Investment Insights

Sterling under pressure after UK Chancellor announcements

Sterling reached a historical low on 26 September against the US dollar of $1.03, representing a depreciation of the currency of over 20% year-to-date. Borrowing costs in the UK soared and confidence in the Chancellor’s economic plan seems to be lost. In this Macro Flash Note, Joaquin Thul analyses the recent market events in the UK.

In recent days economic policy in the UK has come under scrutiny due to the apparent disconnect between monetary and fiscal policy. On Thursday 22 September 2022 the Bank of England’s (BoE) Monetary Policy Committee (MPC) voted to increase interest rates by 50bps to 2.25%. This decision came as a response to the rise of inflation almost to 10%. The BoE expects inflation to peak at 11% in Q4-2022 and quarterly GDP growth to decline to 0.1% in Q3-2022. The interest rate increase was perceived by markets as dovish, in comparison with the 75bps rate hikes delivered by the US Federal Reserve and the Swiss National Bank during the same week.

On the following day, UK Chancellor Kwasi Kwarteng announced a series of supply-side measures and tax cuts with the objective of supporting households with the rising cost of living and boosting UK GDP trend growth from 1.8% to 2.5% in the next five years. These measures, accounting to an estimated £45 billion per year, is one of the biggest taxes giveaways in the last 40 years.1 The measures announced include:

- Reversing the increase of 1.25% in National Insurance from November 2022.

- Cancelling the rise in Corporation tax from 19% to 25% that was scheduled for 2023.

- Bringing forward by 12 months until April 2023 the cut in the basic income tax rate from 20% to 19%.

- Abolition of the upper 45% income tax rate from April 2023. The highest income tax rate will be set at 40%.

- Increasing the initial threshold for stamp duty tax paid on property purchases.

- Removing the cap on bankers’ bonuses, introduced in 2008, to allow banks in the UK to compete with other institutions. This is the first announcement of a broader plan in deregulate the financial services industry in the UK.

- Introducing an Energy Price Guarantee that is expected to cap the average household electricity bill at £2,500 per year for a period of two years from October 2022. This will be in addition to the £400 support that eligible households in the UK will receive from the Energy Bills Support Scheme in the winter.

According to the Chancellor, these measures will be funded by an increase in borrowing and are critical to boost growth in the medium term. Kwarteng’s comments appear to contradict his commitment to fiscal discipline, outlined by the Chancellor to business leaders in London on 26 September. The UK Debt Management Office set out plans to borrow an additional £72bn before April 2023, raising the financing scope in 2022-2023 to £234bn, equivalent to approximately 9% of GDP. The additional borrowing required to fund these have challenged investor’s confidence in the UK government.

Market's reaction

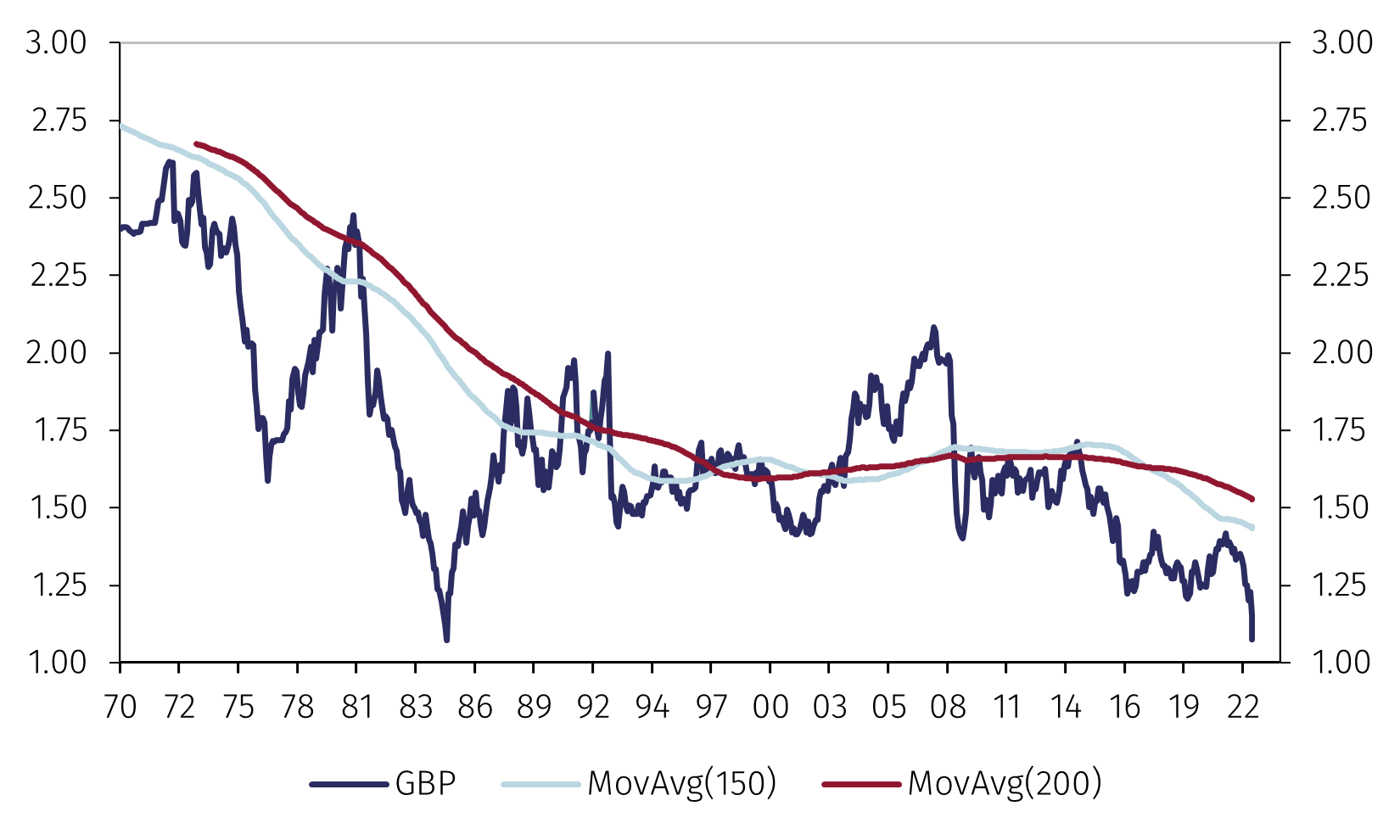

Source: Refinitiv and EFGAM calculations as at 28 September 2022.

Markets reacted negatively to these announcements as the expected debt-funded tax cuts and direct transfers are expected to further fuel domestic inflationary pressures. The Treasury announcements and the perceived dovishness of the BoE prompted a sell-off of sterling and an increase in UK government bond yields.

The pound hit a historical low against the US dollar of $1.03, a depreciation of over 20% on a year-to-date (YTD) basis. Additionally, yields on the short-end of the UK yield curve increased by over 70bps, with 2-year Gilts reaching 4.75%, while 10-year and 30-year government bond yields increased to 4.50% and 4.98% respectively.

On Monday 26 September, the BoE announced an emergency MPC meeting. Markets speculated with an additional rate hike to support the currency and keep up with market expectations of interest rates. Instead, the BoE issued a short statement indicating that it would continue to “monitor the developments in financial markets closely” and expressed its support to the Government’s commitment to sustainable economic growth.2 This kept the pressure on the pound and pushed higher UK borrowing costs, with some UK banks deciding to stop issuing new mortgage deals.

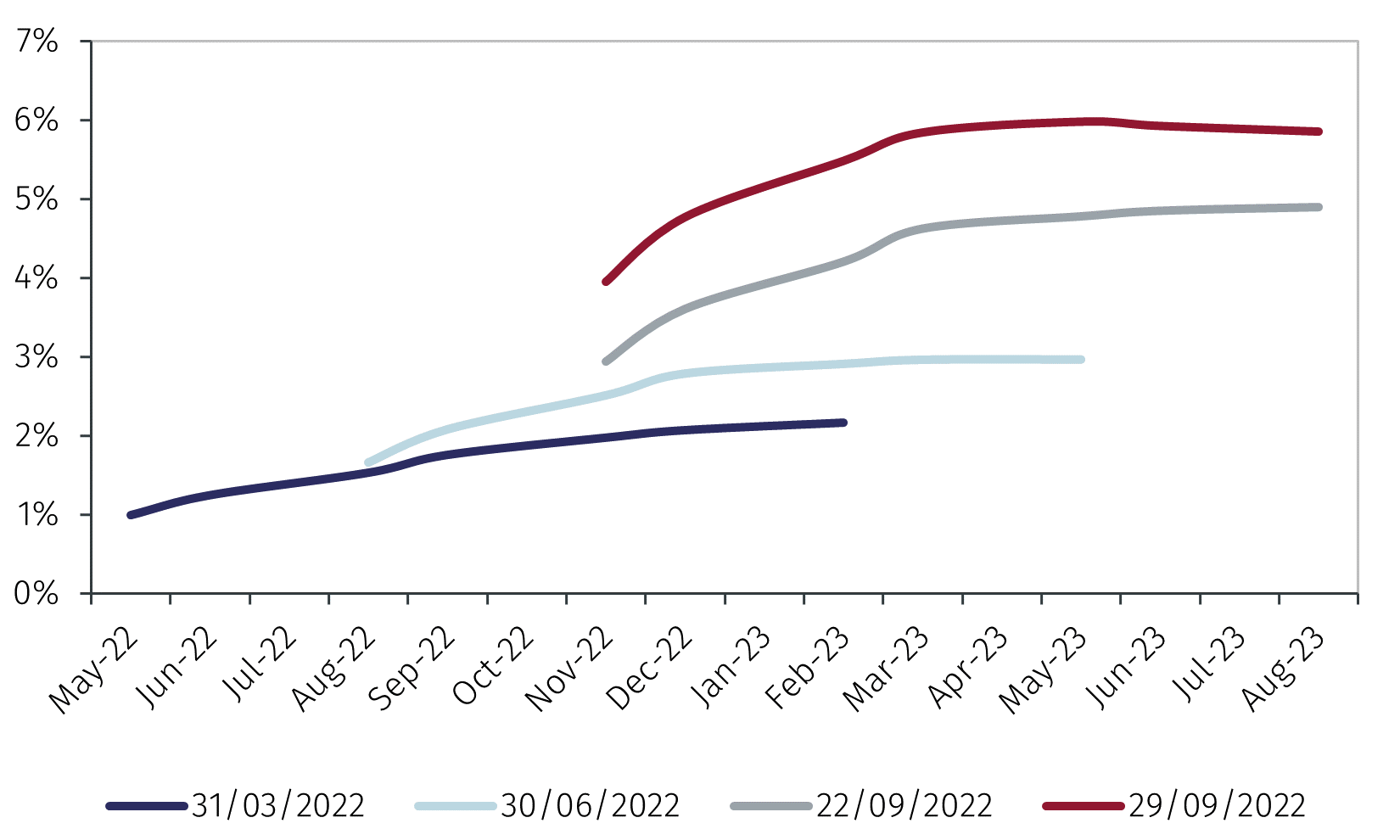

Source: Refinitiv and EFGAM calculations as at 28 September 2022./span>

On Tuesday 27 September the International Monetary Fund (IMF) urged the UK government to re-evaluate the recently announced fiscal plan, warning that these tax cuts could contribute to the rise in inflation. The IMF, known for its support of orthodox economic policies, questioned the Chancellor’s plan of an untargeted fiscal package that will conflict with the BoE’s efforts to control inflation.

As a result of the turmoil in markets, the BoE announced on Wednesday a £65bn bond-buying programme to stabilize markets. The central bank will postpone the Gilt sale operations, due to start next week, and instead will carry out purchases of long-date UK government bonds at a rate of up to £5bn a day from 28 September until 14 October.3

Conclusions

We draw the following conclusions from the recent market action:

- Although the Chancellor’s announcements appear to represent a significant increase in government spending, apart from the energy price cap and some direct money transfers, most of these announcements represent a reversal of previous policies rather than an outright new expense. Nevertheless, the new tax cut plans risks endangering public finances without solving the two main problems facing the UK economy: the rising cost of living and the low levels of growth and productivity.

- The introduction of an energy price cap represents a dangerous policy on its own. Capping utility prices has been widely used in the past by emerging economies to control the rise in the CPI, with recent examples from India, Indonesia and Argentina. However, rather than a temporary solution to rising energy costs, these policies have become entrenched in consumers' expectations and a political tool ahead of elections. The UK Chancellor announced this policy will be applied for two years, which will coincide with the next UK general election, currently scheduled for January 2025.

- Markets have been critical of the BoE for its overly cautious approach to tackling inflation. By being slower than many other developed market central banks at raising interest rates, the BoE risked allowing inflation expectations to rise above the 2% target. To avoid a de-anchoring of inflation expectations, the MPC is now expected to deliver a significant monetary response at its next meeting in November, probably in the form of a 100bps rate hike. BoE Chief Economist Huw Pill announced the MPC is not expected to take any action before its next scheduled meeting on 3 November.

Source: Bloomberg and EFGAM calculations as at 28 September 2022.

It is often said that confidence takes a long time to build, yet it can be destroyed in an instant. When a new government is appointed, it frequently benefits from a honeymoon period during which officials announce and implement their policies. Unfortunately, less than three weeks after taking office, Truss’ economics team seems to have lost credibility already as evidenced by the sharp decline in the pound and the rise in UK government yields. The UK Chancellor will publish a fiscal plan on 23 November, together with an updated outlook from the Office for Budget Responsibility, the UK’s independent fiscal watchdog. The government might want to use this opportunity to reassess some of their recent policy announcements.

1 UK Institute for Government.

2 https://www.bankofengland.co.uk/news/2022/september/statement-from-the-governor-of-the-boe

3 https://www.bankofengland.co.uk/news/2022/september/bank-of-england-announces-gilt-market-operation

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.