Investment Insights

What will US inflation be in August? A forecast based on gasoline prices

With retail oil prices falling in the US, annual CPI inflation is likely to continue to decline sharply in the US in August, perhaps to below 8%, argue Stefan Gerlach and GianLuigi Mandruzzato in this Macro Flash Note.

On 13 September US CPI inflation for August will be released. After reaching 9.1% in June, it fell to 8.5% in July. Chairman Powell stated in his Jackson Hole speech on 26 August that a one-month decline in CPI inflation is not enough for the Federal Reserve to question its outlook for US monetary policy, but a series of positive inflation surprises is likely to do so. Much attention is therefore focused on the August release.1

One important driver of CPI inflation has been energy prices, which constitute 9.2% of the US CPI and which rose 32.9% between July 2021 and July 2022. A large part of energy is gasoline prices, which have a weight of 5.2% and rose 44.0% in the year to July 2022. That these components contributed to the decline in inflation between June and July this year is clear: energy prices fell by -4.5% and gasoline prices by -7.7% on a monthly basis.

Gasoline prices at the pump are readily observed and are collected weekly by the US Energy Information Administration.2 We therefore know that average gasoline prices fell by -12.8% between July and August. The direct effect on this decline is thus to reduce the CPI by 0.7%. This suggests that the annual CPI inflation will fall further in August to perhaps 7.8%.

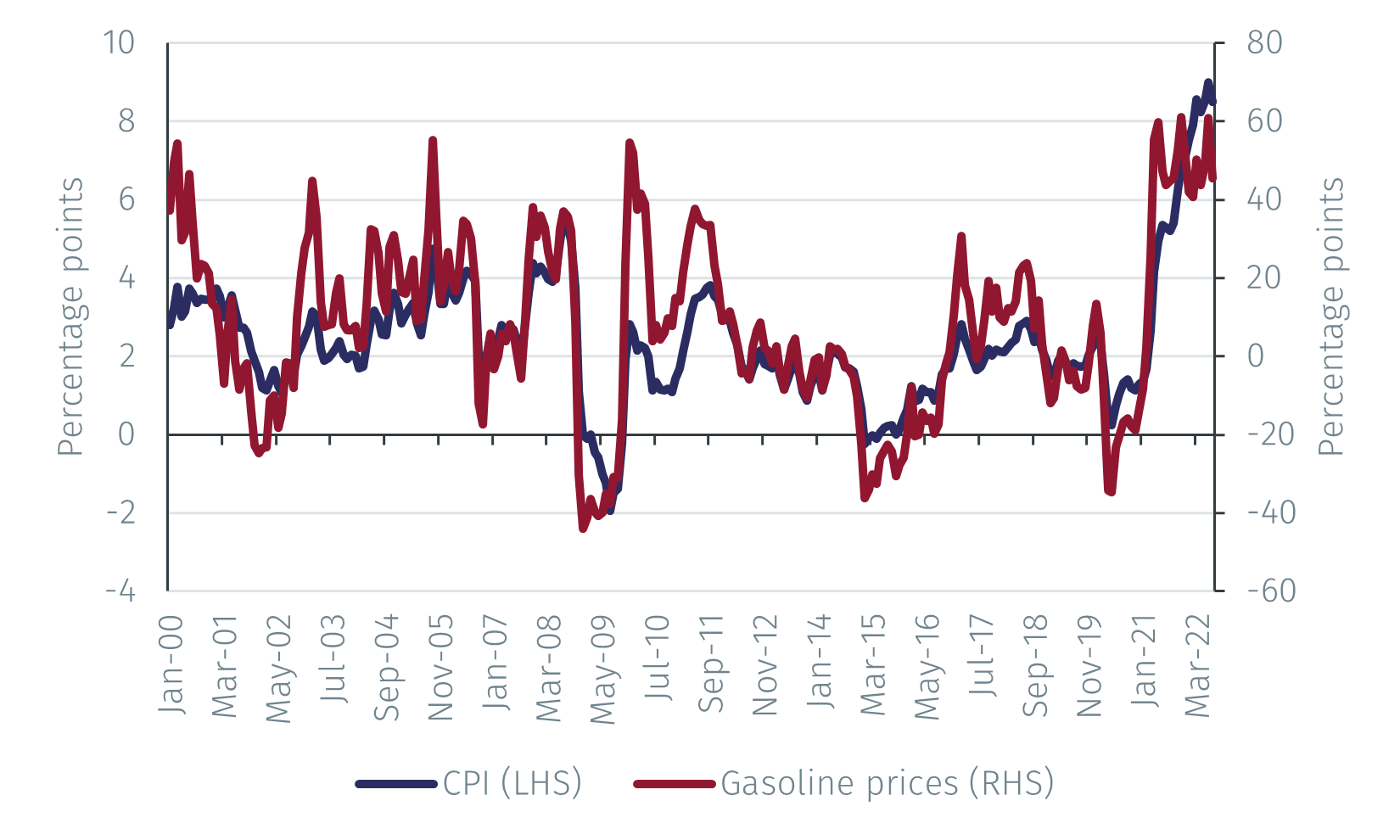

The chart below shows annual CPI inflation and the change in gasoline prices over 12 months. As it is clear, while gasoline prices experience swings of much greater magnitude, the two series are very strongly correlated (correlation = 0.84).

Source: FRED and US Energy Information Administration, data as of 1 September 2022.

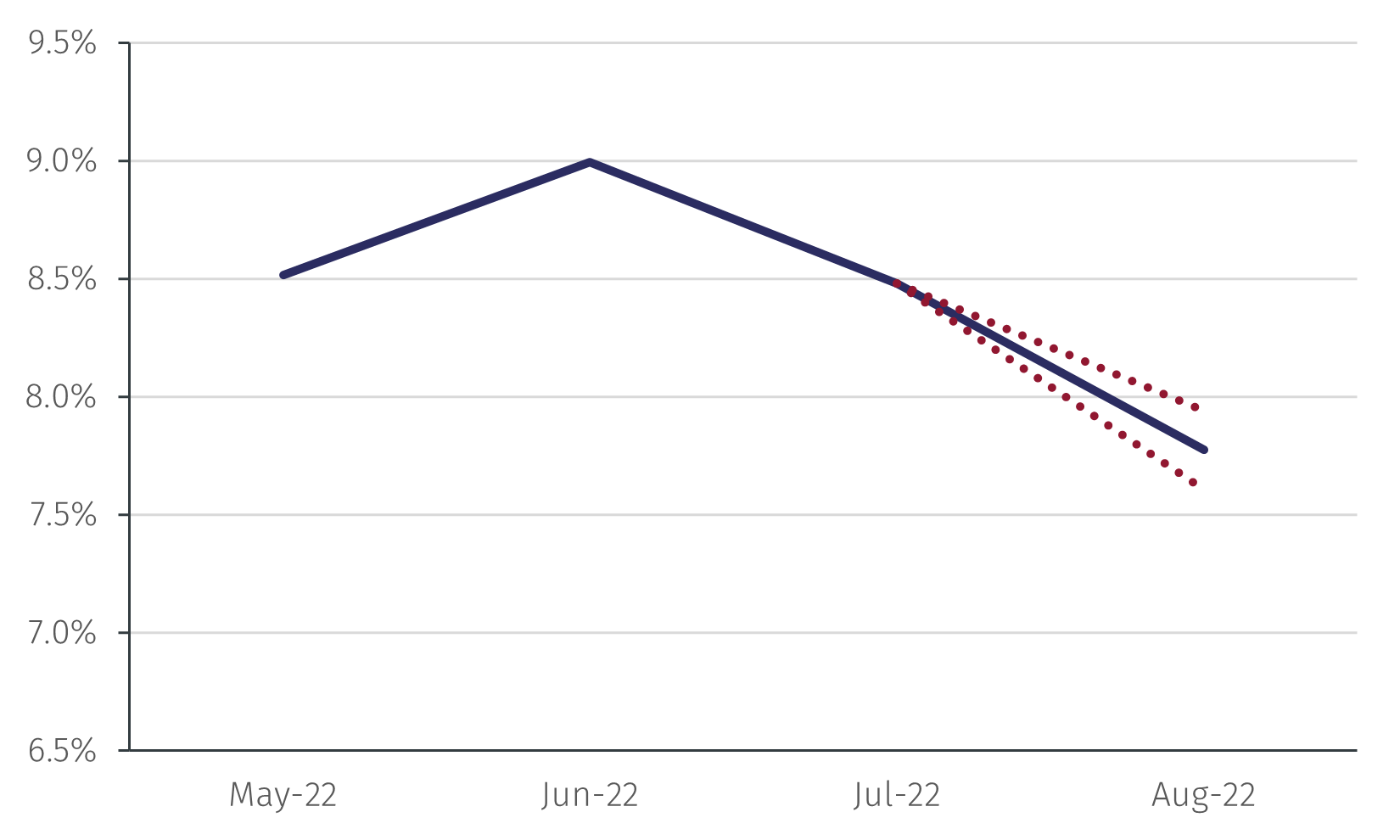

To use the gasoline price data to produce an estimate of CPI inflation in August of this year, we develop a simple statistical model.3 As the chart below shows, that model yields a forecast of annual CPI inflation of 7.7% and a monthly inflation rate of -0.3%.4 (A 67% confidence band is for annual inflation of 7.61% - 7.94% and monthly inflation of -0.17% - -0.47%.)

Source: FRED, US Energy Information Administration and EFGAM calculations, data as of 1 September 2022.

Other factors also point to a moderation of inflation in August. The price of used cars, which accounts for 4.1% of the US CPI and which has been a major contributor to rising inflation over the past several years, fell 3.6% month-on-month in the first half of August according to the Manheim Used Car Index, further unwinding the increases reported since early 2021. In addition, retail companies have recently complained of excessive inventory levels and hinted at discounting prices to wind them down.

To conclude, the chances are that lower energy prices and the unwinding of some of the trends that pushed up US CPI since the beginning of 2021 will lead inflation to fall for a second consecutive month in August.

1 See https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm

2 See https://www.eia.gov/petroleum/gasdiesel/

3 The model views monthly CPI inflation as depending on last month’s CPI inflation, and the percent change in gasoline prices in this and last month. It is estimated on data from January 2000 to July 2022.

4 The BLS’s annual inflation rate is based on seasonally unadjusted data and is 9.1% in July. Our annual inflation rate is based on seasonally adjusted CPI data and is 9.0% in July.

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.