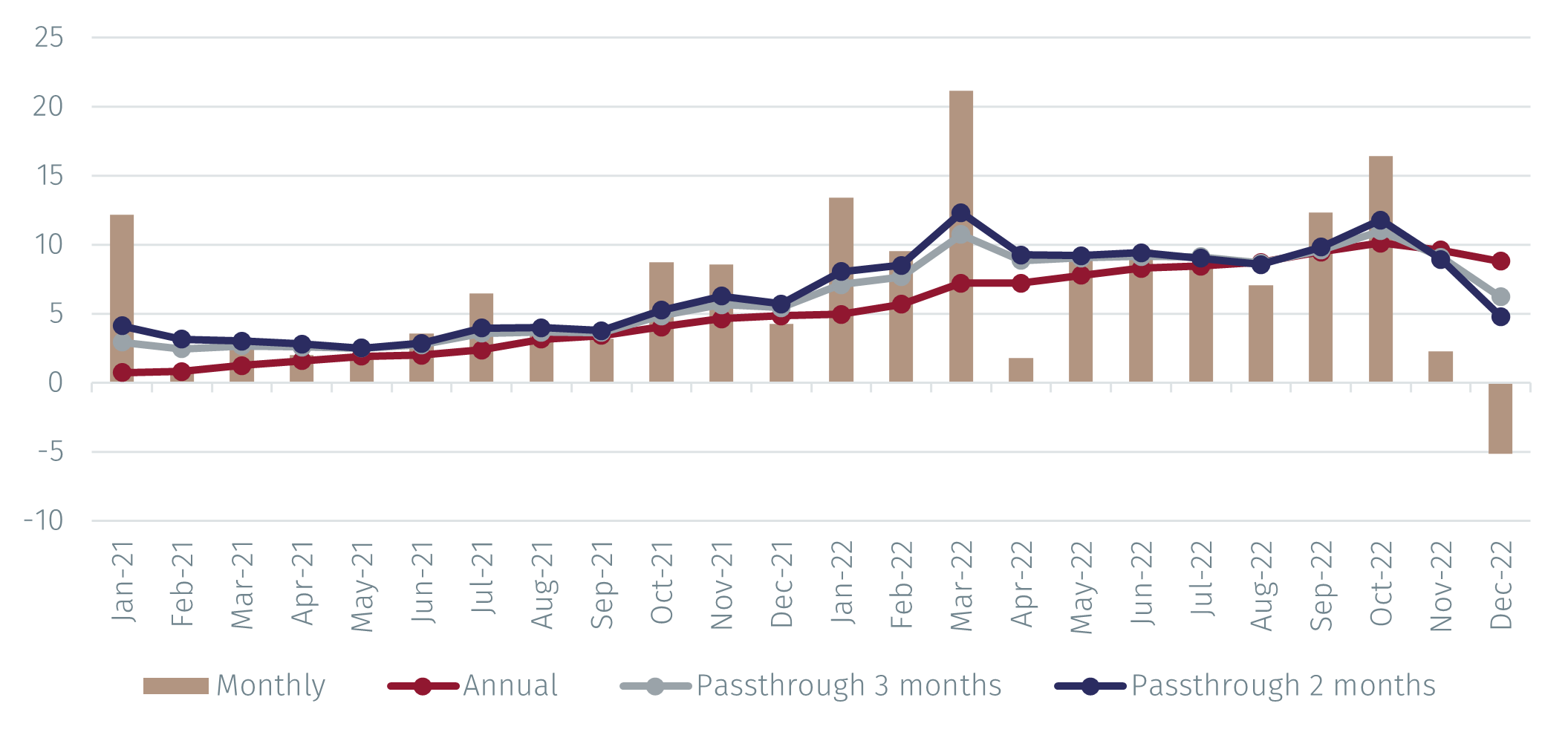

The data from the eurozone tell a similar story. Note first the difference in scale which is necessary because of the more than 20% increase in prices in March 2022, the month after the Russian invasion of Ukraine.

The more flexible measures of inflation pointed to a need to adopt tighter policy already in 2021 also in the eurozone. However, the main difference concerns again the data for December 2022. While annual inflation fell a little during the fourth quarter, it remained almost 9%. In contrast, the more flexible inflation measures declined to 5-6%, indicating that price pressures were abating.

This illustrates how the choice of inflation statistic may affect monetary policy. Annual inflation rates that have a large backward-looking element suggest that little progress has been made in lowering inflation and calls for continued tight policy and further interest rate increases, especially in the eurozone. But the adjusted measures that have greater sensitivity to current price pressures indicate more benign inflation conditions and that more gradual interest rate increases may be all that is needed.

Source: EFG calculations on data from BLS. Data as of 25 January 2023.

In sum, while traditional measures of annual inflation indicate some modest progress in lowering inflation in the US and the eurozone and call for continued tight monetary policy, inflation measures that have greater sensitivity to current price pressures send a more encouraging message, particularly in the US. The outlook for monetary policy will be shaped by what measures policy makers focus on. The risk is that they will focus too much on annual inflation, running a too-tight-for-too-long policy that leads to recessions.

1 See “Instantaneous inflation” by Jan Eeckhout, UPF Barcelona, 23 January 2023.

2 This is true if continuously compounded inflation rates are considered and is approximate if discrete compounding is used.

3 The weights sum to unity.

4 Suppose that monthly inflation is constant at a low level and then suddenly rises to a new, higher level.While annual inflation will the start to rise immediately towards the new, higher level. It will take six months before half of the adjustment has taken place and a year until it is completed.

5 Technically, the weights are geometrically declining. Weights 12 months and further back are set to zero and the weights for months 0 to 11 are adjusted to sum to unity.

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.