Investment Insights

Outlook 2023 - Mid-year review

As we enter the second half of 2023, we review our 10 themes for the year. Economic developments – inflation and growth – are progressing broadly as we expected. Our favouring of the consumer discretionary sector and of investment grade bonds have also worked out as we thought. But our preference for small cap stocks and emerging markets have not done so well. The dollar’s exchange rate index has been broadly flat.

Surprises

The first half of the year has seen some events which we did not expect at all: notably, problems in the banking sector and the collapse of Silicon Valley Bank and Credit Suisse. Although, at the time, they caused much market disruption, the impact on financial markets was short-lived. The trajectory of central bank policy rates seems to have been largely unaffected. Notably, the US Federal Reserve has continued with rate increases. Global bond returns have been positive; and equity markets surprisingly strong.

Economic trends: on track

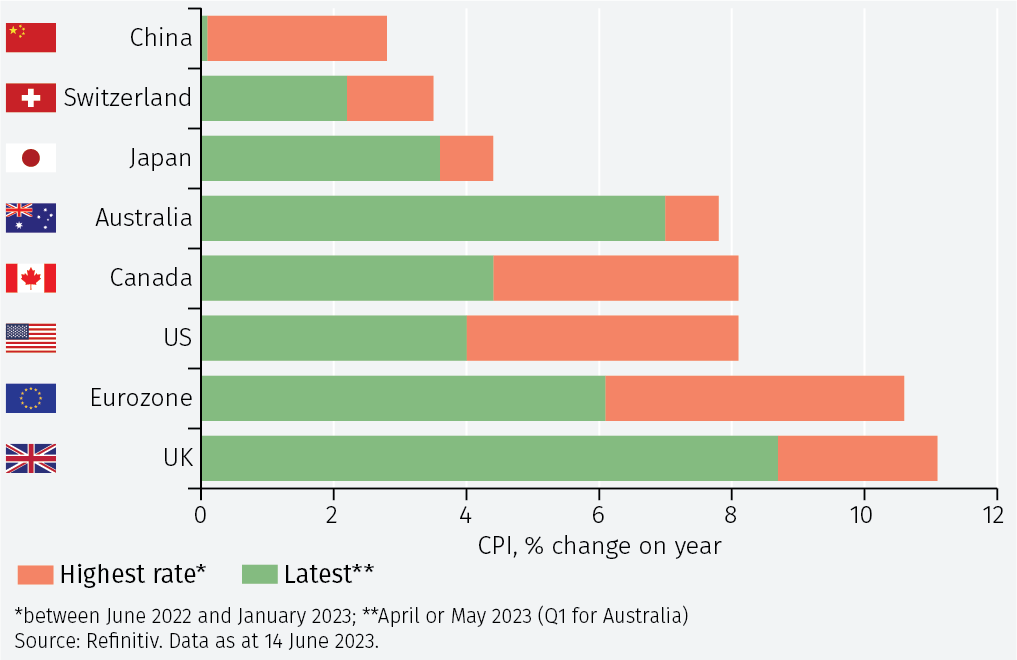

As far as economic developments are concerned, we expected the main focus would remain on inflation, which would finally subside. Broadly, that has been the case (see Figure 1) as supply shortages have eased and energy prices have fallen. Progress has been most marked in the US. However, tight labour markets and higher wages are a global phenomenon.1 This makes the return to 2% inflation more problematic.

On economic growth, we thought that a recession in the eurozone (and Germany in particular) was almost inevitable. That has materialised, but not (yet, at least) the recession we also expected in the UK (although the UK economy has barely expanded over the past four quarters). All eyes are on the US, of course: our expectation that any recession there will be mild and not start until late in 2023 still stands.

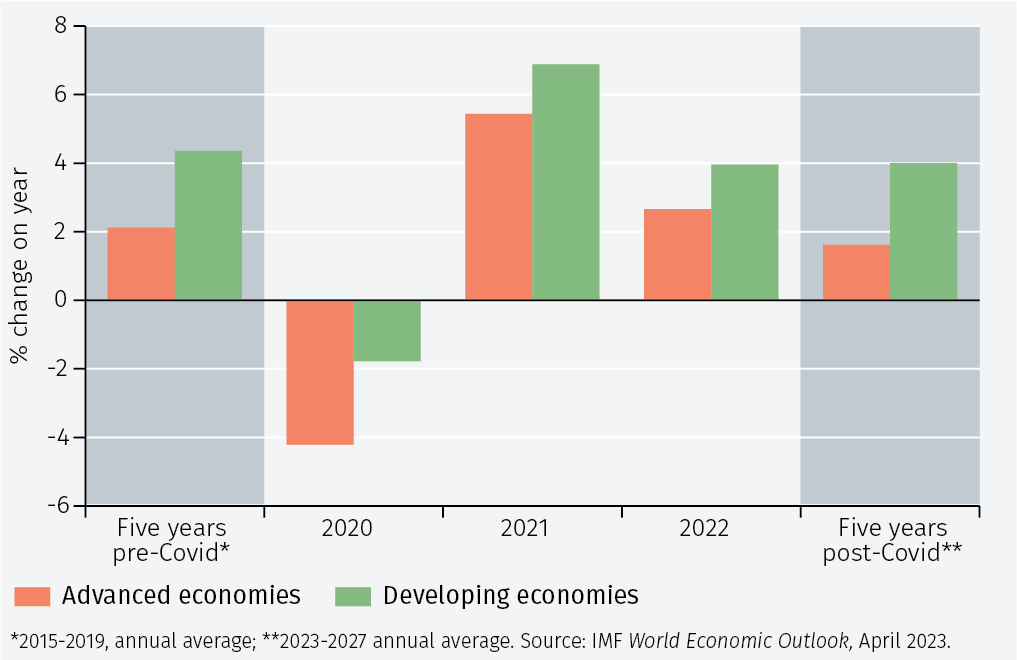

Looking further ahead, we thought the trend for global growth would be a ‘return to reality’ – similar rates to the pre-Covid period, led by the emerging markets. The IMF’s latest forecasts do show such a pattern (see Figure 2). But the IMF has recently claimed this is ‘not good enough’, emphasising the negative impact of trade fragmentation on growth: this could cut world GDP by 7% over the coming years – equivalent to losing Japan and Germany.2 That trade fragmentation has reflected continued geopolitical tensions. Although, on the measure that we used,3 such tensions have eased, other assessments are at odds with that. The war in Ukraine continues; China-US relations remain strained; and lingering tensions, over Taiwan and between Serbia and Kosovo, have been rekindled.

However, Japan’s renaissance continues. Corporate earnings have continued to grow faster than the overall economy. Further helped by the beneficial effects of the yen’s weakness in 2022, the Japanese equity market has reached new highs although the yen has remained weak.

Bond markets: volatile but opportunities realised

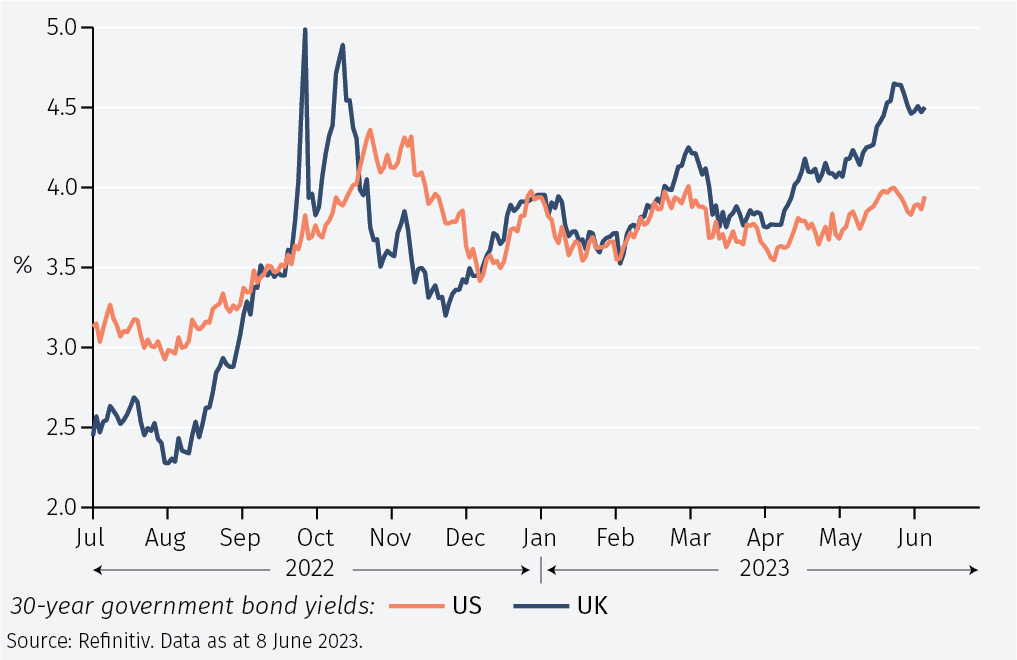

We thought that the bond market vigilantes would be on the lookout for any governments that attempt an unfunded, large fiscal expansion similar to that pursued in the short-lived UK government of September-October 2022. Bond market volatility has certainly been a feature (see Figure 3). But it has owed more to concerns about banking sector problems and the direction of central bank rates than fiscal policy trends.

We favoured investment grade corporate bonds, notably in the US and UK, considering they offered a better return/risk profile than either government bonds or high yield debt for 2023. So far, that has indeed been the case.

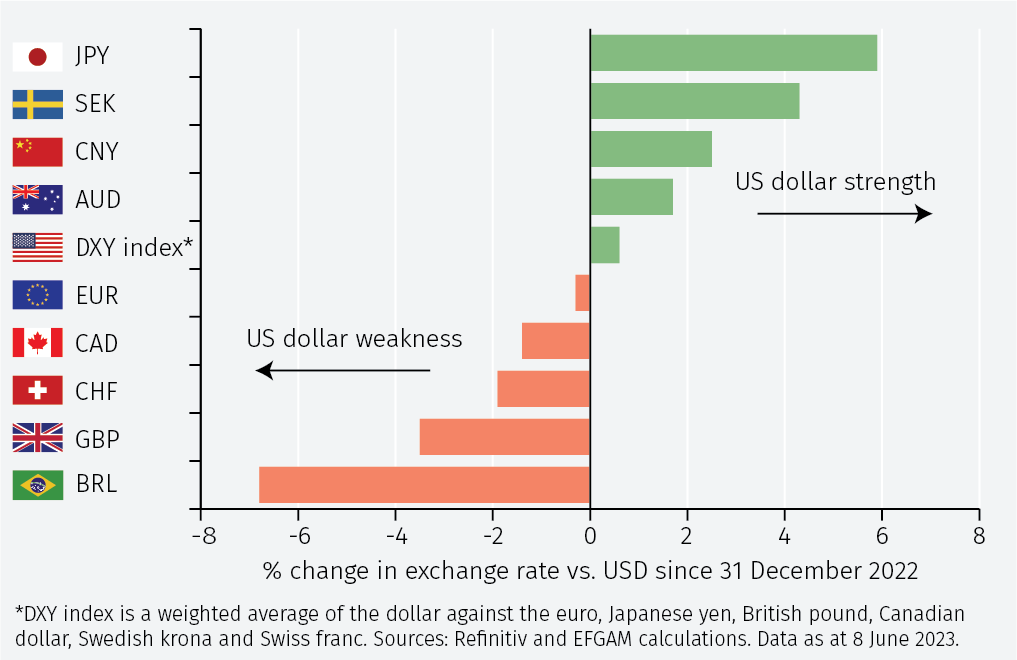

Dollar smile

It is often commented that the US dollar does well when global conditions are unsettled (the currency acts as a safe haven) and also when the US economy performs positively relative to the rest of the world: the ‘dollar smile’. That seems like a reasonable explanation of its behaviour so far in 2023. The dollar has been strong against several emerging market currencies, notably the renminbi, partly reflecting concerns about developments in those economies; but has lost ground against the euro, sterling and the Swiss franc (economies where growth has held up better than generally expected and where central bank tightening probably has further to go): see Figure 4. The dollar’s overall index value has been relatively stable as a result.

Equity market sectors: consumer discretionary does well; small caps disappoint

The first of our two equity market themes was to favour small cap stocks. The reasons we cited were that small cap companies are typically quicker to adapt to changing economic circumstances than larger companies, are attractively valued relative to large caps and have tended to outperform large cap stocks over the long-term. So far, however, large cap stocks, particularly US mega-cap tech stocks, have been better performers.

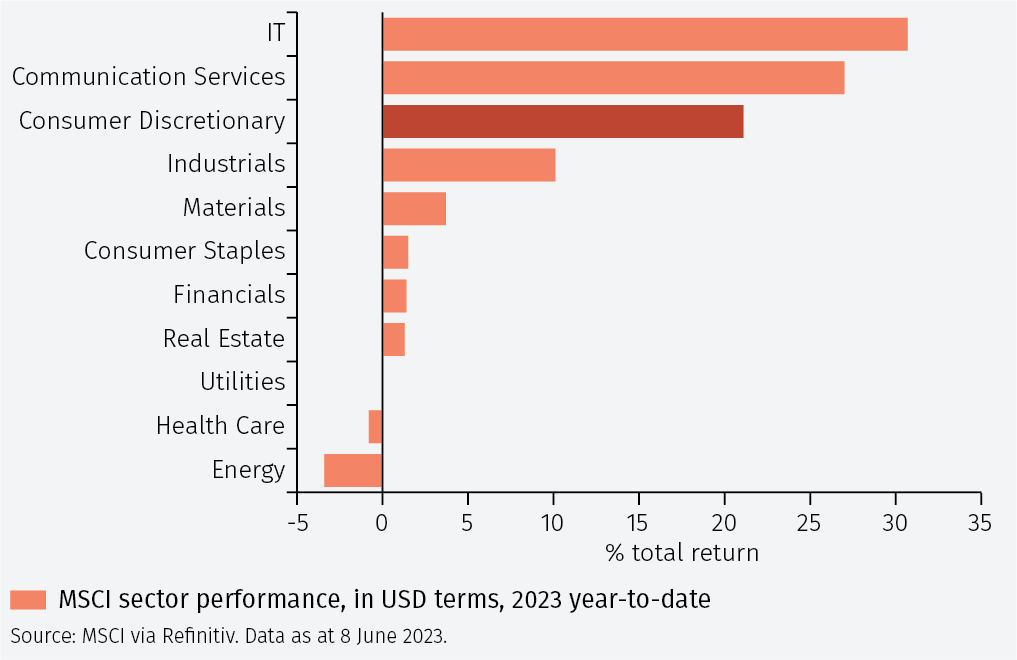

Our second equity market call, a contrarian one, was to favour the consumer discretionary sector. That has worked well, with the sector one of the best-performing ones year-to-date (see Figure 5). We saw pressures on consumer spending easing in 2023 as inflation started to fall and consumers were prepared to run down further the savings accumulated during the pandemic. The strength of consumer discretionary stocks has been particularly notable in the US, but European stocks have not been far behind.

A game of two halves

Of course, in financial markets and economies, like football, first half performance is not necessarily a guide to what happens in the second half. But at this stage we are not changing our ten main themes for the year.

1 Ben Bernanke and Olivier Blanchard, What Caused the U.S. Pandemic-Era Inflation? https://tinyurl.com/55tccawz

2 Comments made by Kristalina Georgieva, IMF managing director, at the Brussels Economic Forum, Thursday 4 May 2023.

3 On the basis of the indicator we highlighted, geopolitical risk on 9 June 2023 was lower than its long-term average and far below the levels of a year ago. Source: https://www.policyuncertainty.com/gpr.html

Important Information

The value of investments and the income derived from them can fall as well as rise, and past performance is no indicator of future performance. Investment products may be subject to investment risks involving, but not limited to, possible loss of all or part of the principal invested.

This document does not constitute and shall not be construed as a prospectus, advertisement, public offering or placement of, nor a recommendation to buy, sell, hold or solicit, any investment, security, other financial instrument or other product or service. It is not intended to be a final representation of the terms and conditions of any investment, security, other financial instrument or other product or service. This document is for general information only and is not intended as investment advice or any other specific recommendation as to any particular course of action or inaction. The information in this document does not take into account the specific investment objectives, financial situation or particular needs of the recipient. You should seek your own professional advice suitable to your particular circumstances prior to making any investment or if you are in doubt as to the information in this document.

Although information in this document has been obtained from sources believed to be reliable, no member of the EFG group represents or warrants its accuracy, and such information may be incomplete or condensed. Any opinions in this document are subject to change without notice. This document may contain personal opinions which do not necessarily reflect the position of any member of the EFG group. To the fullest extent permissible by law, no member of the EFG group shall be responsible for the consequences of any errors or omissions herein, or reliance upon any opinion or statement contained herein, and each member of the EFG group expressly disclaims any liability, including (without limitation) liability for incidental or consequential damages, arising from the same or resulting from any action or inaction on the part of the recipient in reliance on this document.

The availability of this document in any jurisdiction or country may be contrary to local law or regulation and persons who come into possession of this document should inform themselves of and observe any restrictions. This document may not be reproduced, disclosed or distributed (in whole or in part) to any other person without prior written permission from an authorised member of the EFG group.

This document has been produced by EFG Asset Management (UK) Limited for use by the EFG group and the worldwide subsidiaries and affiliates within the EFG group. EFG Asset Management (UK) Limited is authorised and regulated by the UK Financial Conduct Authority, registered no. 7389746. Registered address: EFG Asset Management (UK) Limited, Park House, 116 Park Street, London W1K 6AP, United Kingdom, telephone +44 (0)20 7491 9111.