Review of 2022 Outlook

Each December, we review the Outlook we presented a year earlier. 2022 was a difficult year, with our projections thrown off course by unexpected events: the Russia- Ukraine war, persistently higher oil prices and aggressive interest rate increases. Overall, we scored 6/10. Our longer-term track record is much better. 1

1Partly correct |

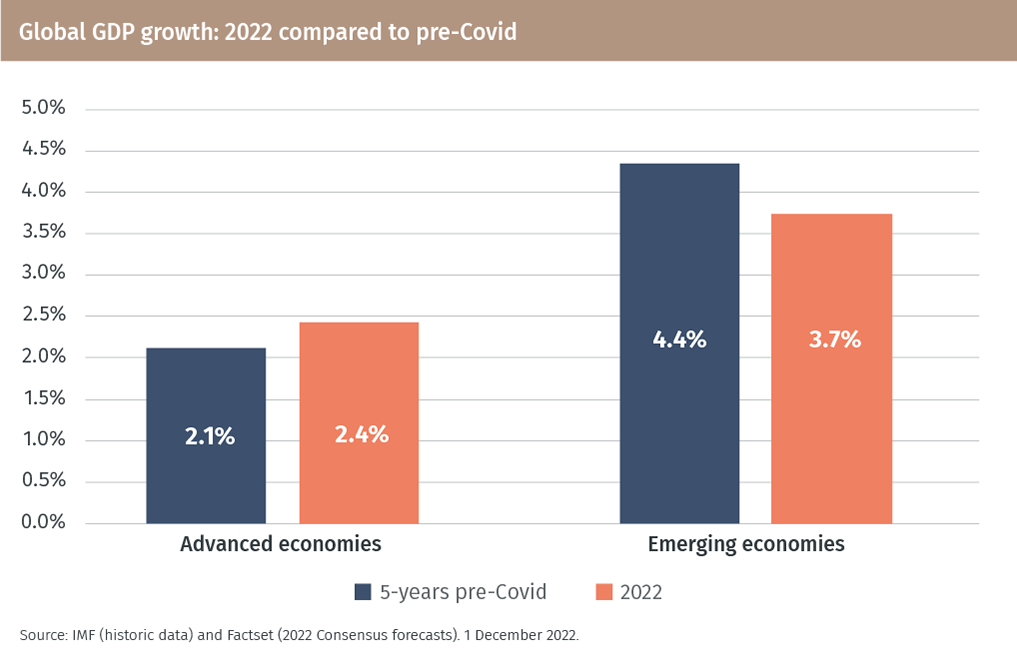

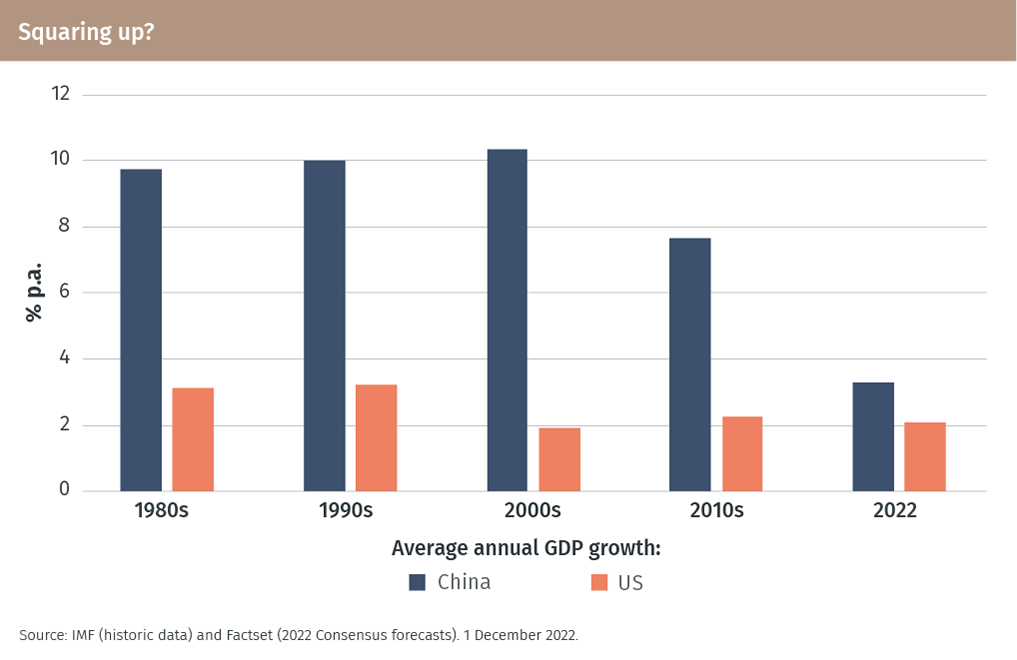

Global growth above trendWe expected advanced and emerging economies’ GDP growth to be above trend (defined as the five years pre-Covid) in 2022. That happened in the advanced economies – but only marginally. Emerging economies’ growth was below trend. However, that was entirely due to a contraction of the Russian economy and weak growth in China, largely because of its zero Covid policy. Other emerging markets grew strongly: India by 6.8% and the ASEAN52 by 5.3%, for example. We expected US GDP growth to come close to that in China. That happened: around 2% versus just over 3%, respectively (a much narrower gap than in the past).

|

2Partly correct |

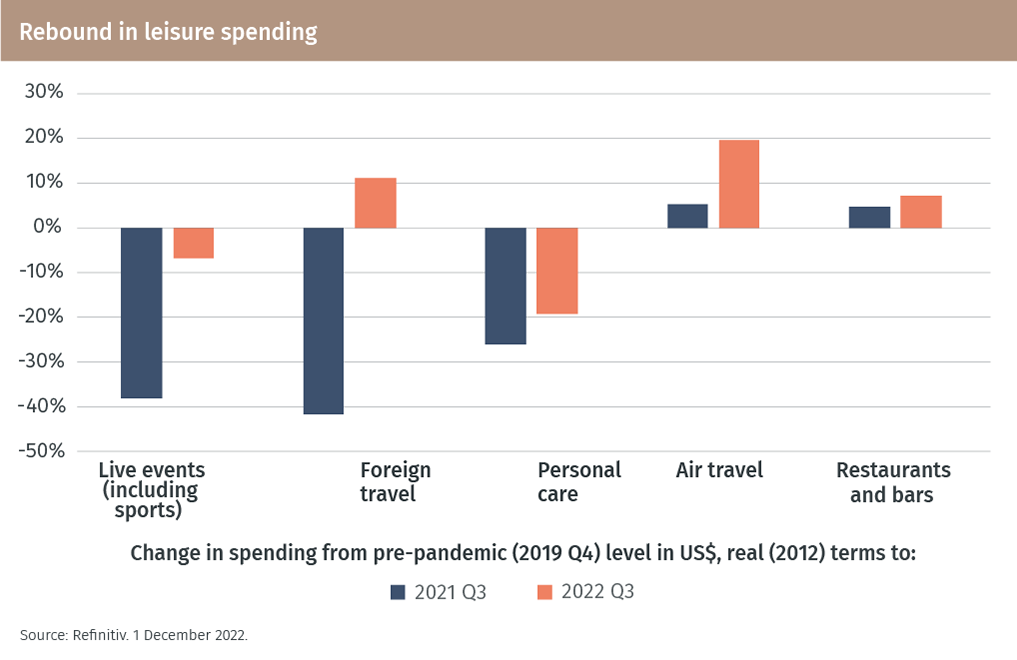

Spending spreeUS consumer spending, in the areas most affected by Covid, did recover. In real, inflation-adjusted terms spending on air fares and foreign travel rose strongly. That was all the more notable given the price increases in these areas. Spending on personal care did not recover as strongly, primarily because of a limited ability to meet extra demand (waiting lists for medical treatments have remained long, for example). However, excess savings remained high and this should support consumer discretionary spending into 2023.

|

3Correct |

Emerging markets go digitalThere was rapid adoption of digital technologies in emerging economies. An October 2022 McKinsey report found that “digital payment transactions are skyrocketing in emerging markets as innovations proliferate”3. The markets which saw this trend most clearly were those outside China. Reflecting this, emerging markets (ex-China) produced higher returns than the entire emerging market universe.4

|

4Incorrect |

Inflation proves transitory; risks of a policy mistakeInflation remained stubbornly high across all the major advanced economies, notably in the US. A large part of the explanation was Russia’s invasion of Ukraine and the impact on commodity prices. In the US, the strength of the economy put additional upward pressure on inflation. Towards the end of 2022, however, there were signs of inflation abating in the eurozone and the US. The concern that interest rate increases will be seen, in retrospect, as a policy mistake still remains.

|

5Correct |

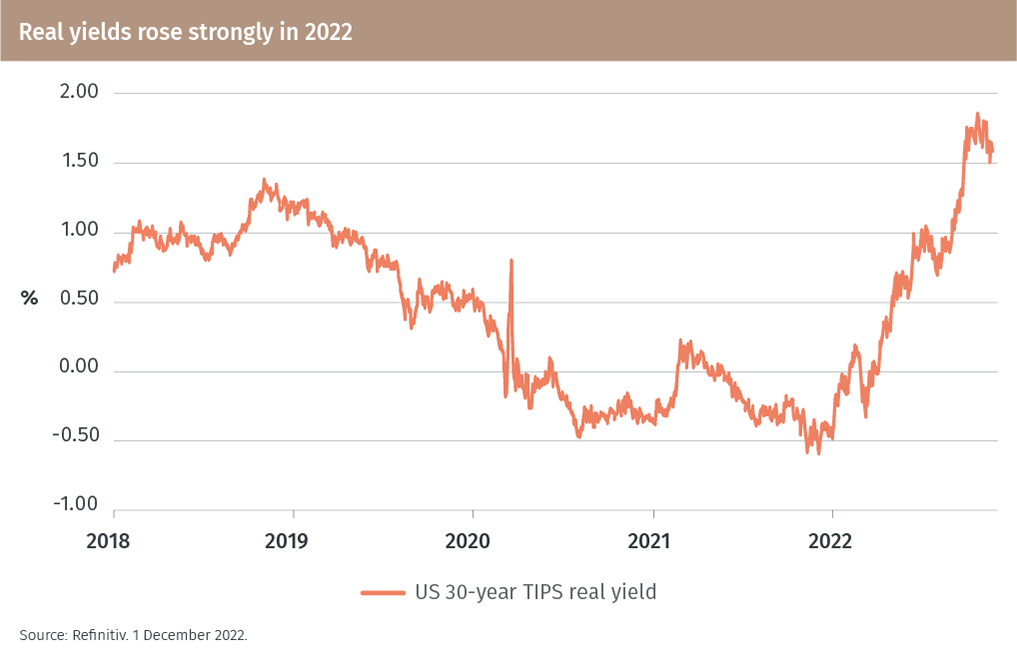

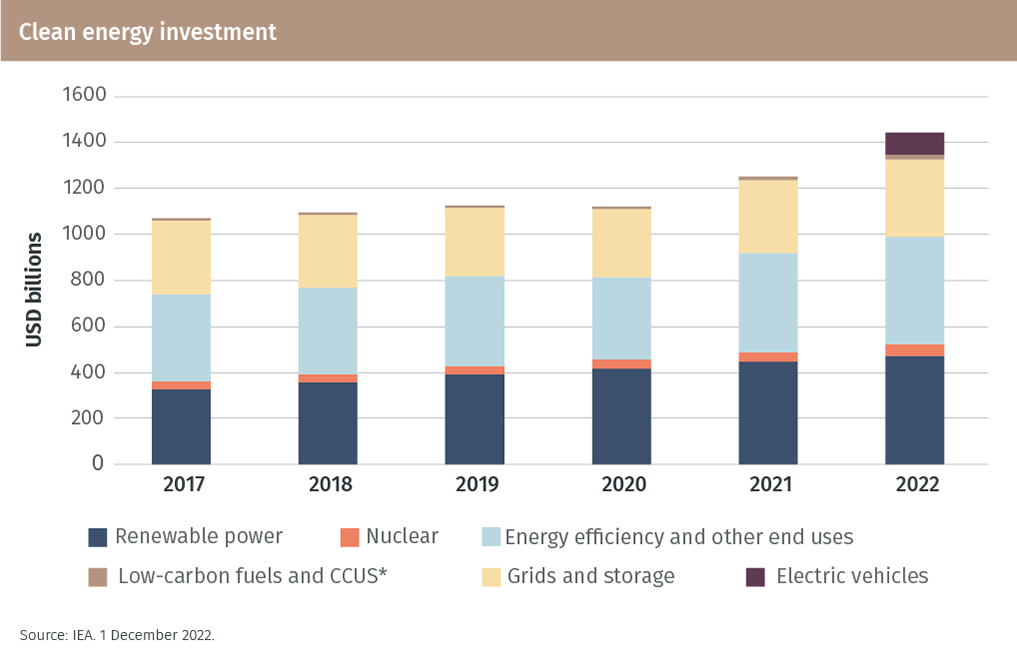

Savings and the green infrastructureWe linked two themes – the need to finance the green infrastructure and the expectation that real yields (notably on US TIPS) would rise. Real yields rose substantially and green infrastructure spending strengthened.

|

6Partly correct |

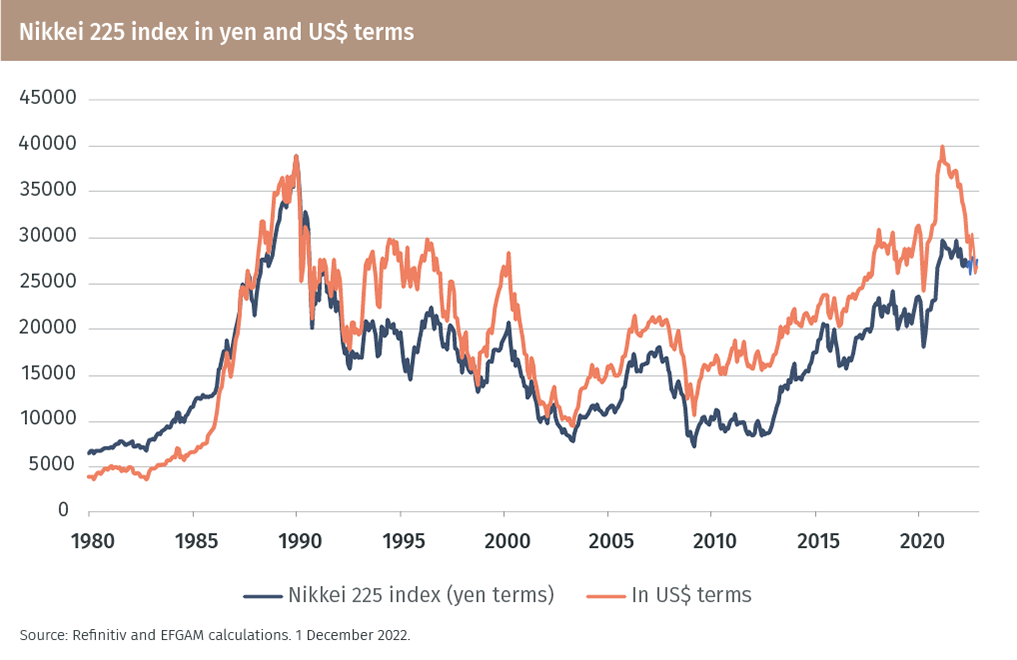

Japan’s quarter-century convalescenceWe were optimistic on prospects for Japan’s equity market, commenting that it had already regained its 1999 peak level in US dollar terms and would regain its peak in yen terms in 2022. That did not happen. The domestic equity market was broadly flat, a much better performance than the other main developed markets. However, the fundamental sign of Japan’s recovery that we cited – a strong recovery in corporate earnings – did materialise.

|

7Incorrect |

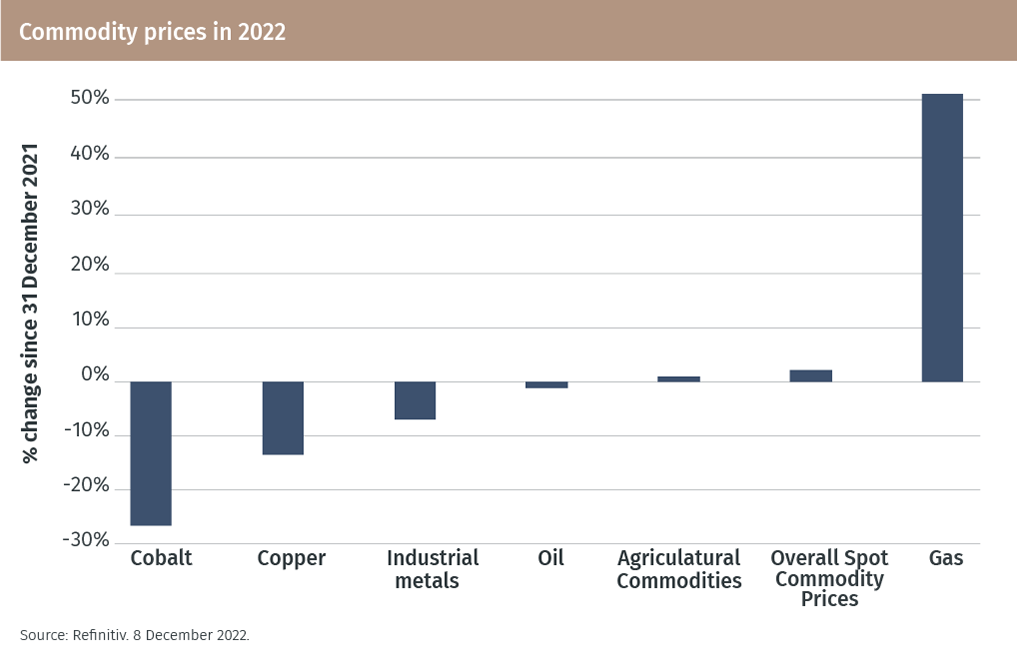

CommoditiesWe looked for commodity prices to ease back, mainly because of weaker growth in China. That was true for industrial metals, but the main spot commodity indices (which have a high weight in oil and gas) rose marginally. The relative winners we saw – copper and cobalt – were weak (falling 14% and 27%, respectively). We see this fall in industrial metal prices as temporary and still expect the transition to the green economy (especially the wider adoption of electric vehicles) as a structural force raising demand.

|

8Correct |

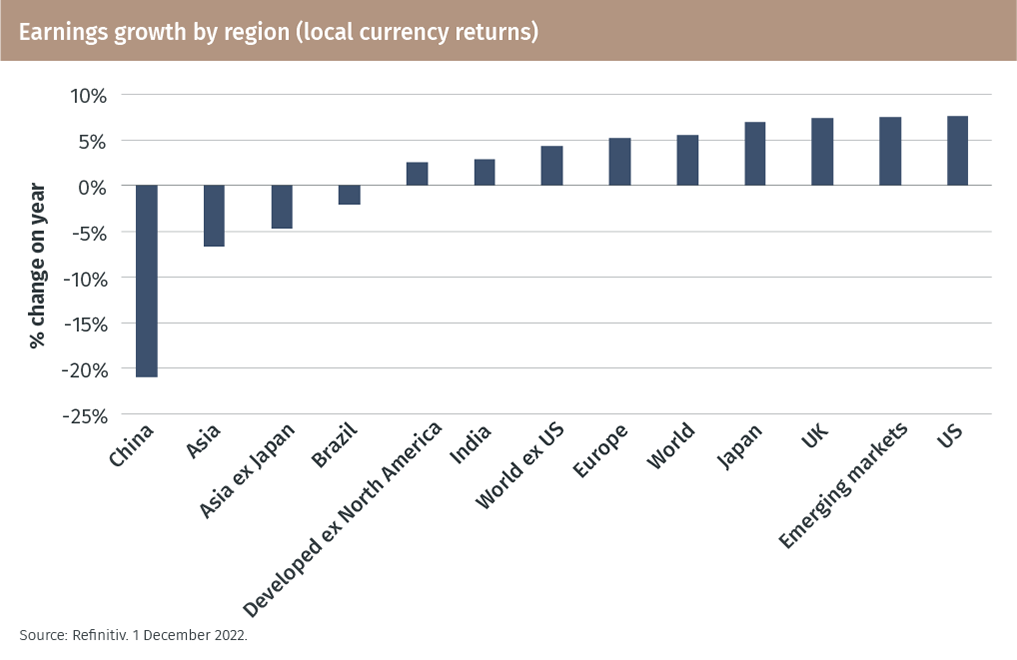

Tougher time for earningsGlobal corporate earnings grew by 5.5% year-on-year in December 2022 in US dollar terms, much lower than in 2021 (a peak rate of over 50%) and broadly in line with our expectations. We said that the US market was still ‘the one to beat’ and indeed it produced the strongest earnings growth in the year, followed by emerging markets, the UK and Japan (see chart 'Earnings growth by region'). Earnings were weakest in China – falling more than 20% compared to a year earlier.

|

9Partly correct |

Fixed income opportunities remainWe expected that upward pressure on government bond yields would depress total returns from bond markets. Emerging market bonds were our choice ‘in a tough environment’. The back up in government bond yields was furious and the widening of spreads created a tough environment for all fixed income markets, with emerging markets one of the weakest sectors. But there were some good opportunities for managing both duration and credit exposure during the year. We started the year with underweight fixed income exposure.

|

10Correct |

Globalisation, reshoring and new trade patternsWe thought that there would be notable pressure for reshoring of production but that the ability to do this would be restrained due to worker shortages. In July 2022, the US Congress passed the CHIPS Act, which aims to strengthen domestic semiconductor manufacturing, design and research. There were similar pressures in other sectors. However, US imports of manufactured goods from Asian low cost countries have not notably declined, according to one study5. Labour shortages remained one of the dominant themes of 2022.

|

Outlook 2023 – Our top 10 themes for the year ahead

The focus will remain firmly on the trend of inflation in the major developed economies in 2023. Finally, we expect it will subside. Geopolitical tensions will ease, especially as China opens up. Economic growth will rebound there, but the reality is that global growth will return to a more pedestrian level in coming years, limited by demographic and productivity trends. A bright spot will be Japan’s continued renaissance. We favour investment grade bonds, small cap equities and the consumer discretionary sector. The US dollar is set to weaken.

These themes are based on our own analysis and represent our views, there is no guarantee that these will actually occur.

1. Inflation (finally) subsides

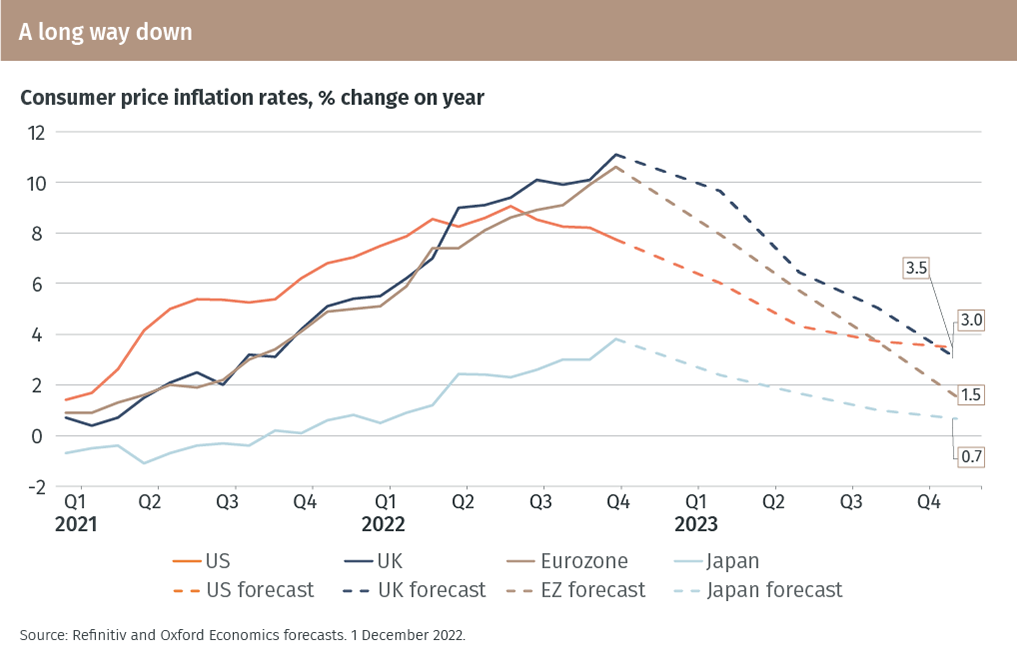

Inflation rates will, finally, come down in the main advanced economies. The US rate will be most closely watched. We see it at 3% by year-end.

Inflation will remain the top theme in 2023, just as it was in 2022. The main focus will be on inflation rates in the major advanced economies – the US, UK, Japan and the eurozone.

Across those economies, ‘base effects’ – favourable comparisons with the equivalent months in 2022 – will help bring inflation rates down. Two important observations are in order. First, such effects are likely to be largest in the US in the first half of the year, but inflation in other regions will remain stickier. That will contribute to US dollar weakness (see Theme 6). Second, such beneficial base effects were widely expected in 2022 but were not big enough to bring year-on-year inflation rates down. The reason was that they were overwhelmed by new price pressures. In 2022, it was continued increases in oil and gas prices, shipping costs and supply shortages (of semiconductors, in particular) that did the damage. In 2023, higher wages and housing costs (notably in the US) are the biggest concerns.

Looking further ahead, some central banks see the drop in the inflation rate being very sharp. The Bank of England sees the tightening that has already taken place pushing inflation close to zero in 2025. If that is the case, central banks’ tightening in 2022 may come to be seen as switching on the air conditioning just as the weather cools.

Inflation rates in emerging economies are much less of a concern, either because policy was tightened rapidly and aggressively (such as in Brazil, which started raising interest rates in early 2021) or because economic growth has been depressed (in China, most notably).

On balance, the (misplaced) optimism about lower inflation in 2022 should be justified as 2023 progresses.

2. Geopolitical tensions ease

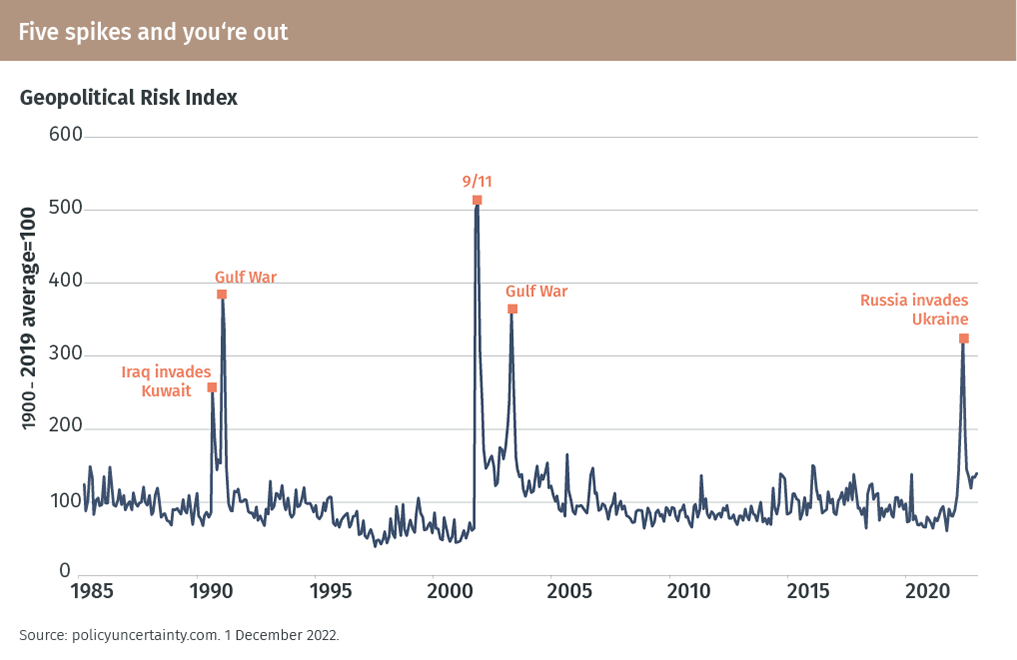

Geopolitical tensions should ease in 2023, helping economies and asset markets.

We are encouraged by the improved tone of global cooperation evident at the G20 and COP27 meetings in late 2022 and important bilateral meetings between China and European leaders. The tide seems to be turning away from confrontation and the spike in geopolitical tensions is easing. The biggest uncertainty relates to Russia, of course. Russia’s rehabilitation could start in 2023 if a solution to the war with Ukraine comes into sight. China, meanwhile, is likely to concentrate on domestic stability as the economy starts to reopen. It will not risk this by escalating pressure on Taiwan. Global co-operation on climate change is evident and we look for further evidence of this as the year progresses.

3. Global growth: back to reality

After sharp gyrations in economic growth rates during the pandemic and its aftermath, 2023 will be a year when we return to reality.

The world’s leading economies have seen sharp gyrations in their growth rates in recent years. UK GDP growth was the worst since 1720 during the pandemic but that was followed by a surge in 2021. In 2023, recession seems unavoidable in the UK and eurozone (notably in Germany, the hardest-hit area by weakness in China and the Russia-Ukraine war). Any US recession will, we think, be mild and of a different nature to the past. In particular, it looks likely to affect some skilled workers (in tech and finance, for example) hardest.

The return to reality in 2023 and beyond will have two strands. First, China will once again be a driver of global growth, although its future potential growth is around 4.5% (see table) rather than the 10% rate of the past. Second, growth almost everywhere will be constrained by a slower growth of the working age population, a decline in the proportion of those of working age wanting to work and structurally lower productivity. These are the driving factors of the long-term potential growth rates shown in the table. For the US, the long-term reality is that it can only grow, in real terms, by just under 2% per annum. Africa is the one region that stands in contrast to those trends. It has huge potential. But, as always with Africa, realising that potential is a challenge. India, similarly a growth laggard in the past, looks set for a good 2023.

4. Japan: renaissance continues

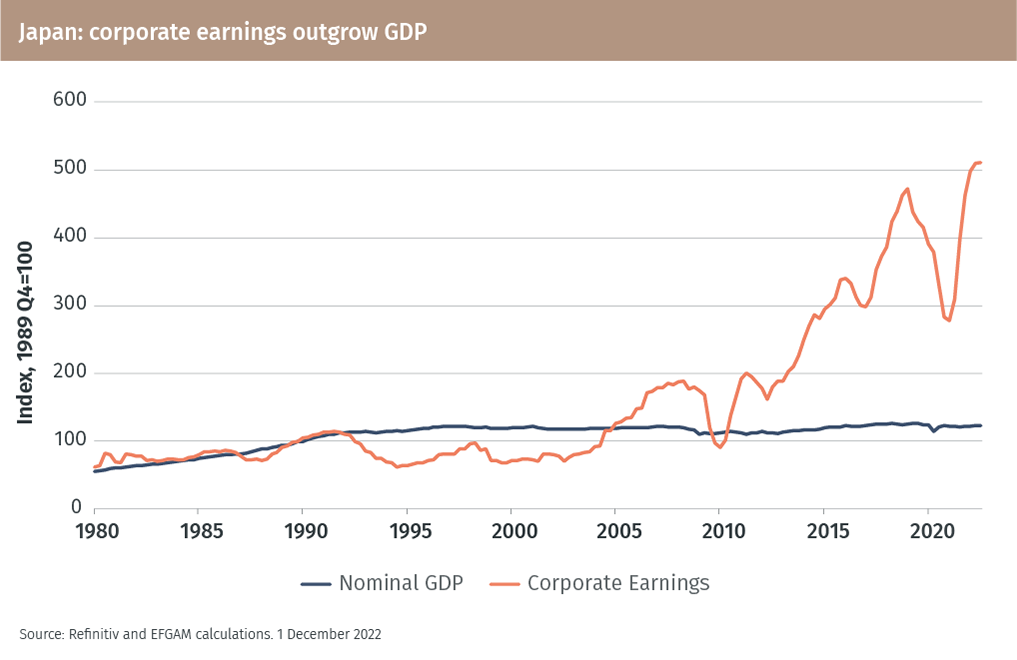

Japan is the prime example of an economy that can grow corporate earnings strongly even with weak economic growth. We see the renaissance of the corporate sector continuing.

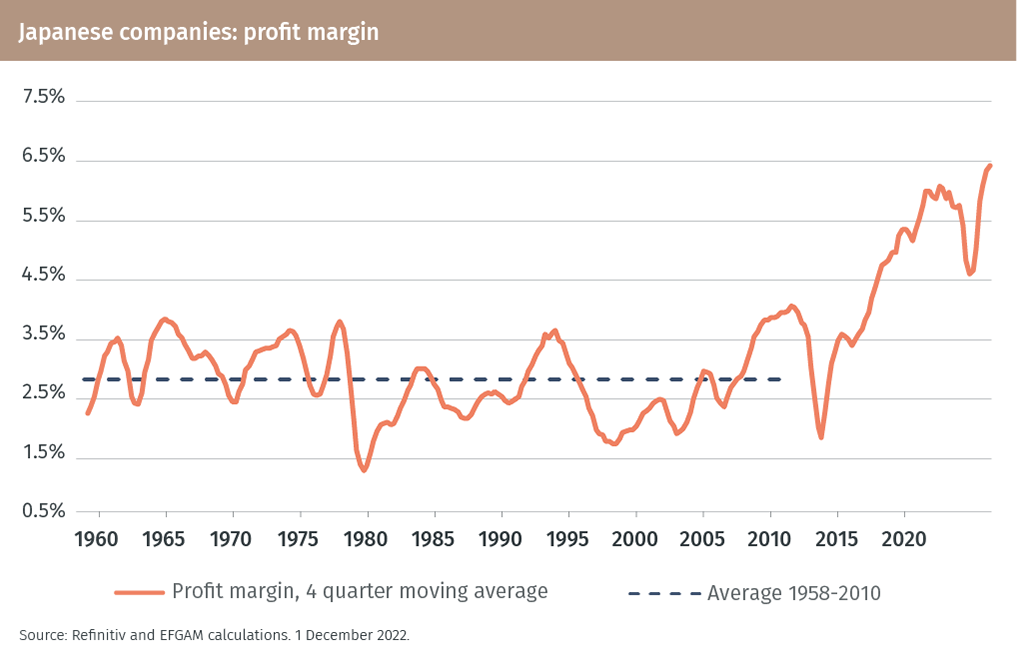

In recent years, corporate earnings in Japan have grown much faster than the overall economy – measured by the trend in nominal GDP, which takes into account real growth and inflation (see chart). That trend will, we think, continue in 2023. It will be helped by the beneficial effects of the yen’s weakness in 2022.

Japan resisted the trend to higher interest rates in 2022. The Bank of Japan was unconvinced that this was necessary. If inflation in Japan drops back, the central bank’s stance will appear fully justified. These trends, and the fact that valuations are low, lead us to favour the Japanese equity market.

Japan’s example shows that company profits can do well in a sluggish growth environment, an encouraging sign for other economies in a slower growth world.

5. Emerging economies recover

A recovery in China and Europe and a strong Japanese economy will help emerging economies, not just in the rest of Asia, but further afield.

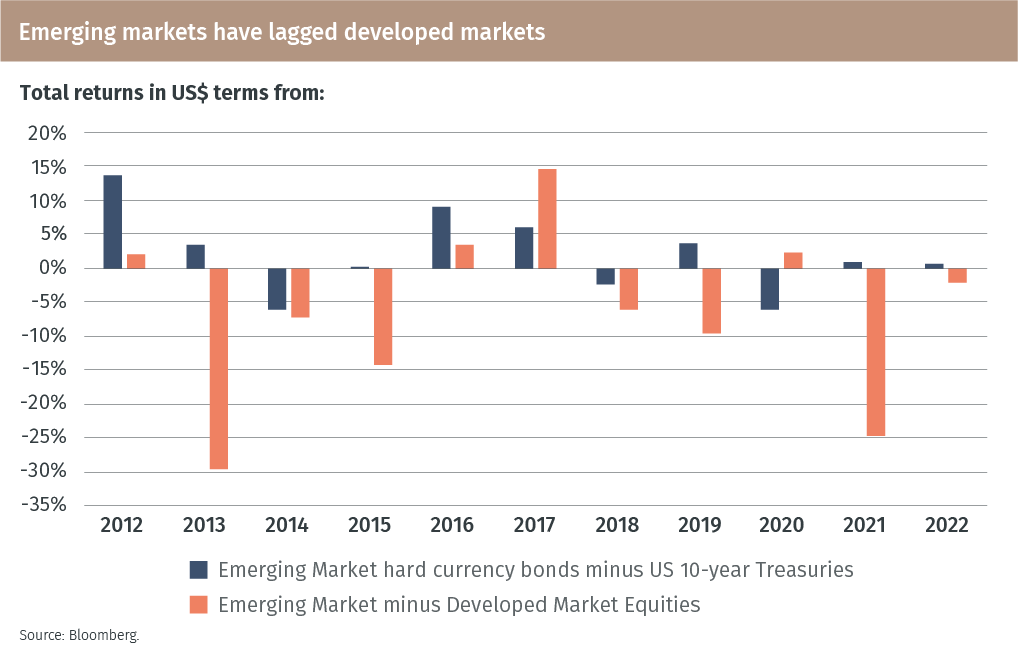

The reality for many emerging markets is that they are still highly dependent on China. For some, that is because China is a major buyer of their raw materials. For others, it is a supplier of cheap manufactured goods. And China’s financial influence is global, so its expected recovery as Covid restrictions are eased and the housing market stabilises, will be welcomed. Improved relations between Europe and China and a strong Japanese economy will also help emerging economies. The dependence on China for other emerging economies should not be overstated, however. They are now rapidly employing digital technologies (our theme from 2022), putting growth on a firmer foundation. Early and aggressive monetary tightening means that inflation is already falling (notably in economies such as Brazil). After years in which emerging equity and bond markets have underperformed developed markets (see chart), we see 2023 as a much better year.

6. Weaker US dollar trend

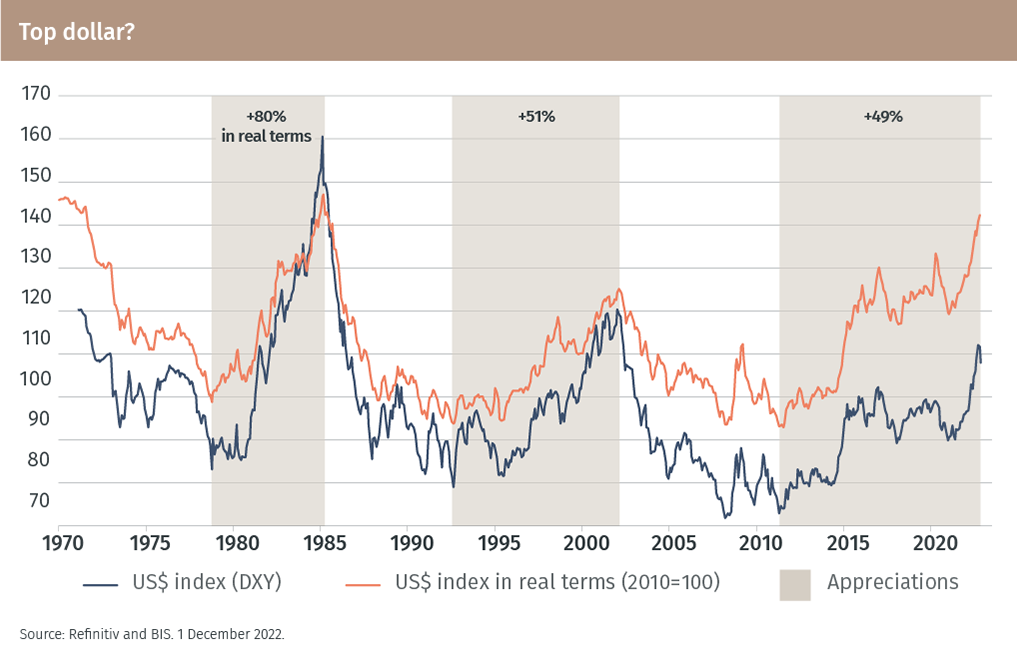

The US dollar has trended upwards for a decade or more. It reached overvalued levels in late 2022. 2023 will be a year of correction.

The improving trend in emerging markets will be enhanced by our sixth main theme: a weaker dollar. The dollar has periodically reached very overvalued levels, only to weaken sharply. We think another peak may have been reached in late 2022 (the real appreciation has been larger and lasted longer than in the two previous periods). That appreciation sows the seeds for the dollar’s weakness through a weaker current account position. The deficit on that measure is expected to top 3% of GDP in 2023, typically a point of vulnerability. With the US Fed tempering and then halting its monetary tightening as 2023 progresses – but with the ECB and Bank of England lagging behind – relative interest rates and capital flows also suggest a weaker dollar trend. One perennial issue is whether the US dollar’s status as a reserve currency will be challenged. Its demise has been claimed in the past but has failed to materialise. One new concern is that US sanctions against Russia could, in the future, be used against other countries, dissuading some from holding US dollars. For now, however, there are no viable alternatives to the US dollar as the world's reserve currency.

7. Bond vigilantes on patrol

The bond market vigilantes brought a quick end to the UK’s attempted fiscal largesse in 2022. They will remain on patrol in 2023.

Bond market vigilantes made a surprise reappearance in 2022, hitting the UK gilt market hard in response to an unfunded, poorly-explained fiscal stimulus. That led to an abrupt change of direction. For years, low inflation and interest rates had convinced many that the vigilantes were taking a nap. But the UK in 2022 reminded everyone of the potential for the bond market to be a strict disciplinarian. The vigilantes will be on the lookout for any other governments that attempt a similar move. Economies with a disappointing growth record or those with a poor net foreign asset position are vulnerable. The UK still falls into that category, so its troubles may not be over. Among emerging markets, Turkey remains a concern. A broader concern is whether we now see a sustained higher level of real and nominal interest rates across all markets. Certainly, negative real rates on long-term government bonds were anomalous. The new equilibrium rate is likely to be positive (we expect around 1%). Added to that, the uncertainty relating to inflation suggests a higher premium on nominal bonds as well. The long bull run in bonds may, finally, be over.

8. Investment grade bonds

Investment grade bonds look attractive in a still uncertain world.

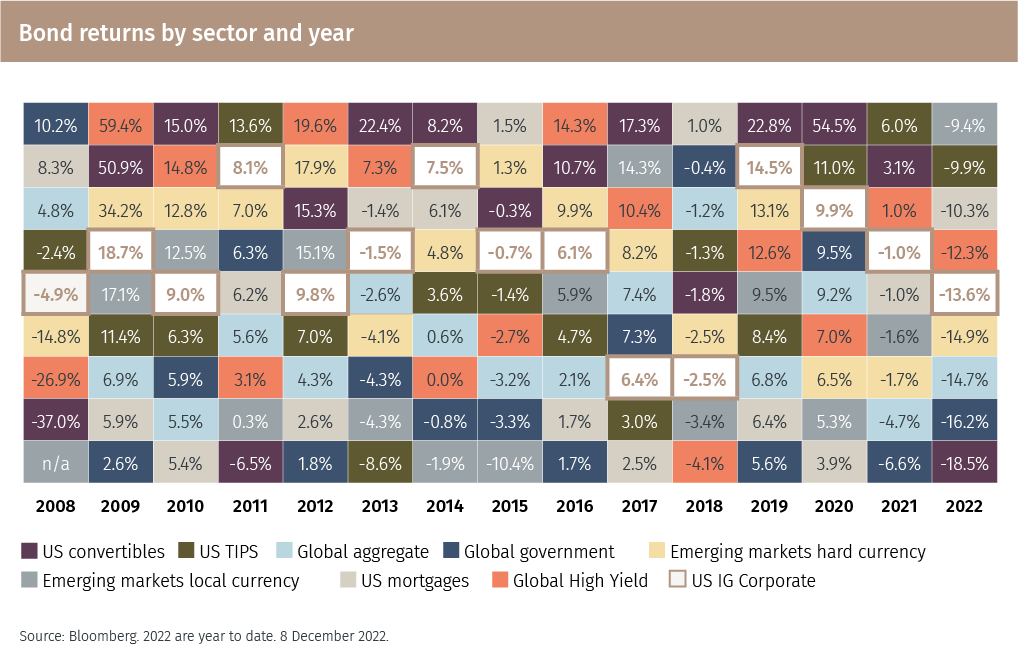

We see investment grade corporate bonds, notably in the US and UK, offering a better return/risk profile than either government bonds or high yield debt for 2023. Investment grade bonds rarely occupy the extreme positions in the ranking of returns from different bond market sectors (see table below). We expect that stability will provide valuable ballast to portfolios in 2023. High yield bonds could be vulnerable in the event of a deterioration in the default cycle. Some areas of the global government bond market are also vulnerable in the context of the factors discussed under Theme 7.

9. Global small caps

We see good opportunities in the global small cap sector.

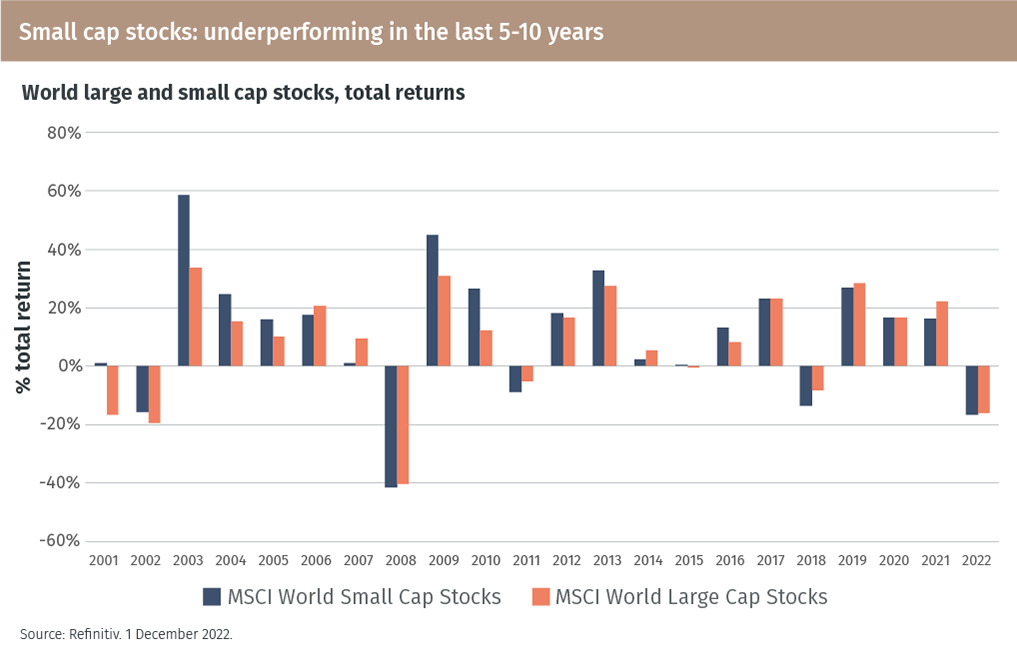

The first of our two main equity market themes is to favour small cap stocks. Small cap companies are typically quicker to adapt to changing economic circumstances than larger companies, are attractively valued relative to large caps and have tended to outperform large cap stocks over the long-term. However, that has not been the case over the last 5-10 years (see chart).

One interesting parallel is with the 1970s, a period of two oil shocks and higher inflation and interest rates. Large cap US stocks essentially moved sideways in that period, but small cap stocks did well. The recent global trend of passive investment styles has tended to favour large cap stocks. A move back towards more active investment strategies and the recognition of the value in the small cap sector as a result of recent underperformance should provide an environment for better small cap performance in 2023.

10. Consumer discretionary sector

Our ‘contrarian’ sector view is to favour consumer discretionary stocks.

Our final equity market call is a contrarian one: to favour the consumer discretionary sector. We see pressures on consumer spending easing in 2023. Inflation will start to recede and, with it, pressure on borrowing costs. Consumers will be prepared to run down further the savings accumulated during the pandemic. Although some have expressed concern about a rise in credit card debt, delinquency rates are still low, less than a third of the rate in the global financial crisis, and any increase will be limited by banks’ generally tougher lending standards since then. Wage growth is expected to remain resilient, especially in sectors which are very short of workers – such as in the hospitality industry.

High mortgage costs will tend to inhibit home moving, in the short-term, meaning more spending on home improvements and renovation is likely. Longer-term, the US economy, in particular, is still short of housing and new home construction will recover after the recent lull. The trend is not confined to the US, so we would favour the expression of the theme on a global basis – but equally weighted, rather than market cap weighted so that the emphasis of mega-cap stocks is reduced.

Footnotes

1 An average score of 83% from 2013 to 2021 inclusive.

2 Indonesia, Malaysia, the Philippines, Singapore and Thailand.

4 The net returns from the MSCI Emerging Markets index in US$ terms were -18.95% in the year to 30 November 15.65% for the MSCI Emerging Markets ex China index. Source: MSCI. 1 December 2022.

5 https://www.kearney.com/operations-performance-transformation/us-reshoring-index

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.