Investment Insights

Changes in the inflation process vs changes in the CPI

The recent surge in inflation in the US and elsewhere is highly unusual. To find a comparable episode, many commentators have pointed to the oil price shocks of the 1970s and 1980s, or even to the Korean War inflation in the 1950s.

But comparing current inflation with inflation 50 or 70 years ago is hazardous. The composition of the basket used to measure consumer prices has changed over time as households’ spending patterns have evolved. Furthermore, improvements are regularly made in the way in which some components of the CPI are measured.

In this Macro Flash Note, Stefan Gerlach analyses a striking recent paper, where former Treasury Secretary Larry Summers and co-authors study the importance of such changes for CPI inflation in the US since the late 1940s.1 Perhaps surprisingly, their analysis shows that the changes have had a material impact on the behaviour of inflation. They conclude that inflation is less sensitive to changes in monetary policy and more sluggish in modern data than in historical data. That suggests that great care must be exercised when comparing the recent behaviour of inflation with that in the distant past.

Changes in the measurement of inflation

Summers and his co-authors focus on two changes to the measurement of the CPI. The first of these concerns the way in which the cost of housing is measured. Before 1983, the Bureau of Labor Statistics (BLS) determined the cost of homeownership in the CPI using a measure that was computed from information on house prices, mortgage interest rates, property taxes and insurance, and maintenance costs.

The use of mortgage interest rates introduced a direct effect of monetary policy on inflation. When monetary policy was tightened, mortgage interest rates increased and measured inflation therefore also rose. And when monetary policy was relaxed, the cost of housing fell as did inflation.

This led to a seemingly close relationship between inflation and interest rates which, furthermore, was perverse. Thus, by relaxing monetary policy the Fed could lower inflation. The BLS changed its approach to measuring the cost of housing in 1983. The new method aimed to estimate what a homeowner could expect to receive in rental income.

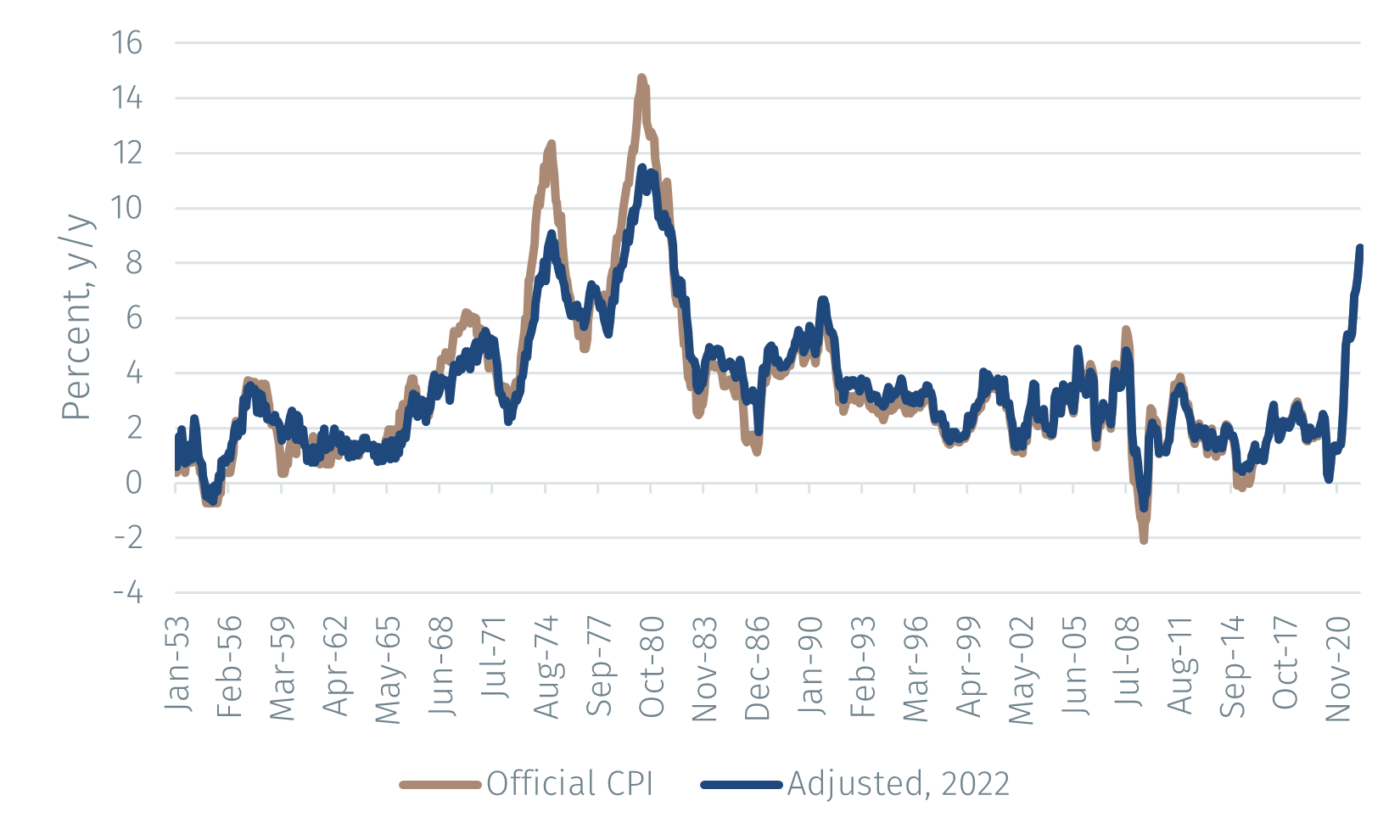

The figure below shows inflation as measured by the official CPI and an adjusted measure that takes into account both the change in the computation of the housing component in 1983 and the change in weights during the period studied (by using the 2022 weights).2 It is readily apparent that the rise in the inflation in the 1970s is less pronounced in the adjusted data and looks more similar to the increase in 2021-22.

Source: Summers and EFGAM calculations. Data as at 10 August 2022.

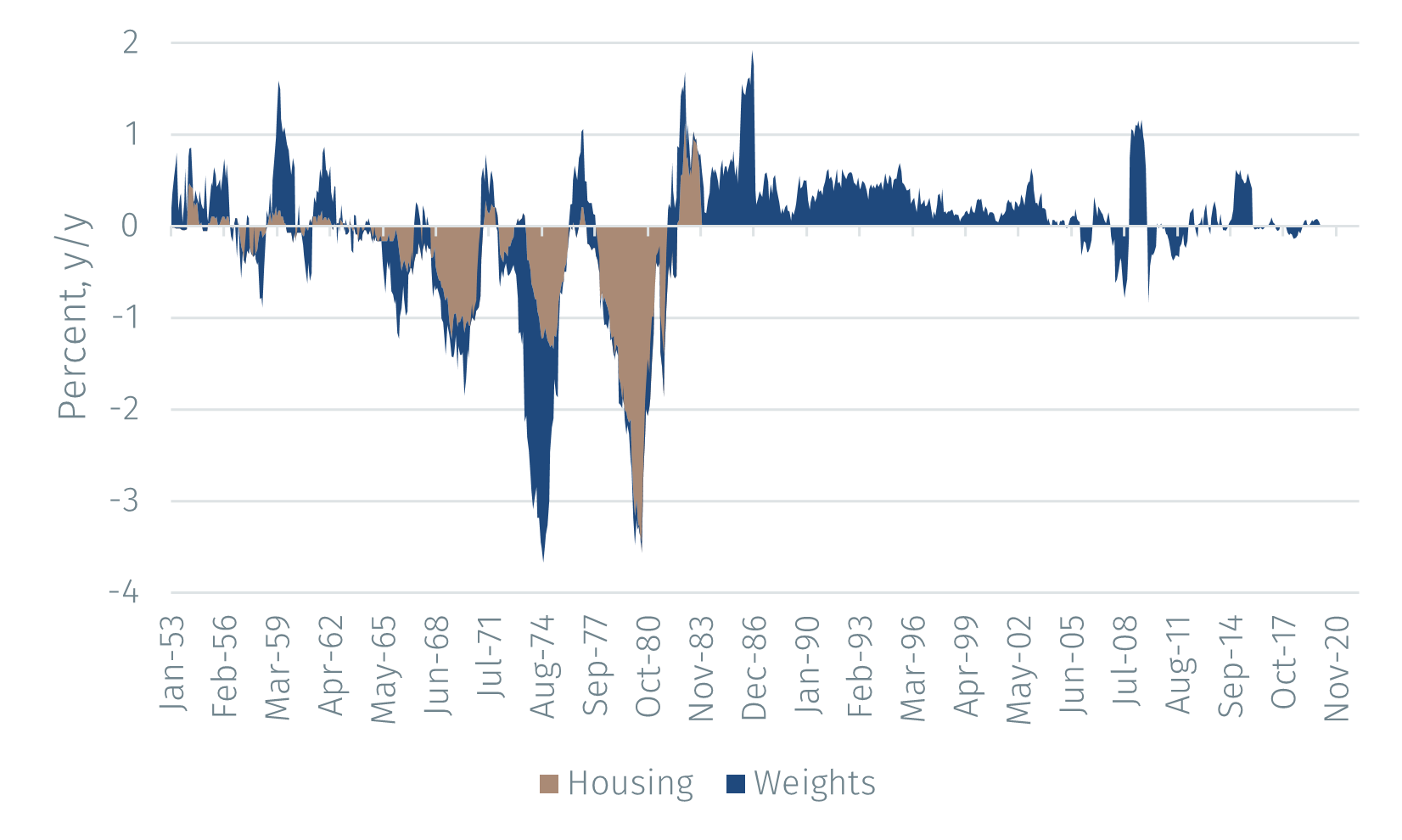

To better see what difference the adjustment makes, the figure above breaks it down into the parts due to the change in the treatment of housing and the change in weights. It indicates that using the modern approach to measuring housing costs would have resulted in 1970s inflation being 1-3% lower. This effect is thus important.

The figure also shows that the change in the weights, which involve a reduction of importance of goods prices, reduces inflation sharply around the first oil shock of 1973-74. Interestingly, it raises inflation in the 1980s. Of course, the weight adjustment becomes less important over time since the weights are increasingly similar to those of 2022.

Conclusions

The analysis by Summers and co-authors matters in the current context for two reasons. First, it shows that large historical movements in inflation relative to modern data partially reflect differences in measurement methods. Second, the current spike in inflation is in fact not too dissimilar from the increases experienced in the 1970s if inflation is measured in the same way. The key conclusion the authors draw is that lowering inflation might be a harder task for the Fed now than previously. Before 1983, when the Fed cut interest rates in response to a weakening economy or an improvement in the inflation outlook, inflation fell immediately because of how the cost of housing was measured. That is no longer the case. Furthermore, the weight of services, whose prices are more inertial than those of goods, has increased (although housing is a large part of what constitutes services).

1 Bolhuis, M. A., Cramer, J. N., & Summers, L. H. (2022). Comparing Past and Present Inflation. NBER working paper No. 30116.

2 The data are from Summers’ website. Marijn Bolhuis graciously provided some explanation for the data that the authors tabulate.

Source: Reuters, Ipsos and EFGAM calculations. Data as of August 2022.

It is also of note that President Biden and President Xi were acquainted long before Biden became the US President. In 2013, President Xi referred to Biden, who was Vice President to Obama at the time, as an “old friend”. Despite current elevated tensions between the two countries, the two Presidents are planning to meet face-to-face for the first time since Biden became President at the next G20 meeting in November.8 The meeting will be closely watched, with the potential to agree on a de-escalation between the two countries.

In summary, a proxy war between the US and China over Taiwanese independence would have negative economic consequences, straining supply chains, elevating inflation, and damaging growth. Nonetheless, this is not the current baseline scenario. China remains hesitant to impact the Taiwanese economy through restrictions on semiconductor trade, as this would also have negative implications for the Chinese economy. At the same time, the US does not want to push China into any form of economic blockade on Taiwan before it has secured its own domestic semiconductor supply chains. This reduces the risk of near-term escalation of the conflict. The US Department of Defence still maintains that China will not take Taiwan militarily within the next two years.9 Furthermore, war would not play into the hands of either President given their own domestic situations and their upcoming elections.

1 https://www.reuters.com/world/asia-pacific/pelosi-addresses-taiwan-parliament-visit-condemned-by-china-2022-08-03/

2 https://english.www.gov.cn/archive/whitepaper/201907/24/content_WS5d3941ddc6d08408f502283d.html

3 Taiwanese Bureau of Trade

4 https://www.bcg.com/publications/2021/strengthening-the-global-semiconductor-supply-chain

5 https://www.state.gov/the-passage-of-the-chips-and-science-act-of-2022/

6 https://www.europarl.europa.eu/RegData/etudes/BRIE/2021/696183/EPRS_BRI(2021)696183_EN.pdf

7 https://obamawhitehouse.archives.gov/the-press-office/2013/12/04/remarks-vice-president-joe-biden-and-president-xi-jinping-peoples-republ

8 https://www.wsj.com/articles/chinas-xi-jinping-plans-to-meet-with-biden-in-first-foreign-trip-in-nearly-three-years-11660318437

9 https://www.reuters.com/world/asia-pacific/no-change-us-assessment-china-timeline-taiwan-despite-pelosi-visit-official-says-2022-08-08/

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.