Macro Flash Note

MFN - China: The Two Sessions and beyond

The recent Two Sessions event in China, incorporating the National People’s Congress and the Chinese People’s Political Consultative Conference, gives an insight into Beijing’s goals for 2023. In this context, Sam Jochim assesses in this Macro Flash Note what can be expected from the Chinese economy this year.

2023 government work report

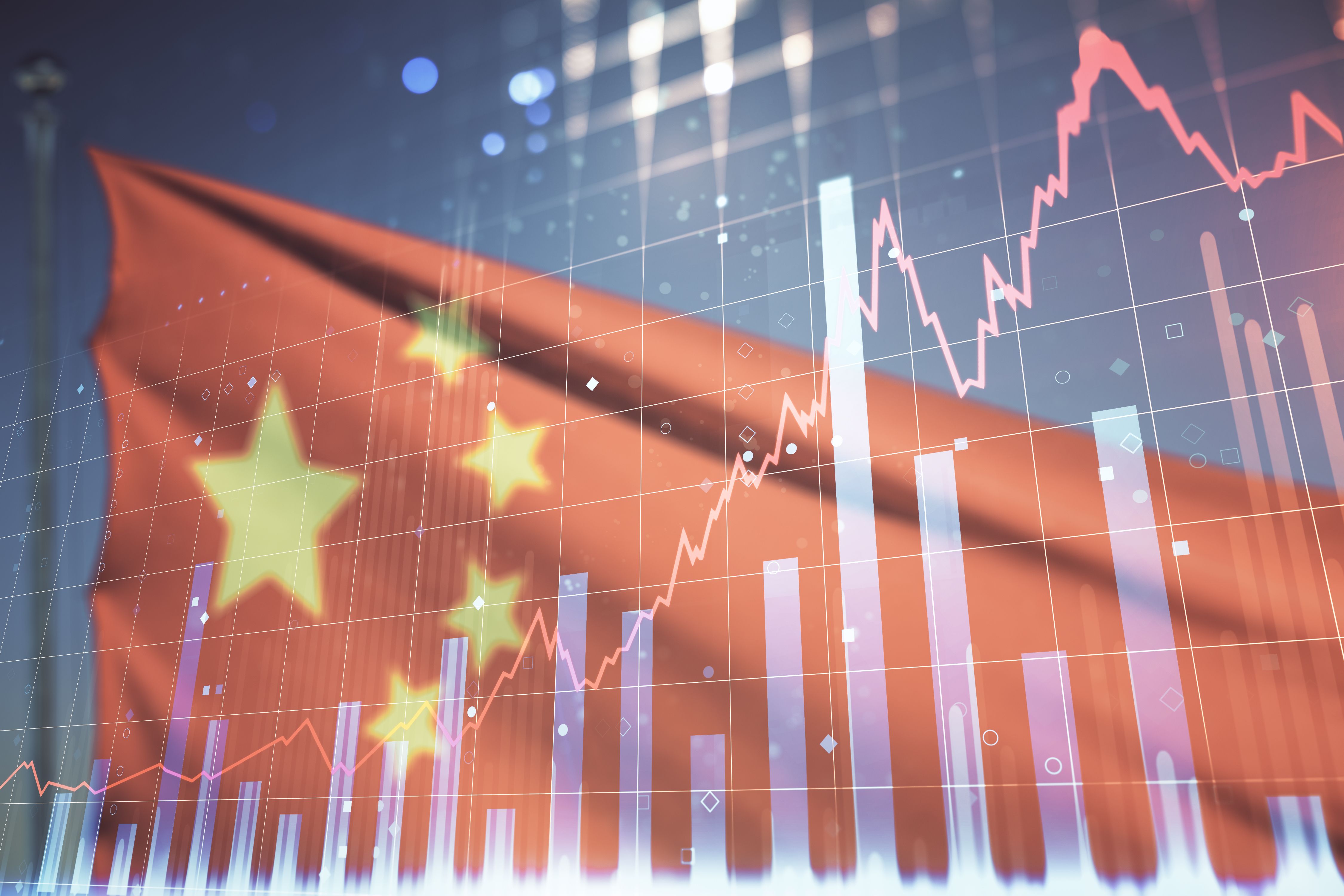

The official GDP growth target announced in the 2023 Government Work Report by outgoing Premier Li Keqiang was around 5%, similar to the IMF’s growth projection in January of 5.2%. This is below the 5.5% target in 2022 and continues a downward trend since President Xi’s first term began in 2013 (see Chart 1). Last year marked the second year since Xi took power that China has failed to meet its own GDP growth target, with its zero-Covid policy dampening economic activity.1 While the target in 2023 is below that of 2022, if achieved it would still represent a rebound from the 3% GDP growth registered last year. The lower growth target may also reflect Xi’s preference to set a more attainable goal, with greater potential for an upside surprise, to restore credibility.

Source: Refinitiv and EFGAM calculations. Data as at 07 March 2023.

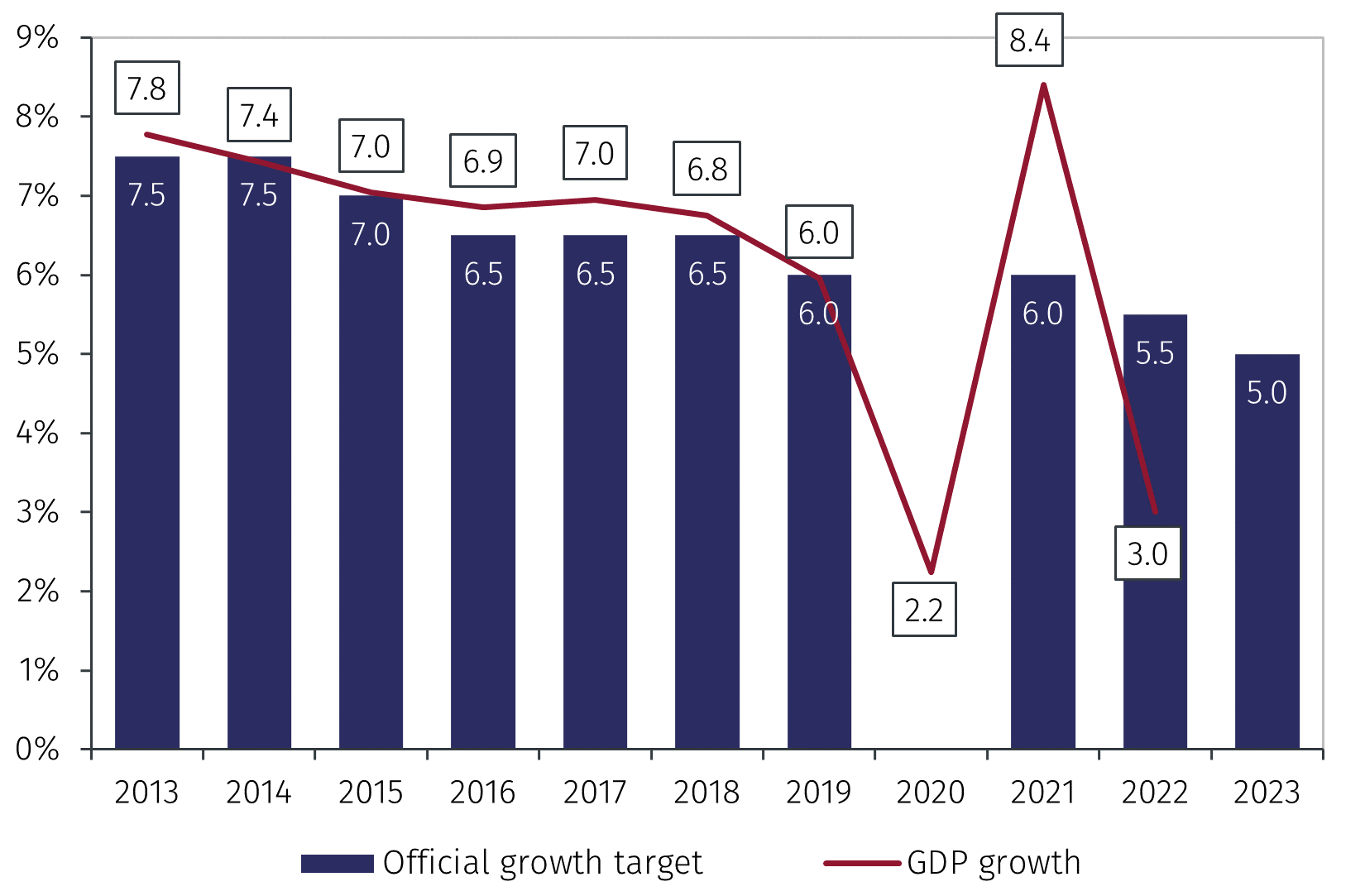

While zero-Covid restrictions restricted economic activity in 2022, they were also associated with an increased propensity to save, with deposits held by Chinese households growing by USD 2.6 trillion last year, the largest rise on record and equivalent to approximately 15% of GDP.2, 3 This highlights the potential for a strong rebound in consumption in 2023. Data implies that this may take time, with low consumer confidence and consumer goods retail sales declining year-on-year in December (see Chart 2).4

Source: Refinitiv. Data as at 07 March 2023.

An explanation for this could be that households are compensating for deteriorating wealth. Real residential property prices fell 5.7% year-on-year in Q3 2022, and real estate makes up an estimated 70% of household wealth in China.5, 6

The real estate sector represents an important driver of growth in China, accounting for around 25% of gross value added.7 Despite this, the Government Work Report implies a continuation of the status quo regarding the struggling sector, with financing only to be made available to healthy developers and to complete projects but prevent unregulated expansion in the sector. Furthermore, the quota for local governments to issue special bonds for infrastructure construction in 2023 is set at RMB 3.8 trillion and falls below the RMB 4.2 trillion actual issuance in 2022. This implies that growth in infrastructure investment is likely to slow relative to 2022 and increases the likelihood that consumption will represent a larger proportion of GDP in 2023 than in previous years.

This could be a silver lining for President Xi. The economic recovery will help limit the fiscal deficit, which is targeted at 3% of GDP in 2023, only slightly above the 2.8% target in 2022. There is an implicit reluctance to provide direct fiscal support to households and this could represent a risk to the growth outlook if consumption does not rebound as expected.

Military spending is set to increase by 7.2% in 2023, slightly above the 7.1% rise in 2022. Armed forces are instructed to devote greater energy to training under combat conditions. This is likely a political message directed to Washington, with elevated geopolitical tensions evident in a speech by foreign minister Qin Gang who claimed the US was headed for “conflict and confrontation” with China. 8

The situation in Taiwan represents a prominent threat to Sino-US relations but language at the Two Sessions continued to promote peaceful reunification, with Beijing seeking to stabilise cross-Strait relations before the Taiwanese election in January 2024.

Regulatory reform

Additionally, the government is conducting regulatory reforms in 2023, aimed at reducing systemic financial risks and strengthening its science and technology capabilities. Reforms to the State Council include the creation of a new State Administration for Financial Regulation (SAFR) and the reorganisation of the Ministry of Industry and Information Technology (MIIT).

The SAFR will be positioned directly under the State Council and will oversee the supervision of the entire financial industry, excluding the securities industry. It implies a greater level of regulation in the sector and aims to reduce systemic risk by improving financial stability. The new structure highlights the low probability of major credit expansion in 2023.

The reorganisation of MIIT sees it gain several responsibilities previously held by the Ministry of Science and Technology and strengthens its power. It highlights Xi’s desire to build up China’s semiconductor production capabilities and become technologically self-reliant.9

Conclusion

The Two Sessions highlights Beijing’s desire for private sector driven growth in 2023. The outlook is positive but avoids excessive optimism, with consumer confidence still low and no evidence of large fiscal stimulus. GDP growth is targeted at its lowest level since Xi became President in 2013 but would still represent a rebound from 2022’s growth rate and is likely aimed at restoring credibility to the target. Combined with the regulatory reforms, there is a clear focus on longer-term challenges such as financial stability and technological self-reliance.

1 China did not set a growth target in 2020 due to heightened uncertainty regarding the impacts of the Covid pandemic.

2 https://www.ft.com/content/2c066d1c-11a8-455a-8a9f-31f3d3d46b99

3 Based on 2021 GDP data from the World Bank

4 Although China’s zero-Covid policy was largely removed in early December, some restrictions remained in place for part of the month and may have impacted retail sales.

5 Based on residential property price statistics from the BIS.

6 The Economist

7 Based on 2017 input-output tables published by the National Bureau of Statistics. https://openknowledge.worldbank.org/server/api/core/bitstreams/254aba87-dfeb-5b5c-b00a-727d04ade275/content

8 https://www.reuters.com/world/china/china-says-if-us-does-not-change-path-towards-it-there-will-surely-be-conflict-2023-03-07/

9 See EFGAM Macro Flash Note, Chinese Communist Party 20th National Congress (November 2022)

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.