Investment Insights

Taiwan caught in the middle of US-China power struggle

The visit of US House Speaker Nancy Pelosi to Taipei on 2 August sparked tensions between the US and China, with Taiwan caught in the middle. In this Macro Flash Note, Sam Jochim discusses the recent developments.

The “One China” policy maintains that there is only one sovereign state that includes Taiwan. Pelosi’s visit to Taipei was seen to undermine this policy, with the House Speaker telling President Tsai that the US “will not abandon Taiwan.1

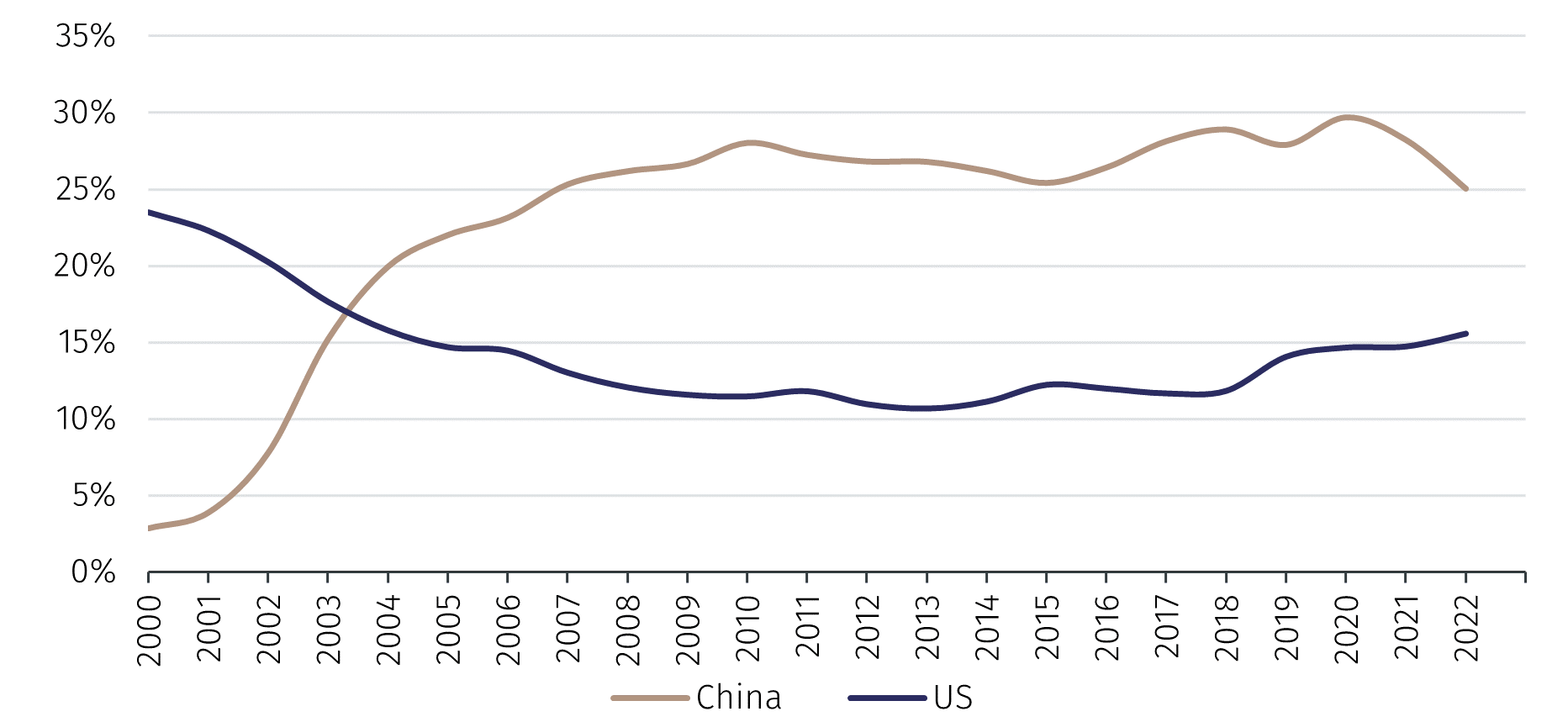

In response, Beijing announced live-fire drills in the vicinity of Taiwan which ended on 10 August. This was a worrying development given that China has previously refused to rule out using military force to gain control of Taiwan, as expressed in an official government paper.2 Furthermore, China implemented a halt on exports of sand to Taiwan and imports from Taiwan of citrus fruits and some types of fish. Having overtaken the US to become Taiwan’s largest export partner in 2004 (see Chart 1), China has the potential to damage the Taiwanese economy through trade restrictions.

Source: Taiwan Bureau of Trade and EFGAM calculations. Data as of August 2022.

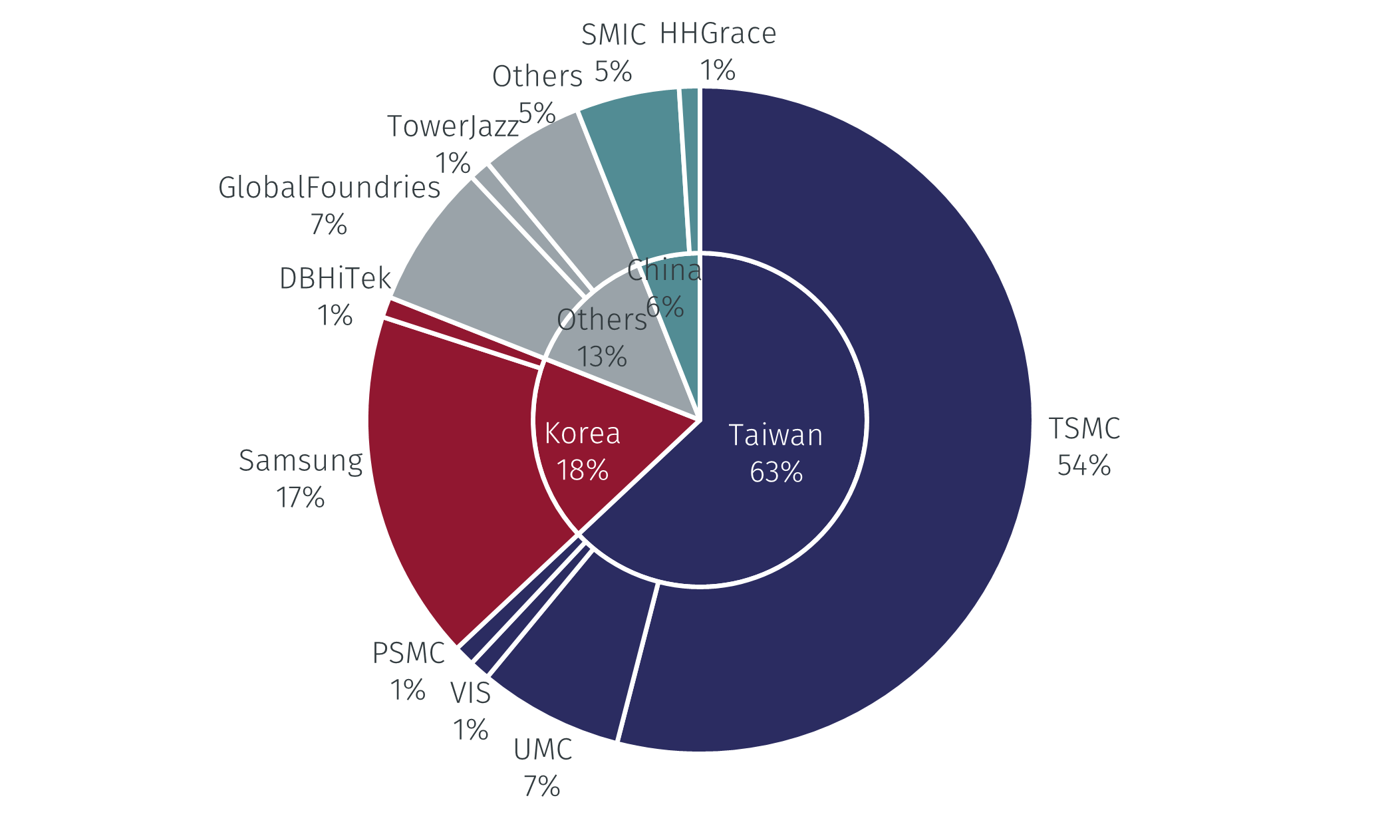

However, the restrictions that have been introduced are minor, with fish and citrus fruits ranking 27th and 43rd respectively out of Taiwan’s exports to China in 2021.3 Taiwan’s main export to both China and the US is semiconductors. The chip market is of huge importance and is one which Taiwan dominates (see Chart 2). On top of accounting for 63% of global semiconductor production in 2020, Taiwan accounted for 92% of the production of the most advanced semiconductors.4 Put plainly, China could not afford to limit the flow of chips arriving from Taiwan and the US could not afford to create a situation in which its own supply of chips from Taiwan was compromised. The signing of the CHIPS act by US President Joe Biden, the day before Chinese military drills were halted, highlighted the push from the US to become less dependent on Taiwanese chips.5 This process will take time, however, and it seems unlikely the situation will escalate to a military conflict before it is complete.

Source: TrendForce and EFGAM calculations. Data as of March 2021.

In addition, any restriction on the flow of chips from Taiwan to China would be a political own goal. The Chinese economy has lacked momentum in 2022, with growth looking likely to come in below the official government target of 5.5% and urban unemployment currently at its highest since August 2020. Multiple Taiwanese companies operating in China and employing Chinese citizens rely on Taiwanese chips as a key part of their production line. With President Xi expected to secure a third term in power during the Communist Party’s 20th National Congress in November, the Chinese authorities will be keen to avoid any further slowdown in Chinese economic growth.

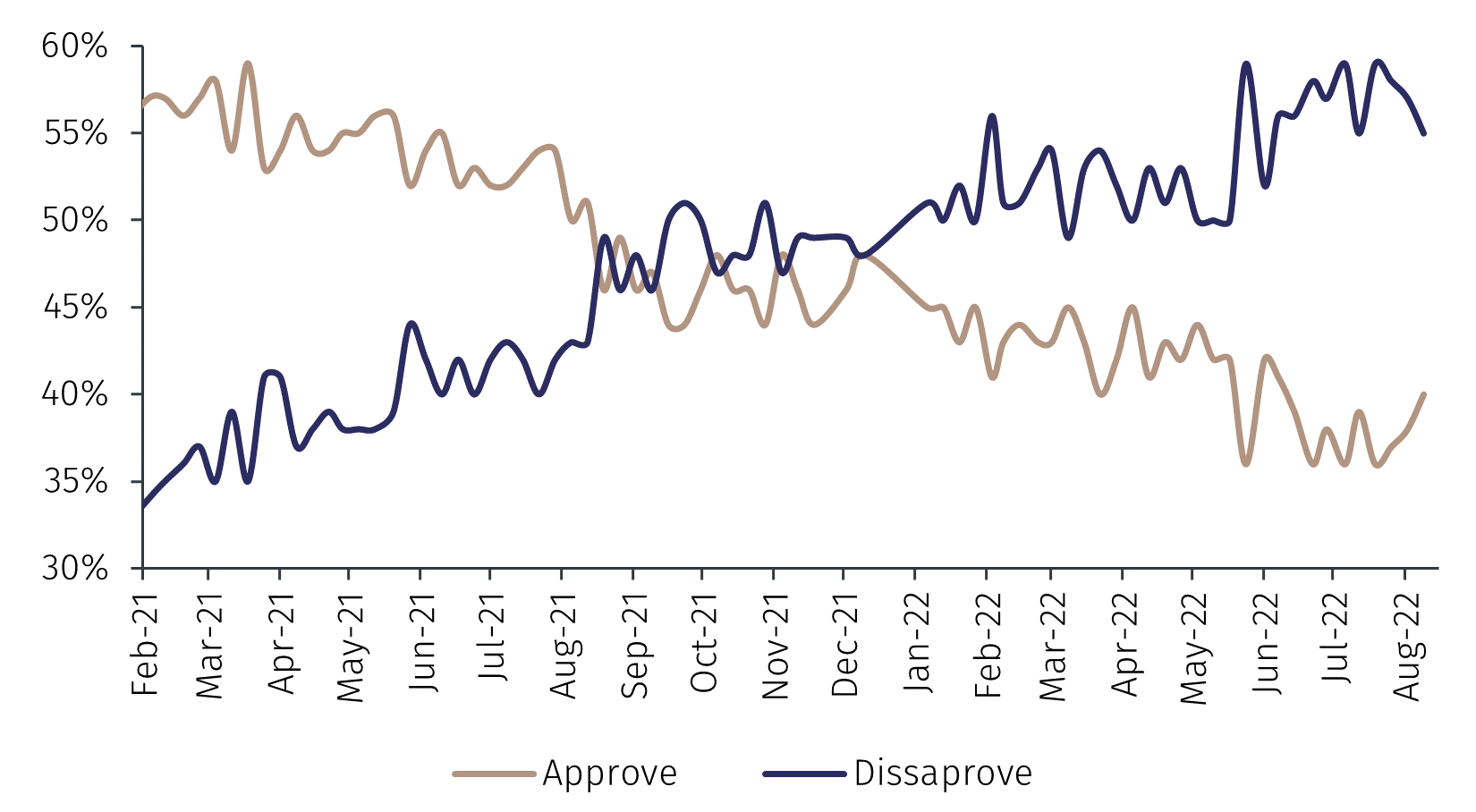

In fact, both President Xi and President Biden have benefitted from recent events in terms of their respective domestic support. President Xi has used Pelosi’s visit as an excuse to showcase China’s strength and dedication to its One China principle via the military drills around Taiwan. Similarly, President Biden, whose popularity had been declining before Pelosi’s visit, also sent a signal of US strength in not appeasing China. Furthermore, the response has reaffirmed the US’ willingness to support other Asian countries such as Japan in their respective territorial disputes with China over islands in Asia.6 This could play an important role in the China-US battle for geopolitical influence in the Indo-Pacific area. The response has seen Biden’s ratings climb to a two-month high in approval polls, though they remain at a low absolute level ahead of the midterm elections in November (see Chart 3).

Source: Reuters, Ipsos and EFGAM calculations. Data as of August 2022.

It is also of note that President Biden and President Xi were acquainted long before Biden became the US President. In 2013, President Xi referred to Biden, who was Vice President to Obama at the time, as an “old friend”. Despite current elevated tensions between the two countries, the two Presidents are planning to meet face-to-face for the first time since Biden became President at the next G20 meeting in November.8 The meeting will be closely watched, with the potential to agree on a de-escalation between the two countries.

In summary, a proxy war between the US and China over Taiwanese independence would have negative economic consequences, straining supply chains, elevating inflation, and damaging growth. Nonetheless, this is not the current baseline scenario. China remains hesitant to impact the Taiwanese economy through restrictions on semiconductor trade, as this would also have negative implications for the Chinese economy. At the same time, the US does not want to push China into any form of economic blockade on Taiwan before it has secured its own domestic semiconductor supply chains. This reduces the risk of near-term escalation of the conflict. The US Department of Defence still maintains that China will not take Taiwan militarily within the next two years.9 Furthermore, war would not play into the hands of either President given their own domestic situations and their upcoming elections.

1 https://www.reuters.com/world/asia-pacific/pelosi-addresses-taiwan-parliament-visit-condemned-by-china-2022-08-03/

2 https://english.www.gov.cn/archive/whitepaper/201907/24/content_WS5d3941ddc6d08408f502283d.html

3 Taiwanese Bureau of Trade

4 https://www.bcg.com/publications/2021/strengthening-the-global-semiconductor-supply-chain

5 https://www.state.gov/the-passage-of-the-chips-and-science-act-of-2022/

6 https://www.europarl.europa.eu/RegData/etudes/BRIE/2021/696183/EPRS_BRI(2021)696183_EN.pdf

7 https://obamawhitehouse.archives.gov/the-press-office/2013/12/04/remarks-vice-president-joe-biden-and-president-xi-jinping-peoples-republ

8 https://www.wsj.com/articles/chinas-xi-jinping-plans-to-meet-with-biden-in-first-foreign-trip-in-nearly-three-years-11660318437

9 https://www.reuters.com/world/asia-pacific/no-change-us-assessment-china-timeline-taiwan-despite-pelosi-visit-official-says-2022-08-08/

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.