Investment Insights

How fast will the FOMC raise interest rates?

The Fed is set to continue to tighten monetary policy. But how fast will it raise rates? In this issue of Infocus chief economist Stefan Gerlach looks at the historical evidence since 1980 and compares what the FOMC and the markets expect in the current cycle.

With CPI inflation in the US exceeding 8% year-on-year in March and with interest rates at 0.25%-0.5% the Federal Reserve is in a tightening mode, having first hiked rates by 25bps on 16 March. But how fast might it raise interest rates from here? To address this question, it is useful to review how the Fed has behaved in past tightening episodes.

The historical record

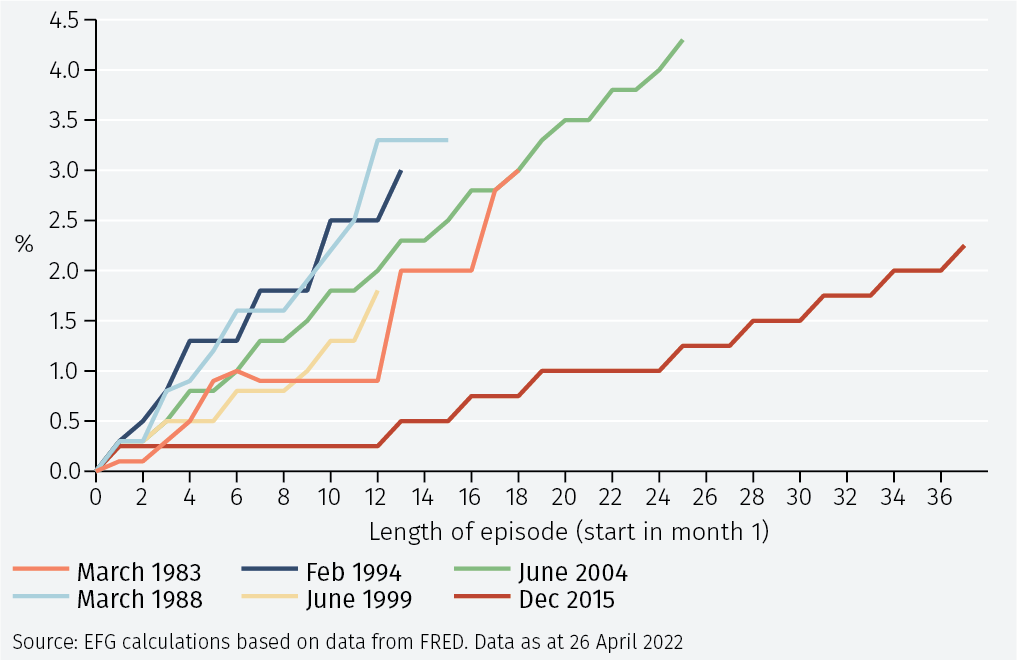

Relying on work dating tightening cycles by Federal Reserve staff, the analysis focuses on the six episodes since 1980.1 Figure 1 shows how the target for the federal funds rate evolved in these episodes. While the first five evolved in broadly similar ways, the sixth tightening cycle, which started in December 2015 and was the first after the Global Financial Crisis (GFC), was much slower but also longer than the earlier five. This is not surprising: since the GFC was centred on the financial system the Fed naturally decided to proceed cautiously.

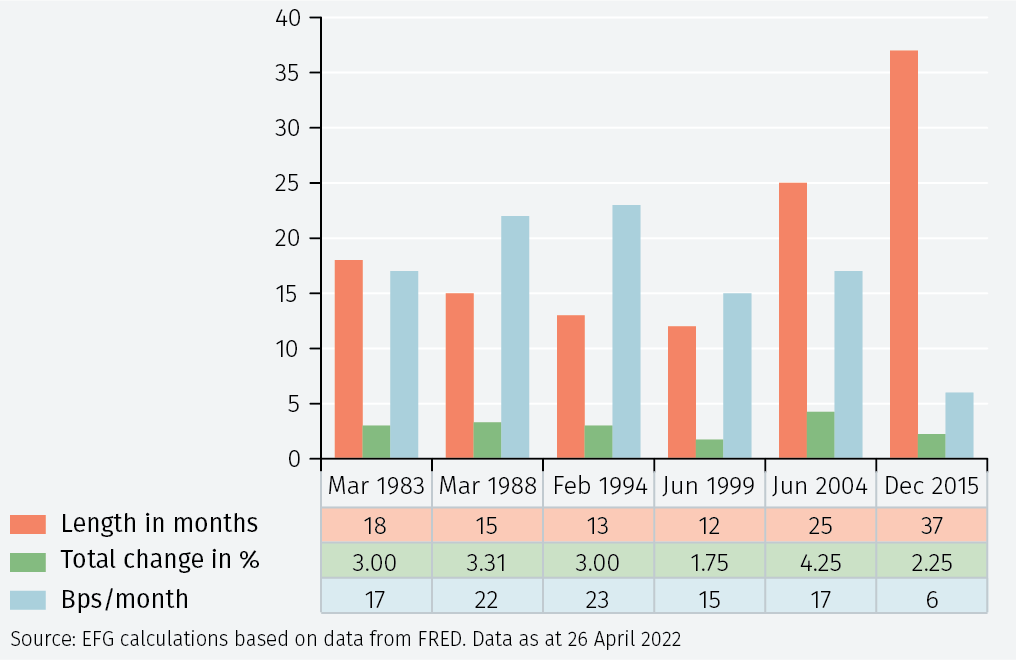

Figure 2 provides more detail about these episodes. The table shows the month of the first interest rate increase, the number of months the episode lasted, the total increase in interest rates and the average increase in rates per month. The first four episodes lasted between 12 to 18 months. The episode that started in 2004 was a little longer, lasting 25 months. The longest was the post-GFC episode that lasted more than three years.

The table shows that these tightening cycles involved a cumulative increase in interest rates of between 1.75% and 4.25%. Interestingly, the long post-GFC episode entailed a relatively small cumulative increase of 2.25%.

Another way to compare these episodes is to look at the 'speed' of tightening, defined as the cumulative increase in interest rates divided by the length of the episode. The episodes have been broadly similar, with an average speed of tightening of 15 – 23bps per month.2 The exception is the post-GFC episode with an average speed of 6bps per month.

As a rule of thumb, and disregarding the 2015 episode, the historical evidence suggests that tightening episodes last about 15 months and involve around a 3% cumulative increase in interest rates, implying a speed in the order of 20bps per month.

What do FOMC members, and the markets, expect this time?

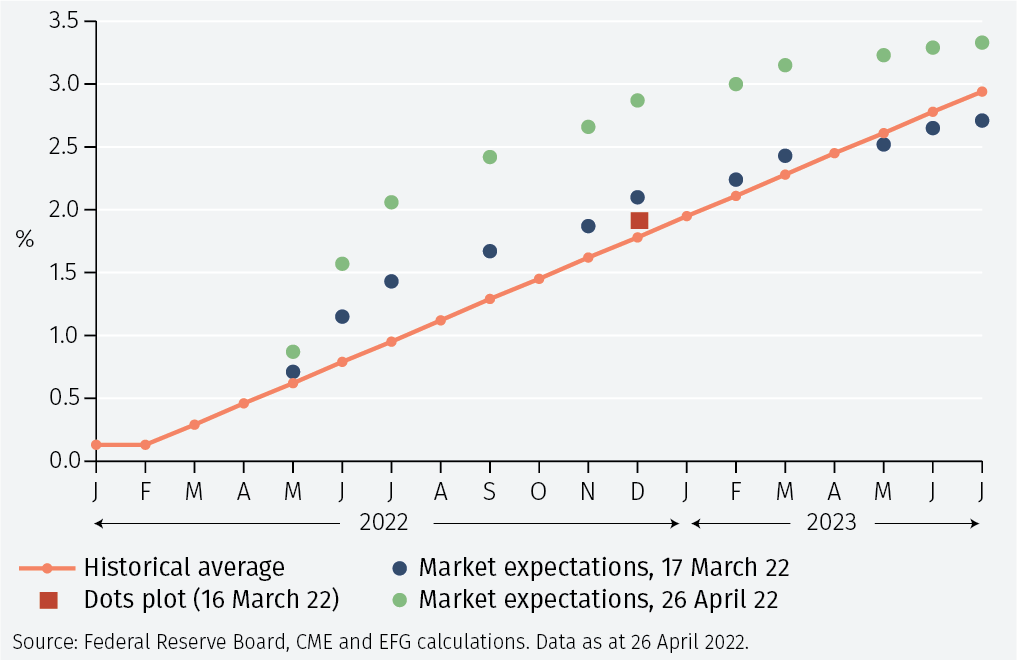

Next, we turn to the question of how FOMC members and market participants think this episode of interest rate tightening will evolve. Figure 3 shows the path assuming a monthly increase of 17.3bps, which is the average monthly increase for the episodes reviewed above (disregarding the post-GFC tightening cycle), starting from March 2022 onward. That path implies an interest rate of 1.855% in December.

Interestingly, the median dot for December 2022 in the FOMC’s 'dot plot' published in March 2022 is for an interest rate of 1.875%. Thus, the FOMC expects to raise interest rates in a manner compatible with the historical record. Furthermore, the median FOMC member expects interest rates to peak at 2.75% at the end of 2023, which matches very well the historical record of tightening cycles involving about a 3% increase in interest rates in total.

Figure 3 also shows the path priced in by financial market participants on 17 March (the day after the last FOMC meeting) and on 26 April, with each dot indicating an FOMC meeting.3 The figure shows that while market expectations in March were broadly compatible with the historical record of interest rate increases, there are now far more aggressive increases expected for this year. In particular, the market anticipates rapid interest rate increases in May, June and July, followed by increases according to the historical norm of about 20bps per month until early 2023. It seems likely that FOMC members will revise their dots upward at their June meeting.

Conclusions

This analysis suggests three main conclusions.

- A 'standard' Fed tightening cycle lasts about 15 months and involves around a 3% cumulative increase in interest rates, implying a speed of tightening in the order of 20bps per month.

- The median FOMC member apparently expected at the time of the March meeting that rates would follow a path similar to the historical average.

- Market participants are pricing in more aggressive interest rate increases at the May, June and July FOMC meetings, but that rates thereafter will rise at the same speed as in past interest rate tightening cycles of about 20bps per month.

1 See A Look at Fed Tightening Episodes since the 1980s: Part I, Kevin L. Kliesen, 14 April 2022, Federal Reserve Bank of St. Louis. https://tinyurl.com/54z5p23c

2 Speed is computed using the cumulative increase in interest rates over the first 12 months since that is the shortest episode. Interestingly, the speed of tightening is strikingly similar over that period.

3 The CME’s FedWatch Tool (https://tinyurl.com/ycksjkye) provides the probability of future FOMC decisions as priced in by financial markets; the figure shows probability-weighted averages.

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Leconfield House, Curzon Street, London W1J 5JB, United Kingdom, telephone +44 (0)20 7491 9111.