Macro Flash Note

MFN - Policy responses to the collapse of SVB

When central banks raise interest rates by 400 basis points in less than a year, things can go wrong. That is a main lesson that should be drawn from the collapse of Silicon Valley Bank (SVB). In this Macro Flash Note, EFG Chief Economist Stefan Gerlach looks at the collapse of SVB from the perspective of a central banker.

On 8 March, Silicon Valley Bank announced that it had closed a considerable position in US Treasuries and agency mortgage-backed securities, incurring a USD1.8bn loss in the process, and that it sought to raise more than USD2.25bn in capital to strengthen its balance sheet.1

The next day, customers withdrew more than a quarter of the bank’s total deposit base, leading regulators to shut down the bank, citing both illiquidity and insolvency. What went so wrong as to trigger the second-largest bank failure in American history?

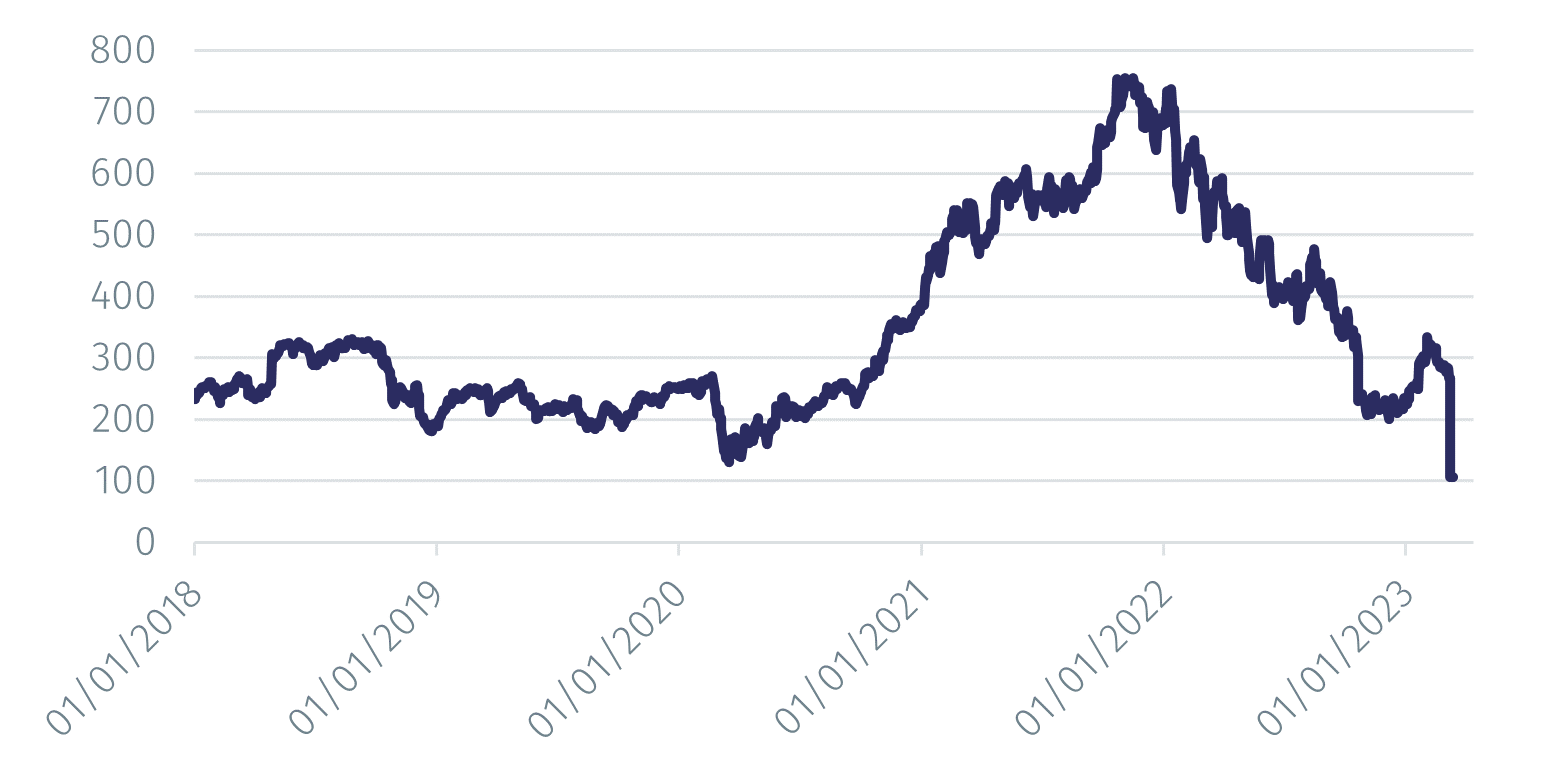

Source: Refinitiv. Data as at 14 March 2023. Past performance is not a guide to future performance.

SVB was an unusual bank, with clients largely linked to the tech industry. A very small fraction, less than 10%, of its deposit base was covered by FDIC insurance. During the pandemic the bank saw rapid deposit growth as the Silicon Valley venture capital industry boomed. It used the expanding deposit base to purchase long-maturity US Treasury bonds and mortgage-backed securities. The possibility of significant losses on these positions seemed very remote during the Covid pandemic when it appeared that interest rates would stay low for a prolonged period of time.

12 months ago the Fed started its most dramatic monetary tightening cycle since the early 1980s, causing these positions to experience large losses. As rumours started to circulate that the bank would need to raise capital, uninsured depositors began to withdraw money, setting off a downward spiral of stress for the bank. The combination of losses on its assets and large deposit outflows led the bank to become illiquid and insolvent. In many respects this is a classic liquidity mismatch problem, the likes of which has been responsible for many historical banking collapses.

In such circumstances, the primary concern of regulators and the Fed is to prevent contagion to other financial institutions that could cause distress among other banks and create a doom loop. One particular concern is that plenty of other financial institutions, in the US and elsewhere, may have taken large positions in long government bonds and are therefore also exposed to the unusual surge in interest rates.

To prevent financial instability from spreading, regulators want to introduce a firewall to stop market sentiment from collapsing. The Fed’s creation of a new Bank Term Funding Program (BTFP) was designed to ensure that. By offering loans of up to one year in length to a range of financial institutions (banks, savings associations, credit unions, and other eligible depository institutions) that can pledge a variety of assets (Treasury securities, agency debt and mortgage-backed securities, and other qualifying assets) as collateral, and by valuing the assets at par, the BTFP will provide liquidity against high-quality securities, eliminating an institution's need to engage in fire sales of those assets.

In parallel, policy makers have said they will make all depositors whole, even those who are technically uninsured. Since SVB held high-quality liquid assets, these could in theory be sold and the proceeds used to pay off depositors, although this entails realising losses.

The more likely outcome is that SVB will be sold to a larger institution that can hold the held-to-maturity securities until maturity. To date, no such buyer has been identified (although SVB’s UK business has been sold to HSBC).

On 13 March, Treasury Secretary Yellen approved actions enabling the FDIC to complete its resolution of SVB in a manner that fully protects all depositors. The losses associated with the resolution will not be borne by the taxpayer. In contrast, shareholders and some other unsecured debtholders will not be protected. Senior management has also been removed.

This episode illustrates how central banks can face a trade-off between stabilising inflation and ensuring financial stability: rapid increases in interest rates to push inflation back to target can raise the risk of financial instability.

How will this affect Fed policy? It seems likely that the Fed will respond to this episode by setting lower interest rates than it otherwise would. Thus, the probability that it will raise rates by 0.5% at its meeting on 22 March has declined sharply and the likelihood that it will rates interest by 0.25% has increased commensurately. However, in an episode of financial instability markets are in flux and the potential for further unsettling news is high. There are good reasons to expect interest rate expectations to remain volatile in the run-up to the policy meeting.

1 This piece draws on “The Death of Silicon Valley Bank: What We Know So Far about The Second-Biggest Bank Failure in American History,” by Joseph Politano, 12 March 2023.

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.